- Sweden

- /

- Metals and Mining

- /

- OM:BOL

Assessing Boliden After Recent Output Growth and a 39% Rally in 2025

Reviewed by Bailey Pemberton

- Wondering if Boliden could be a bargain (or just hype) right now? Let’s break down what’s behind the numbers and see where the real value might lie.

- Boliden’s stock has climbed 5.0% over the last week and boasts a 39.2% gain year-to-date. This momentum has put the company firmly on many investors' radars as interest picks up.

- This upward swing comes in the wake of fresh news about increased output at their key mining sites and ongoing discussions around sustainable metals supply in Europe. Both developments have drawn extra attention to the company’s future prospects. Recent headlines have highlighted Boliden's investments in greener technologies and partnerships aimed at reducing carbon emissions.

- When it comes to value, Boliden currently holds a 5 out of 6 valuation score, suggesting it passes most of our undervaluation checks. Next, we’ll dive into the classic approaches for assessing worth, but there’s one method in particular you won’t want to miss by the end of this article.

Approach 1: Boliden Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This method helps investors approximate what a business is truly worth, based on expected future performance.

Boliden’s current Free Cash Flow stands at SEK 6.2 billion. Over the next five years, analysts project annual increases in Free Cash Flow, with forecasts reaching SEK 9.9 billion by 2028. In addition, projections are extended further by analysts and data providers, estimating continued steady growth. By 2035, Boliden’s Free Cash Flow is expected to reach approximately SEK 17.8 billion in nominal terms.

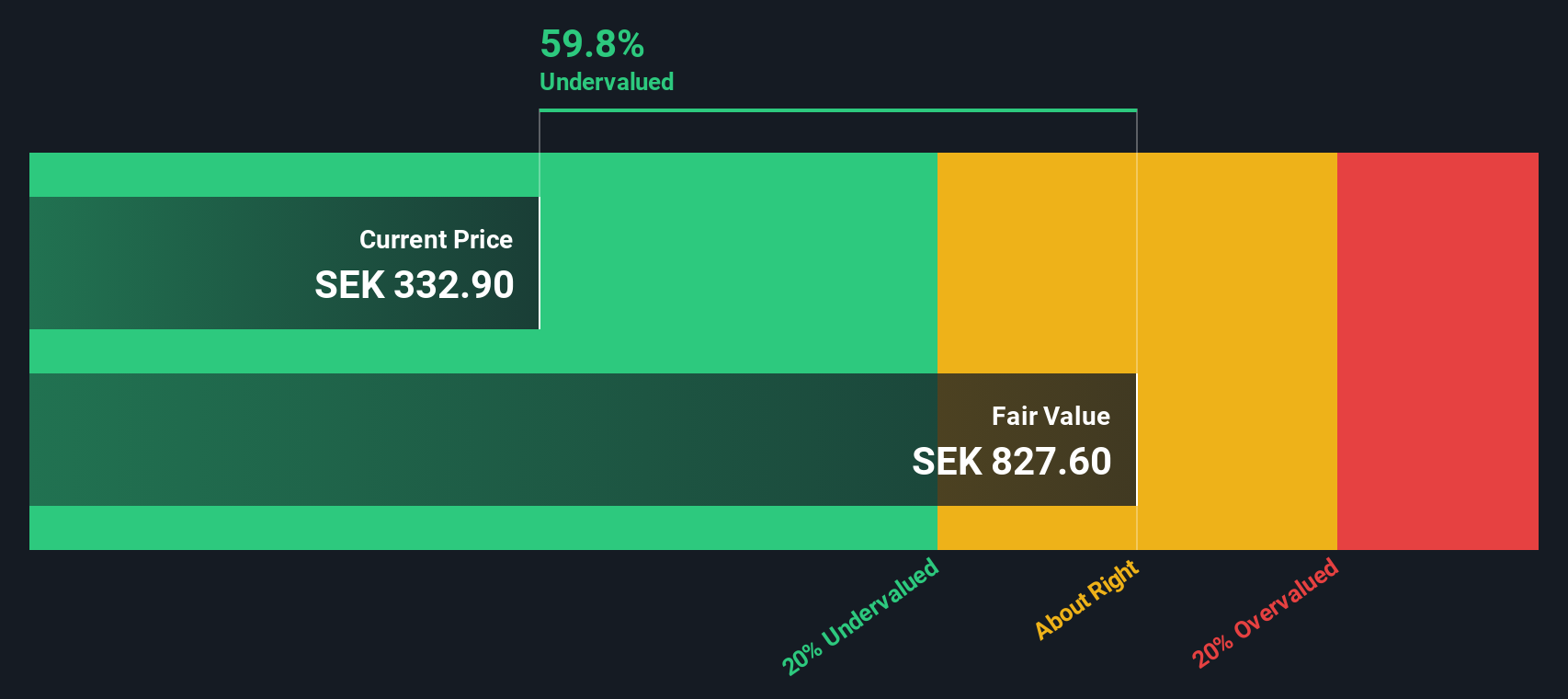

Based on the DCF approach, Boliden’s intrinsic value is estimated at SEK 1,030 per share. With the share currently trading at a 57.2% discount to this calculated value, the DCF model suggests the stock is significantly undervalued compared to its underlying projected cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Boliden is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Boliden Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies, as it relates a company's current share price to its earnings per share. For investors, the PE ratio provides a quick sense of how much the market is willing to pay for a company’s future potential profits.

Growth expectations and risk are key factors that shape what a “normal” or “fair” PE ratio should look like. Rapidly growing firms tend to justify higher PE multiples and attract investors eager for future gains, while riskier or slower-growing companies typically trade at lower multiples.

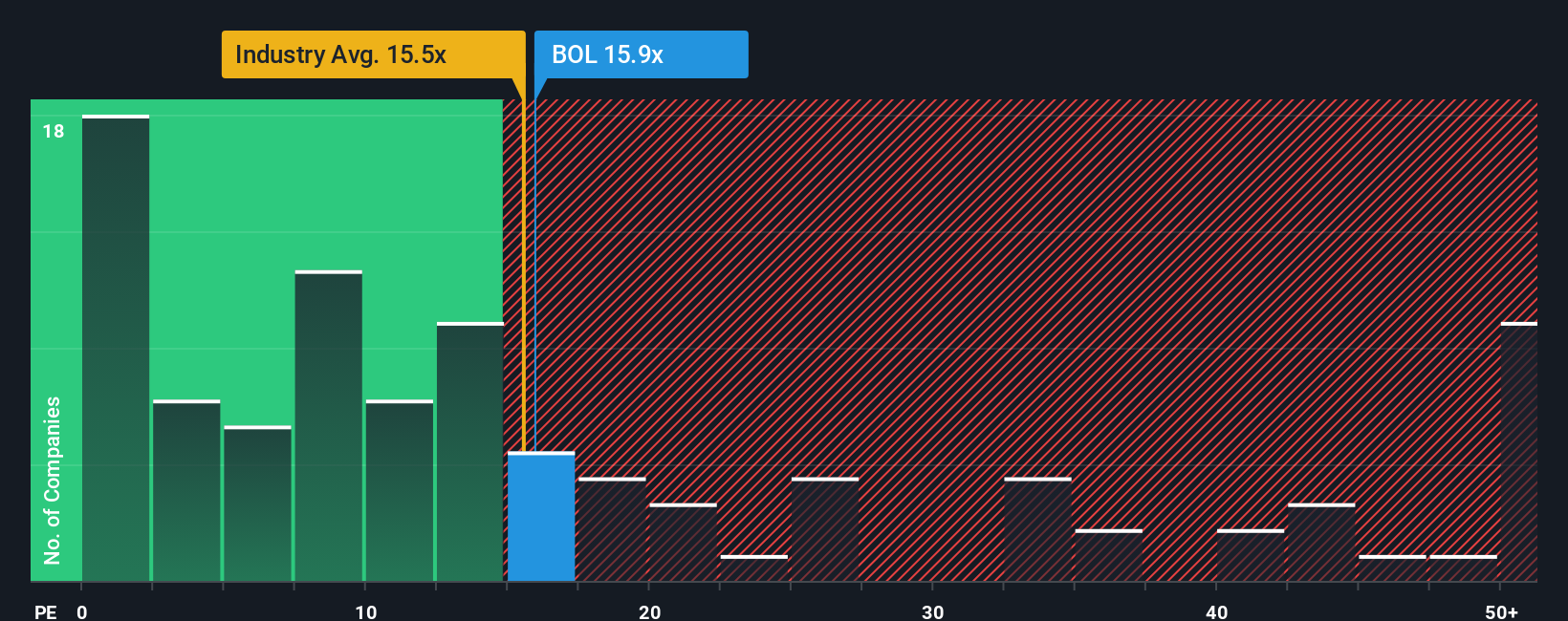

Boliden currently trades at a PE ratio of 15.54x, which is noticeably below both the Metals and Mining industry average of 20.15x and the peer group’s average of 19.39x. However, Simply Wall St's proprietary “Fair Ratio” model estimates Boliden’s fair PE at 21.98x. This tailored metric goes beyond simple industry or peer comparisons by factoring in Boliden's specific earnings growth outlook, profit margins, market capitalization, and risk profile.

By comparing Boliden’s current PE of 15.54x with its Fair Ratio of 21.98x, it becomes clear that the stock trades at a significant discount relative to what might be considered appropriate, given all relevant company and market dynamics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Boliden Narrative

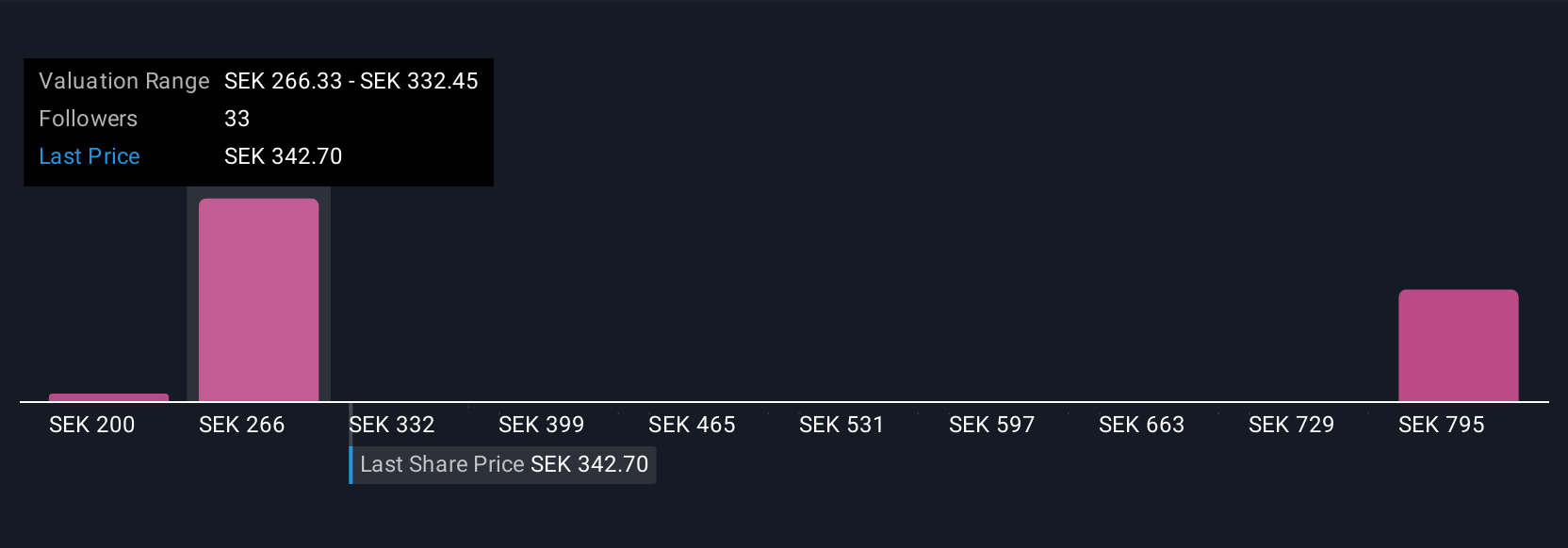

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story investors create that ties their perspective on a company’s future to numbers, such as what they believe is a fair value based on projected revenue, earnings, and profit margins. Rather than just crunching ratios or following models, a Narrative connects Boliden’s unique story to a tailored financial forecast and a personal estimate of fair value.

Simply Wall St has made Narratives easy and accessible on the Community page, where millions of investors build and share their outlooks. With Narratives, you can clearly explain why you think Boliden is worth buying or selling, then compare your calculated fair value to today’s live price to see if an opportunity exists. Narratives are dynamic as well, automatically updating as new information such as company news or earnings gets released, so your investment view stays current.

For example, right now the most optimistic view on Boliden’s fair value is SEK 412 per share, reflecting confidence in continued efficiency gains and profit growth. The lowest analyst estimate stands at SEK 250, showing concerns about operational risks. Your Narrative lets you decide which story and numbers best fit your outlook, giving you the tools to invest smarter and with more confidence.

Do you think there's more to the story for Boliden? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boliden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOL

Boliden

Engages in the extracting, producing, and recycling of base metals in Sweden, Finland, other Nordic region, Germany, the United Kingdom, Europe, North America, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.