- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

The 8.1% return this week takes Xvivo Perfusion's (STO:XVIVO) shareholders five-year gains to 198%

The last three months have been tough on Xvivo Perfusion AB (publ) (STO:XVIVO) shareholders, who have seen the share price decline a rather worrying 40%. But that doesn't change the fact that the returns over the last five years have been very strong. In fact, the share price is 198% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

The past week has proven to be lucrative for Xvivo Perfusion investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for Xvivo Perfusion

Xvivo Perfusion isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Xvivo Perfusion saw its revenue grow at 9.8% per year. That's a pretty good long term growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 24% per year over in that time. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. When a growth trend accelerates, be it in revenue or earnings, it can indicate an inflection point for the business, which is can often be an opportunity for investors.

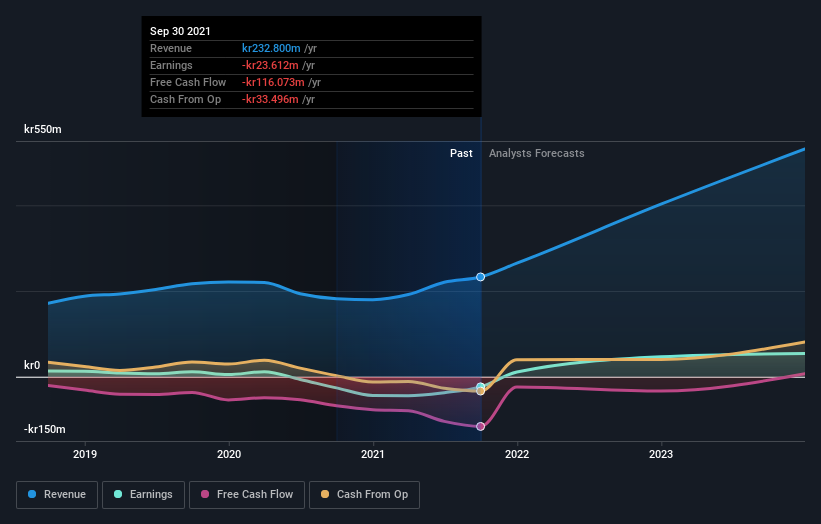

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Xvivo Perfusion will earn in the future (free profit forecasts).

A Different Perspective

Xvivo Perfusion shareholders are down 13% for the year, but the market itself is up 36%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 24% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Xvivo Perfusion you should be aware of.

Xvivo Perfusion is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives