- Sweden

- /

- Household Products

- /

- OM:ESSITY B

Shareholders Will Likely Find Essity AB (publ)'s (STO:ESSITY B) CEO Compensation Acceptable

Key Insights

- Essity's Annual General Meeting to take place on 21st of March

- Salary of kr17.0m is part of CEO Magnus Groth's total remuneration

- Total compensation is 70% below industry average

- Over the past three years, Essity's EPS fell by 3.2% and over the past three years, the total shareholder return was 0.2%

Performance at Essity AB (publ) (STO:ESSITY B) has been rather uninspiring recently and shareholders may be wondering how CEO Magnus Groth plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 21st of March. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

Check out our latest analysis for Essity

How Does Total Compensation For Magnus Groth Compare With Other Companies In The Industry?

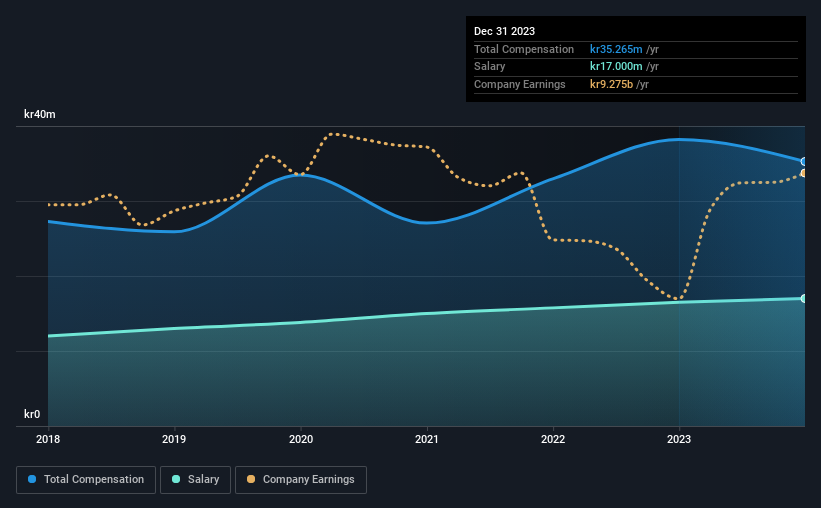

According to our data, Essity AB (publ) has a market capitalization of kr177b, and paid its CEO total annual compensation worth kr35m over the year to December 2023. That's a slight decrease of 7.7% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at kr17m.

In comparison with other companies in the Sweden Household Products industry with market capitalizations over kr83b, the reported median total CEO compensation was kr118m. This suggests that Magnus Groth is paid below the industry median. Furthermore, Magnus Groth directly owns kr24m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr17m | kr17m | 48% |

| Other | kr18m | kr22m | 52% |

| Total Compensation | kr35m | kr38m | 100% |

Speaking on an industry level, nearly 47% of total compensation represents salary, while the remainder of 53% is other remuneration. Although there is a difference in how total compensation is set, Essity more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Essity AB (publ)'s Growth Numbers

Essity AB (publ) has reduced its earnings per share by 3.2% a year over the last three years. It achieved revenue growth of 12% over the last year.

The decline in EPS is a bit concerning. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Essity AB (publ) Been A Good Investment?

With a total shareholder return of 0.2% over three years, Essity AB (publ) has done okay by shareholders, but there's always room for improvement. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

To Conclude...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Essity that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Essity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ESSITY B

Essity

Develops, produces, and sells hygiene and health products and services in Europe, North and Latin America, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives