HEXPOL (OM:HPOL B) Margin Decline Undercuts Bullish Narratives Despite Attractive Valuation

Reviewed by Simply Wall St

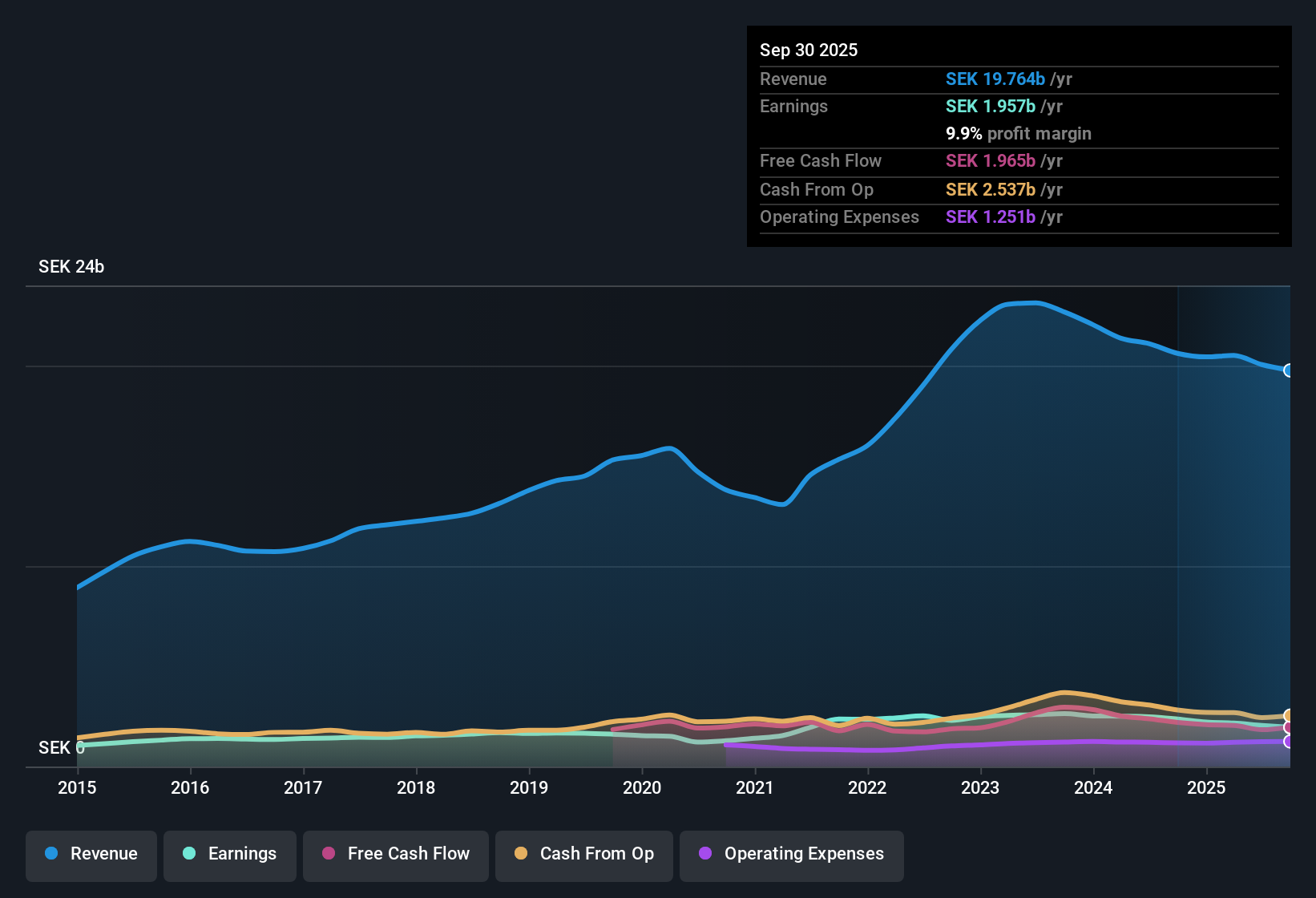

HEXPOL (OM:HPOL B) reported net profit margins of 10.2%, down from 11.8% last year, marking a clear year-over-year decline in profitability. Despite averaging 6.4% earnings growth per year over the last five years, the most recent annual period showed negative earnings growth. Forecasts for annual earnings and revenue growth (5.71% and 0.5% respectively) now lag well behind the broader Swedish market. Investors may see a positive in HEXPOL’s favorable 14.3x P/E relative to peers, but weaker margins and a muted growth outlook soften the overall picture.

See our full analysis for HEXPOL.The real test comes next as we compare these earnings numbers to the prevailing narratives shaping sentiment around HEXPOL. Some long-held views could be affirmed, while others may get put to the test.

See what the community is saying about HEXPOL

Margin Expansion Projected Despite Last Year’s Dip

- Analysts estimate profit margins will rebound from the current 10.2% to 12.5% over the next three years, signaling confidence in HEXPOL's ability to offset margin pressures seen over the last year.

- Analysts' consensus view emphasizes that operational efficiency improvements and strategic acquisitions, like Kabkom and Piedmont, are key levers supporting this projected margin turnaround.

- This margin optimism stands out even as recent annual earnings turned negative and forecasts trail Swedish market growth.

- Notably, consensus attributes margin resilience to HEXPOL's sustainability initiatives and product mix upgrades, citing increased recycling projects and advanced polymer expansion as enablers.

- To see how margin outlook ties into the latest strategic moves, head to the full consensus narrative for HEXPOL.

📊 Read the full HEXPOL Consensus Narrative.

Valuation Lags Sector and DCF Fair Value

- At SEK85.30, shares trade on a 14.3x P/E multiple, well below the European Chemicals industry’s 17.2x average and at a 44% discount to the DCF fair value of SEK153.19.

- Analysts' consensus view notes that this undervaluation, paired with high-quality earnings and no flagged risks, contributes to the perception of good value, even as revenue and EPS growth forecasts remain modest.

- While sector valuation provides some downside cushion, consensus also points out that margin improvement and strategic positioning must materialize to justify a rerating.

- The stock’s discount is contextually noteworthy given that both margin pressures and below-market growth forecasts weigh on expectations.

Slow Revenue Growth Amplifies Bull and Bear Debates

- HEXPOL’s annual revenue is projected to grow by just 0.5% over the coming years, significantly underperforming the Swedish market average of 3.9% and trailing even consensus analyst assumptions of 1.6% over the next three years.

- Analysts' consensus view highlights that this sluggish top-line outlook is a flashpoint for debate:

- Bulls spotlight exposure to end-markets powered by megatrends like EVs and sustainability, expecting portfolio upgrades to eventually boost sales.

- Bears counter that overexposure to declining ICE vehicle platforms and pricing pressure could structurally cap revenue and dull the impact from new initiatives.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for HEXPOL on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the numbers? In just minutes, you can shape that point of view into your own narrative. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding HEXPOL.

See What Else Is Out There

HEXPOL’s weak earnings growth, declining profit margins, and uninspiring revenue forecasts highlight a lack of consistent and steady performance across cycles.

If you want companies delivering predictably strong results year after year, use our stable growth stocks screener (2098 results) to zero in on proven winners built for consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives