Market Might Still Lack Some Conviction On Nexam Chemical Holding AB (publ) (STO:NEXAM) Even After 26% Share Price Boost

Nexam Chemical Holding AB (publ) (STO:NEXAM) shareholders have had their patience rewarded with a 26% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

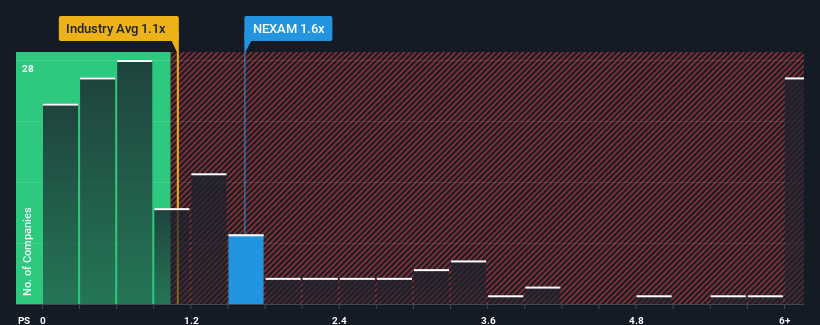

In spite of the firm bounce in price, Nexam Chemical Holding may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.6x, considering almost half of all companies in the Chemicals industry in Sweden have P/S ratios greater than 2.8x and even P/S higher than 10x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Nexam Chemical Holding

How Has Nexam Chemical Holding Performed Recently?

Recent times haven't been great for Nexam Chemical Holding as its revenue has been falling quicker than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Nexam Chemical Holding's future stacks up against the industry? In that case, our free report is a great place to start.How Is Nexam Chemical Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Nexam Chemical Holding's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 8.3% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 19% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.2%, which is noticeably less attractive.

In light of this, it's peculiar that Nexam Chemical Holding's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Nexam Chemical Holding's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Nexam Chemical Holding currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Nexam Chemical Holding that you should be aware of.

If these risks are making you reconsider your opinion on Nexam Chemical Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Nexam Chemical Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nexam Chemical Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEXAM

Nexam Chemical Holding

Develops solutions that enhance properties and performance of plastics in Sweden, Europe, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives