As the pan-European STOXX Europe 600 Index rises for the fourth consecutive week, buoyed by easing trade tensions between China and the U.S., investors are closely watching European markets for opportunities. In this environment, dividend stocks can offer a reliable income stream and potential stability amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.33% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.55% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.43% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.80% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.52% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.70% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

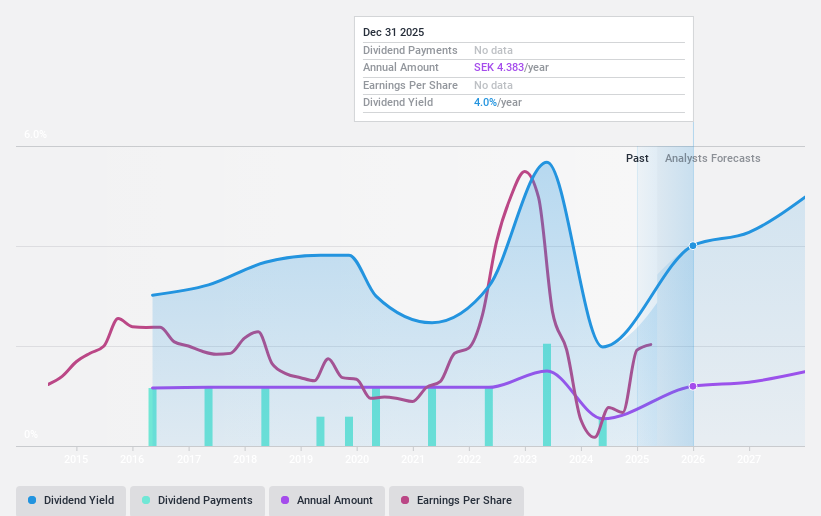

Billerud (OM:BILL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Billerud AB (publ) is a global provider of paper and packaging materials with a market cap of SEK27.21 billion.

Operations: Billerud AB (publ) generates its revenue primarily from Region Europe with SEK28.55 billion and Region North America with SEK12.55 billion.

Dividend Yield: 3.2%

Billerud's recent earnings report shows improved financial performance, with sales reaching SEK 11.10 billion and net income at SEK 415 million for Q1 2025. Despite a proposed dividend increase to SEK 3.50 per share, the company's dividend history is marked by volatility and unreliability over the past decade. However, dividends are well-covered by earnings (47.1% payout ratio) and cash flows (68.9% cash payout ratio), though the yield remains below top-tier levels in Sweden at 3.2%.

- Click here to discover the nuances of Billerud with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Billerud shares in the market.

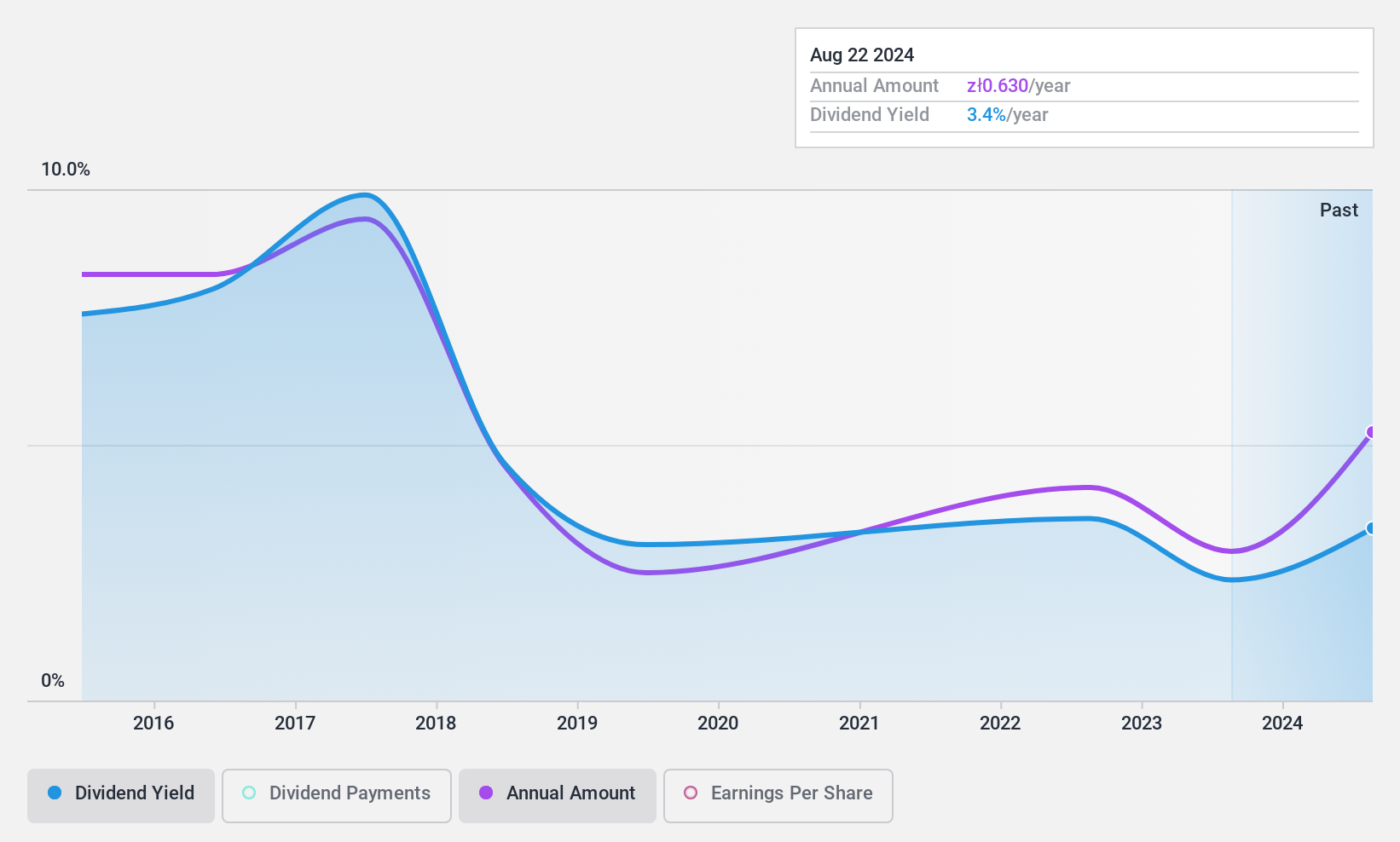

Kino Polska TV Spolka Akcyjna (WSE:KPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kino Polska TV Spolka Akcyjna is a media company that operates in Poland and internationally, with a market cap of PLN384.54 million.

Operations: Kino Polska TV Spolka Akcyjna generates revenue through several segments, including Zoom TV (PLN32.04 million), Stopklatka TV (PLN59.40 million), Kino Polska Channels (PLN35.72 million), Sale of License Rights (PLN15.35 million), Production of TV Channels (PLN9.60 million), and Filmbox Movie Channels and Thematic Channels (PLN161.08 million).

Dividend Yield: 3.2%

Kino Polska TV Spolka Akcyjna's recent earnings report highlights a strong financial performance with sales of PLN 315.5 million and net income of PLN 66.72 million for 2024. Despite this growth, the company's dividend history has been volatile and unreliable over the past decade, although dividends are well-covered by both earnings (17.6% payout ratio) and cash flows (17.2% cash payout ratio). The dividend yield of 3.25% is low compared to top-tier Polish market payers at 7.03%.

- Delve into the full analysis dividend report here for a deeper understanding of Kino Polska TV Spolka Akcyjna.

- Upon reviewing our latest valuation report, Kino Polska TV Spolka Akcyjna's share price might be too pessimistic.

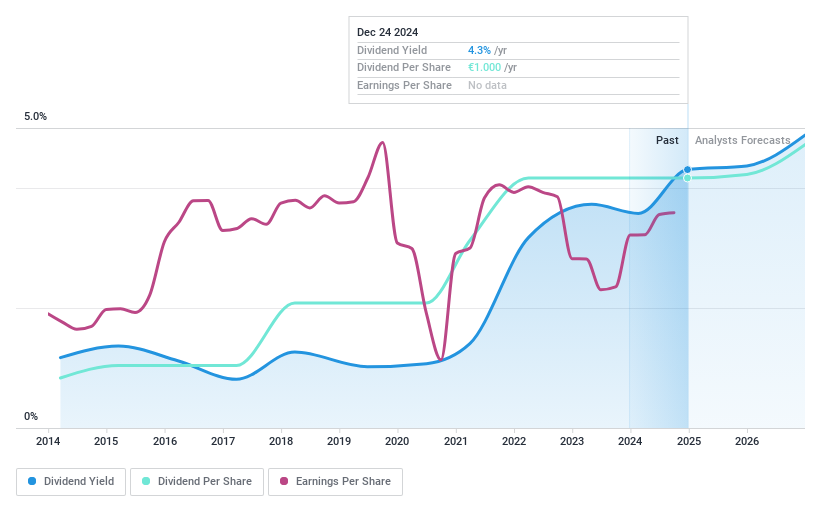

Cancom (XTRA:COK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cancom SE, along with its subsidiaries, offers information technology services both in Germany and internationally, with a market cap of €928.13 million.

Operations: Cancom SE generates revenue primarily from its Wholesale - Computer Peripherals segment, which amounts to €1.74 billion.

Dividend Yield: 3.4%

Cancom's dividends have been stable and reliable over the past decade, with recent affirmations of an annual dividend of €1.00 per share. However, the dividend yield of 3.4% is lower than top-tier German market payers at 4.31%. The high payout ratio (100.8%) indicates dividends are not well covered by earnings, though they are supported by a low cash payout ratio (18.5%). Recent revenue guidance for 2025 ranges from €1.7 billion to €1.85 billion, reflecting ongoing growth potential.

- Dive into the specifics of Cancom here with our thorough dividend report.

- The valuation report we've compiled suggests that Cancom's current price could be quite moderate.

Taking Advantage

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 228 more companies for you to explore.Click here to unveil our expertly curated list of 231 Top European Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kino Polska TV Spolka Akcyjna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:KPL

Kino Polska TV Spolka Akcyjna

Operates as a media company in Poland and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives