- Sweden

- /

- Metals and Mining

- /

- OM:GRNG

Gränges (STO:GRNG) Will Pay A Larger Dividend Than Last Year At SEK1.60

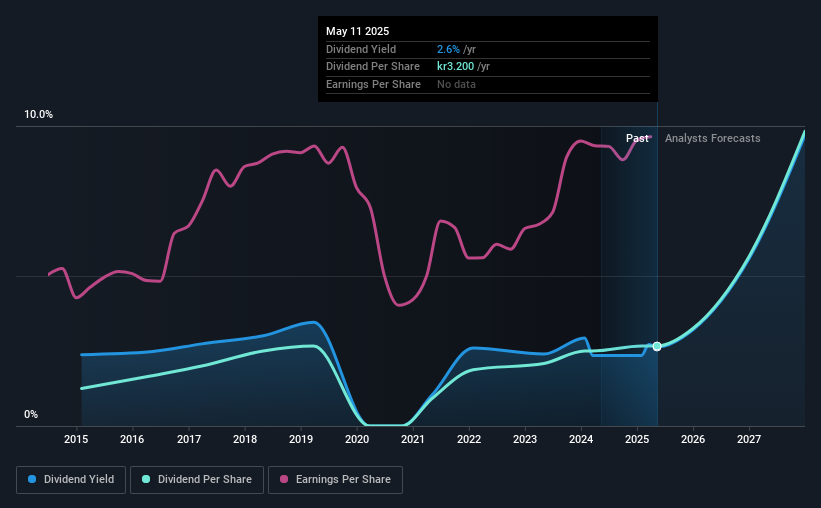

The board of Gränges AB (publ) (STO:GRNG) has announced that it will be paying its dividend of SEK1.60 on the 19th of May, an increased payment from last year's comparable dividend. This takes the annual payment to 2.6% of the current stock price, which unfortunately is below what the industry is paying.

Gränges' Payment Could Potentially Have Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Gränges is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. In general, we consider cash flow to be more important than earnings, so we would be cautious about relying on the sustainability of this dividend.

Over the next year, EPS is forecast to expand by 54.3%. Assuming the dividend continues along recent trends, we think the payout ratio could be 21% by next year, which is in a pretty sustainable range.

See our latest analysis for Gränges

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the annual payment back then was SEK1.50, compared to the most recent full-year payment of SEK3.20. This works out to be a compound annual growth rate (CAGR) of approximately 7.9% a year over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

We Could See Gränges' Dividend Growing

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's encouraging to see that Gränges has been growing its earnings per share at 5.8% a year over the past five years. Gränges definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think Gränges' payments are rock solid. While Gränges is earning enough to cover the payments, the cash flows are lacking. We don't think Gränges is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for Gränges (of which 1 doesn't sit too well with us!) you should know about. Is Gränges not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GRNG

Gränges

Engages in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications in Asia Pacific, Europe, and North and South Americas.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026