- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Boliden (OM:BOL): Assessing Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Boliden.

Boliden’s share price has put in an impressive run, climbing 19.1% over the past month and extending its momentum to a 31.1% share price return in the last three months. This short-term rally builds on longer-term strength, with a one-year total shareholder return of 23.6% and a 108% total return over five years. This suggests the recent surge reflects renewed optimism around the company’s growth prospects and possibly shifting views on risk and valuation.

If Boliden’s performance has you scanning for other standouts, it could be the perfect time to check out fast growing stocks with high insider ownership.

With the share price soaring and now trading above analyst targets, the key question arises: is Boliden undervalued relative to its future potential, or has the recent rally already priced in all of its growth?

Most Popular Narrative: 12.6% Overvalued

Bullish sentiment around Boliden’s future profitability has driven its fair value estimate to SEK 366, while the last close was SEK 411.7. This notable gap frames the debate about what is already priced in. The stage is set for scrutiny on whether operational momentum can justify this premium.

The Odda green zinc smelter expansion is on track with ramp-up in H2 2025 and full contribution expected in 2026, leveraging stricter environmental standards and demand for low-carbon metals in Europe. This expansion should improve both revenue growth and net margins due to potential premium pricing.

Curious what assumptions justify paying up for Boliden? The most popular narrative hinges on transformative projects expected to supercharge future earnings and margins. The catch: can those bold forecasts turn into reality, or will the numbers surprise you? Unlock the full valuation playbook to see what’s driving this high-stakes fair value debate.

Result: Fair Value of $366 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price weakness or setbacks in new project permits could quickly challenge the positive outlook for Boliden’s continued outperformance.

Find out about the key risks to this Boliden narrative.

Another View: Discounted Cash Flow Tells a Different Story

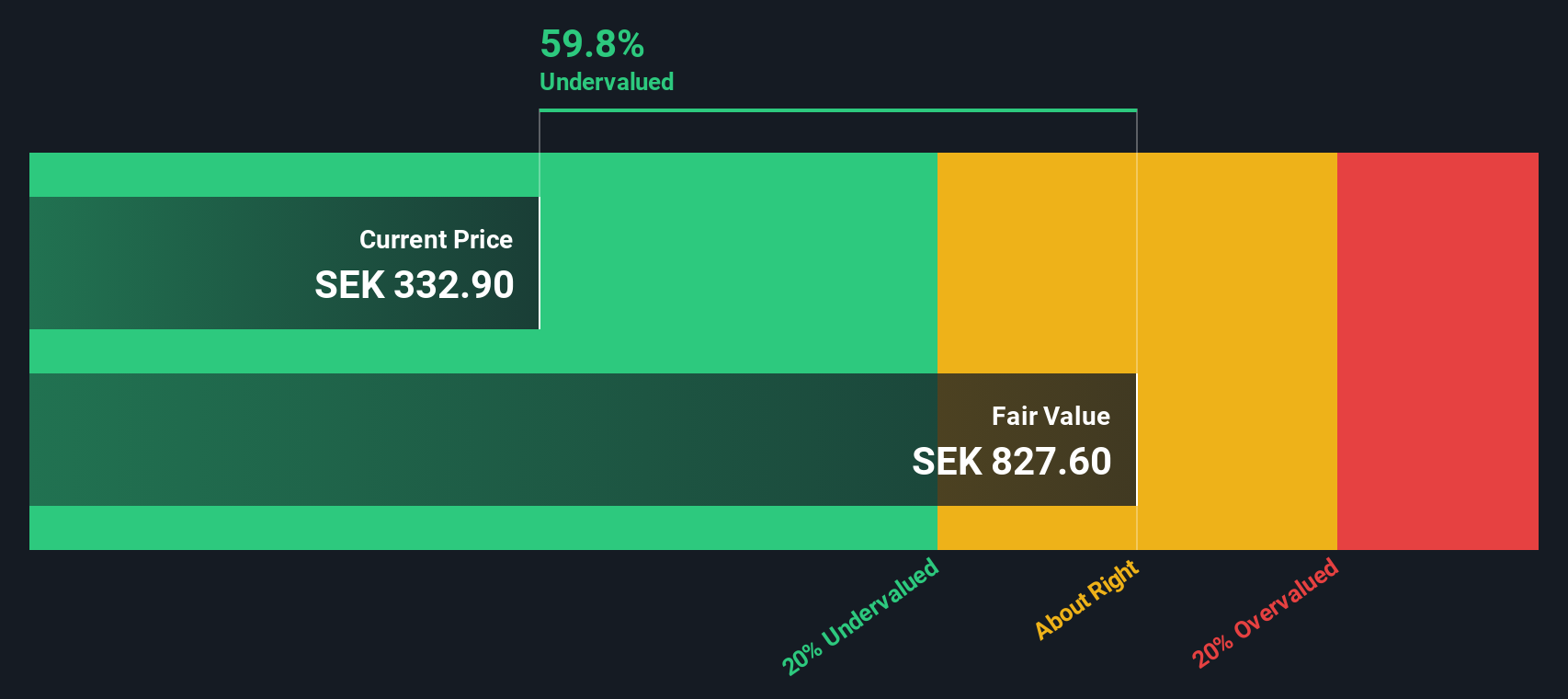

While analysts currently see Boliden as overvalued based on recent earnings projections and share price, our SWS DCF model paints a strikingly different picture. The model suggests Boliden could actually be significantly undervalued, with plenty of upside potential if future cash flows materialize as forecast. Which reading will prove closer to reality—the market's skepticism or the deeper value hiding beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Boliden Narrative

If you have your own perspective or prefer to dig into the numbers yourself, you can shape your own view and narrative in just a few minutes. Do it your way.

A great starting point for your Boliden research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let today’s market winners make you miss tomorrow’s standouts. Open up new possibilities with top stock ideas tailored for your next bold move.

- Uncover stocks boasting strong cash flow potential and attractive valuations by checking out these 874 undervalued stocks based on cash flows.

- Spot the companies harnessing artificial intelligence breakthroughs in healthcare with these 33 healthcare AI stocks, giving you early access to the industry’s innovators.

- Start growing your portfolio income by locking in juicy yields through these 17 dividend stocks with yields > 3% delivering dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives