- Sweden

- /

- Metals and Mining

- /

- OM:DRIL

Market Still Lacking Some Conviction On Drillcon AB (publ) (STO:DRIL)

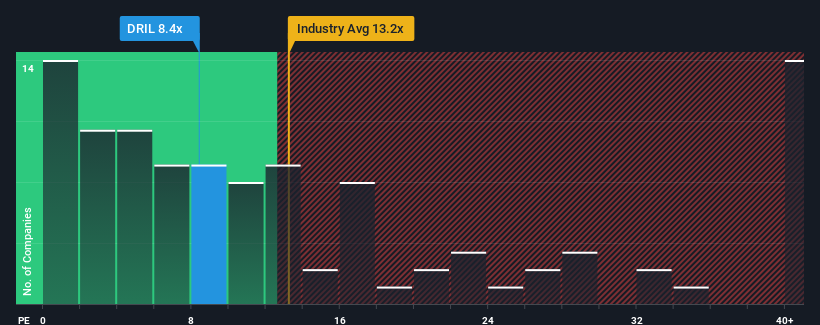

With a price-to-earnings (or "P/E") ratio of 8.4x Drillcon AB (publ) (STO:DRIL) may be sending very bullish signals at the moment, given that almost half of all companies in Sweden have P/E ratios greater than 24x and even P/E's higher than 43x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Drillcon has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Drillcon

Is There Any Growth For Drillcon?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Drillcon's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 77%. Pleasingly, EPS has also lifted 402% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 30% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Drillcon's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Drillcon's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Drillcon revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Drillcon has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course, you might also be able to find a better stock than Drillcon. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:DRIL

Drillcon

Operates as a diamond core drilling and raise boring contractor in Europe and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)