- Sweden

- /

- Metals and Mining

- /

- OM:GRNG

Earnings Miss: Gränges AB (publ) Missed EPS By 7.9% And Analysts Are Revising Their Forecasts

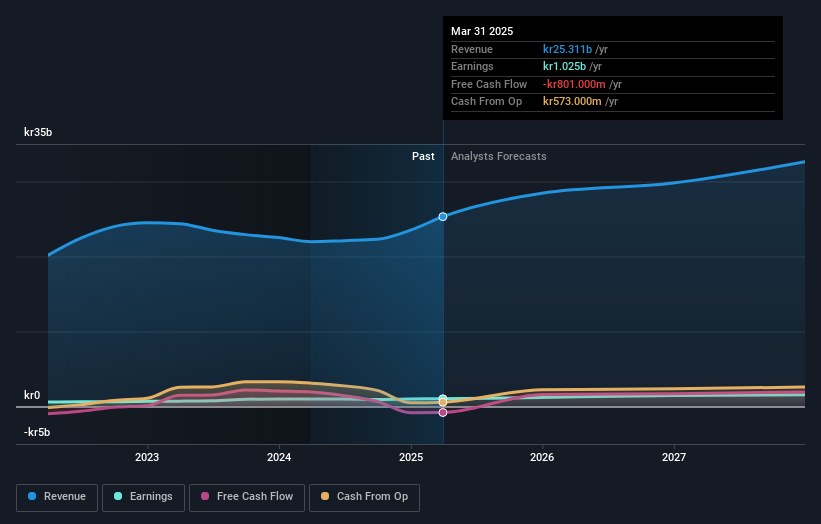

It's been a pretty great week for Gränges AB (publ) (STO:GRNG) shareholders, with its shares surging 14% to kr125 in the week since its latest quarterly results. It was a pretty mixed result, with revenues beating expectations to hit kr7.2b. Statutory earnings fell 7.9% short of analyst forecasts, reaching kr2.34 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Taking into account the latest results, the consensus forecast from Gränges' three analysts is for revenues of kr28.4b in 2025. This reflects a notable 12% improvement in revenue compared to the last 12 months. Per-share earnings are expected to jump 21% to kr11.65. In the lead-up to this report, the analysts had been modelling revenues of kr28.3b and earnings per share (EPS) of kr12.14 in 2025. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

See our latest analysis for Gränges

The consensus price target held steady at kr157, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Gränges analyst has a price target of kr178 per share, while the most pessimistic values it at kr133. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Gränges'historical trends, as the 17% annualised revenue growth to the end of 2025 is roughly in line with the 15% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 4.9% per year. So although Gränges is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target held steady at kr157, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Gränges going out to 2027, and you can see them free on our platform here.

Before you take the next step you should know about the 2 warning signs for Gränges (1 is significant!) that we have uncovered.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GRNG

Gränges

Engages in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications in Asia Pacific, Europe, and North and South Americas.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026