Investors Give Re:NewCell AB (publ) (STO:RENEW) Shares A 84% Hiding

The Re:NewCell AB (publ) (STO:RENEW) share price has fared very poorly over the last month, falling by a substantial 84%. For any long-term shareholders, the last month ends a year to forget by locking in a 84% share price decline.

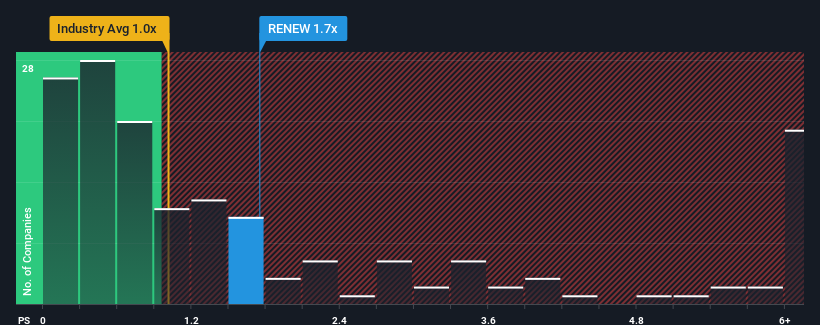

Following the heavy fall in price, Re:NewCell's price-to-sales (or "P/S") ratio of 1.7x might make it look like a buy right now compared to the Chemicals industry in Sweden, where around half of the companies have P/S ratios above 3.6x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Re:NewCell

What Does Re:NewCell's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Re:NewCell has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Re:NewCell will help you uncover what's on the horizon.How Is Re:NewCell's Revenue Growth Trending?

In order to justify its P/S ratio, Re:NewCell would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 184% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 3.0%, which is noticeably less attractive.

With this information, we find it odd that Re:NewCell is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Re:NewCell's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Re:NewCell's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 5 warning signs for Re:NewCell (2 can't be ignored!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RENEW

Re:NewCell

Re:NewCell AB (publ) operates as a textile recycling company in Sweden.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives