- Finland

- /

- Medical Equipment

- /

- HLSE:REG1V

3 European Stocks Estimated To Be Up To 33.6% Below Intrinsic Value

Reviewed by Simply Wall St

As trade tensions show signs of easing, European markets have experienced a positive uptick, with the STOXX Europe 600 Index climbing 2.77% and major indices like Germany's DAX and France's CAC 40 also seeing gains. In this environment of cautious optimism, identifying stocks that are trading below their intrinsic value can be particularly appealing to investors seeking opportunities in a market where economic growth remains stable despite external uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.56 | SEK96.48 | 49.7% |

| Andritz (WBAG:ANDR) | €57.15 | €112.74 | 49.3% |

| Qt Group Oyj (HLSE:QTCOM) | €56.30 | €109.63 | 48.6% |

| LPP (WSE:LPP) | PLN15600.00 | PLN30445.48 | 48.8% |

| Pluxee (ENXTPA:PLX) | €18.80 | €36.93 | 49.1% |

| Stille (OM:STIL) | SEK190.00 | SEK369.93 | 48.6% |

| TF Bank (OM:TFBANK) | SEK351.50 | SEK682.26 | 48.5% |

| ATON Green Storage (BIT:ATON) | €1.93 | €3.83 | 49.6% |

| Expert.ai (BIT:EXAI) | €1.31 | €2.58 | 49.3% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.67 | 49.4% |

Let's explore several standout options from the results in the screener.

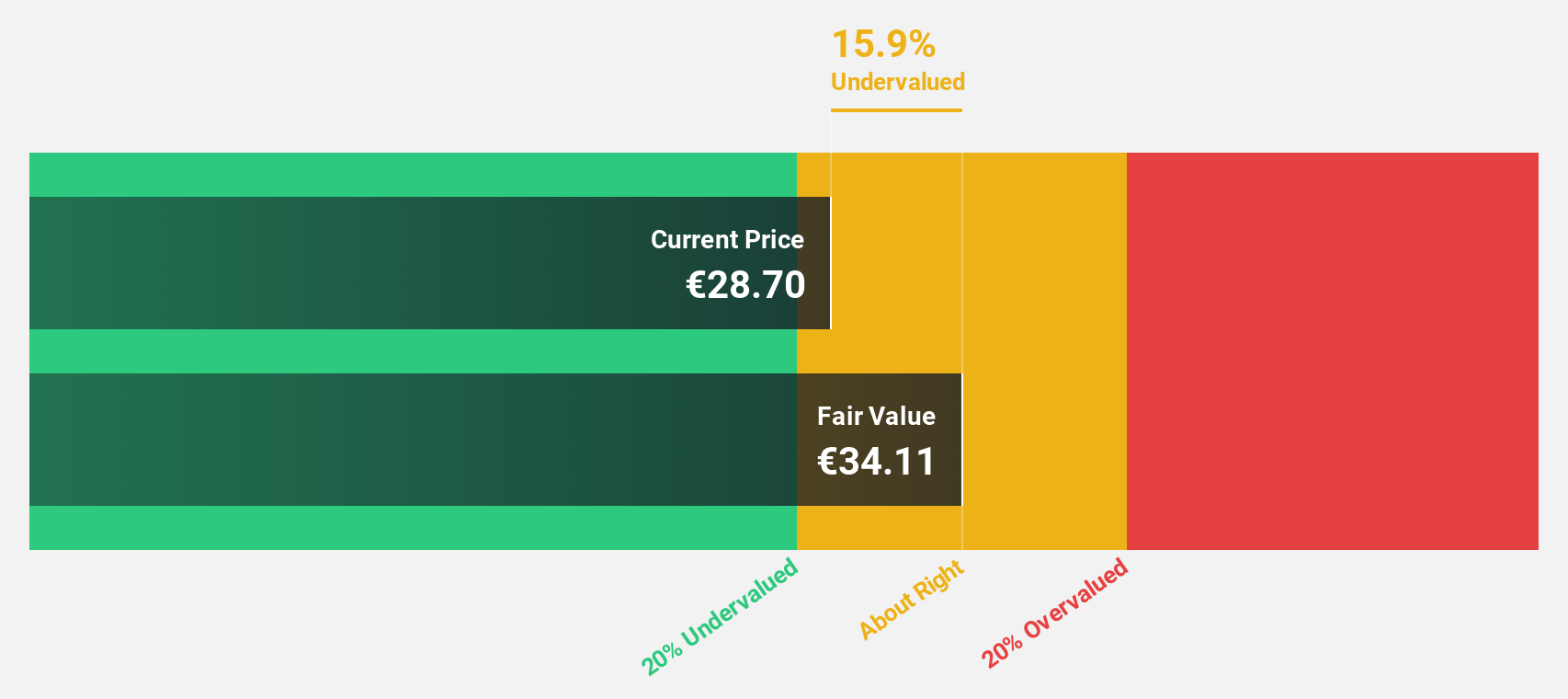

Revenio Group Oyj (HLSE:REG1V)

Overview: Revenio Group Oyj specializes in ophthalmological devices and software solutions for diagnosing glaucoma, macular degeneration, and diabetic retinopathy, serving markets in Finland, the United States, and internationally with a market cap of €728.81 million.

Operations: The company's revenue primarily comes from its Health Tech segment, which generated €103.82 million.

Estimated Discount To Fair Value: 21%

Revenio Group Oyj is trading at €27.4, below its estimated fair value of €34.68, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow 16.7% annually, outpacing the Finnish market's 12.6%. Recent FDA clearance for its iCare MAIA microperimeter supports growth in the ophthalmic segment, while a dividend of €0.40 per share was approved at the recent AGM, reflecting stable shareholder returns amidst leadership changes and strategic innovations.

- Our earnings growth report unveils the potential for significant increases in Revenio Group Oyj's future results.

- Navigate through the intricacies of Revenio Group Oyj with our comprehensive financial health report here.

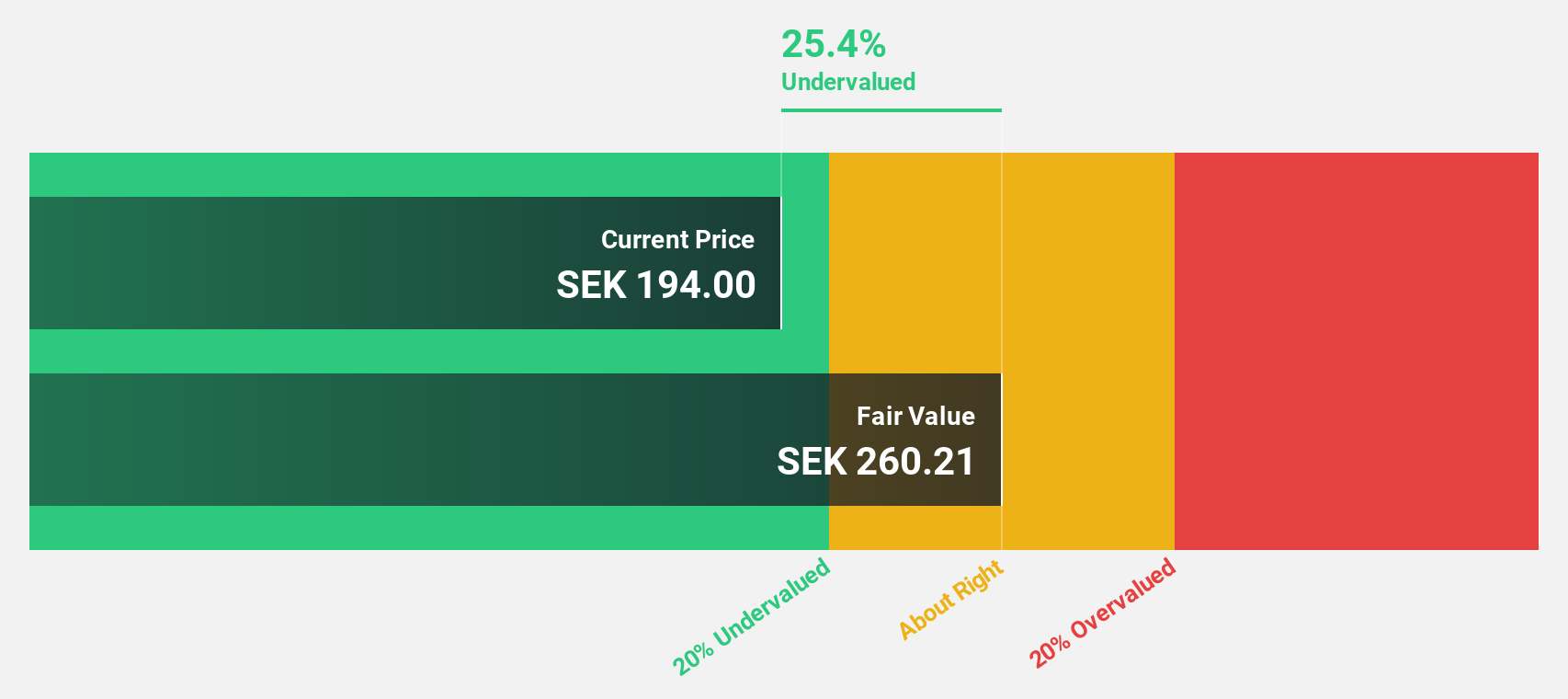

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of SEK4.71 billion.

Operations: The company's revenue segment for Medical Imaging Systems amounts to SEK723.22 million.

Estimated Discount To Fair Value: 21.2%

CellaVision AB (publ) is trading at SEK 197.6, below its estimated fair value of SEK 250.81, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow at 19.4% annually, exceeding the Swedish market's growth rate of 16.6%. Despite a decline in Q4 sales and net income compared to the previous year, CellaVision maintains a positive outlook with high forecasted return on equity and proposed dividends aligning with its policy.

- Our comprehensive growth report raises the possibility that CellaVision is poised for substantial financial growth.

- Get an in-depth perspective on CellaVision's balance sheet by reading our health report here.

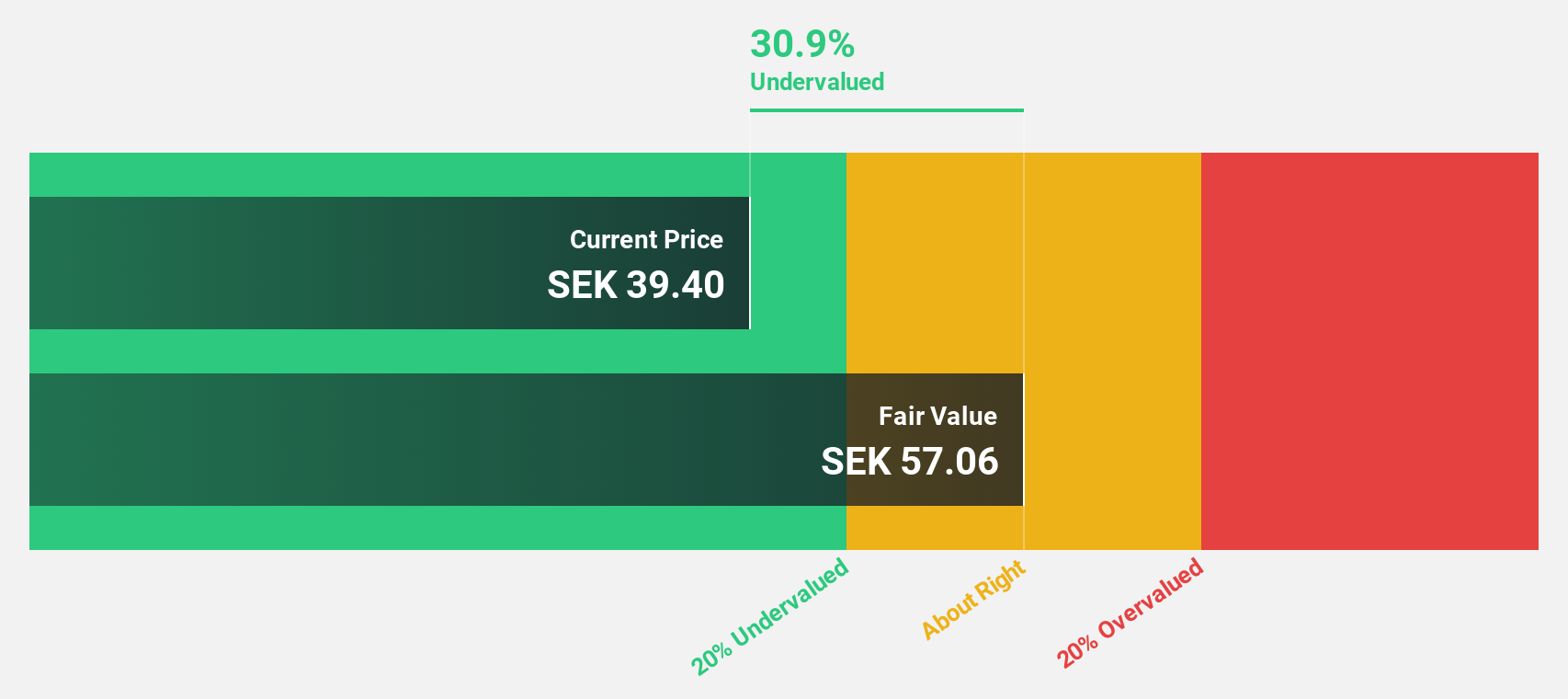

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK19.64 billion.

Operations: Vimian Group AB's revenue is derived from four main segments: Medtech (€123.90 million), Diagnostics (€20.90 million), Specialty Pharma (€172 million), and Veterinary Services (€58.20 million).

Estimated Discount To Fair Value: 33.6%

Vimian Group AB is trading at SEK 37.48, significantly below its estimated fair value of SEK 56.43, highlighting potential undervaluation based on cash flows. The company reported Q1 sales of €107.5 million and net income of €4.3 million, showing improvement from the previous year. Earnings are forecast to grow substantially at 42.3% annually over the next three years, outpacing the Swedish market's growth rate and indicating strong future prospects despite a low return on equity forecast.

- Our growth report here indicates Vimian Group may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Vimian Group.

Turning Ideas Into Actions

- Access the full spectrum of 180 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:REG1V

Revenio Group Oyj

Provides ophthalmological devices and software solutions for the diagnosis of glaucoma, macular degeneration, and diabetic retinopathy in Finland, the United States, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives