- Sweden

- /

- Medical Equipment

- /

- OM:SPEC

Top Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets react to recent interest rate cuts by the ECB and SNB, investors are closely watching for a potential rate cut from the Federal Reserve. In such a fluctuating market landscape, penny stocks—often representing smaller or emerging companies—continue to capture attention as potential opportunities for value. Despite their somewhat outdated name, these stocks can offer significant returns when backed by strong financials and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £804.39M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £154.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £67.89M | ★★★★☆☆ |

Click here to see the full list of 5,733 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

SpectraCure (OM:SPEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SpectraCure AB (publ) develops cancer treatment systems and has a market cap of SEK300.62 million.

Operations: Currently, there are no reported revenue segments for SpectraCure AB (publ).

Market Cap: SEK300.62M

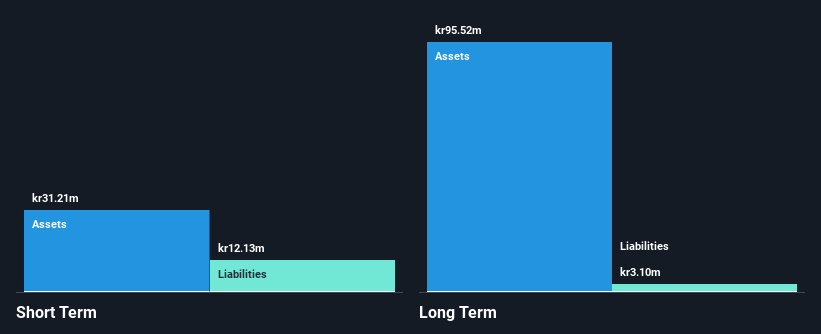

SpectraCure AB (publ) is a pre-revenue company with a market cap of SEK300.62 million, reporting minimal revenue of SEK1.22 million for the first nine months of 2024, down from SEK2.18 million the previous year. The company remains debt-free but faces financial challenges with less than one year of cash runway and increasing losses, which have grown by 9.3% annually over five years. Despite having an experienced management team, its board lacks tenure stability, and the share price has been highly volatile recently. Short-term assets exceed liabilities, offering some balance sheet strength amid operational uncertainties.

- Click here and access our complete financial health analysis report to understand the dynamics of SpectraCure.

- Review our historical performance report to gain insights into SpectraCure's track record.

Lee's Pharmaceutical Holdings (SEHK:950)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lee's Pharmaceutical Holdings Limited is an investment holding company that develops, manufactures, markets, and sells pharmaceutical products primarily in the People's Republic of China with a market cap of HK$812.59 million.

Operations: The company generates revenue from Licensed-In Products amounting to HK$483.06 million and Proprietary and Generic Products totaling HK$716.01 million.

Market Cap: HK$812.59M

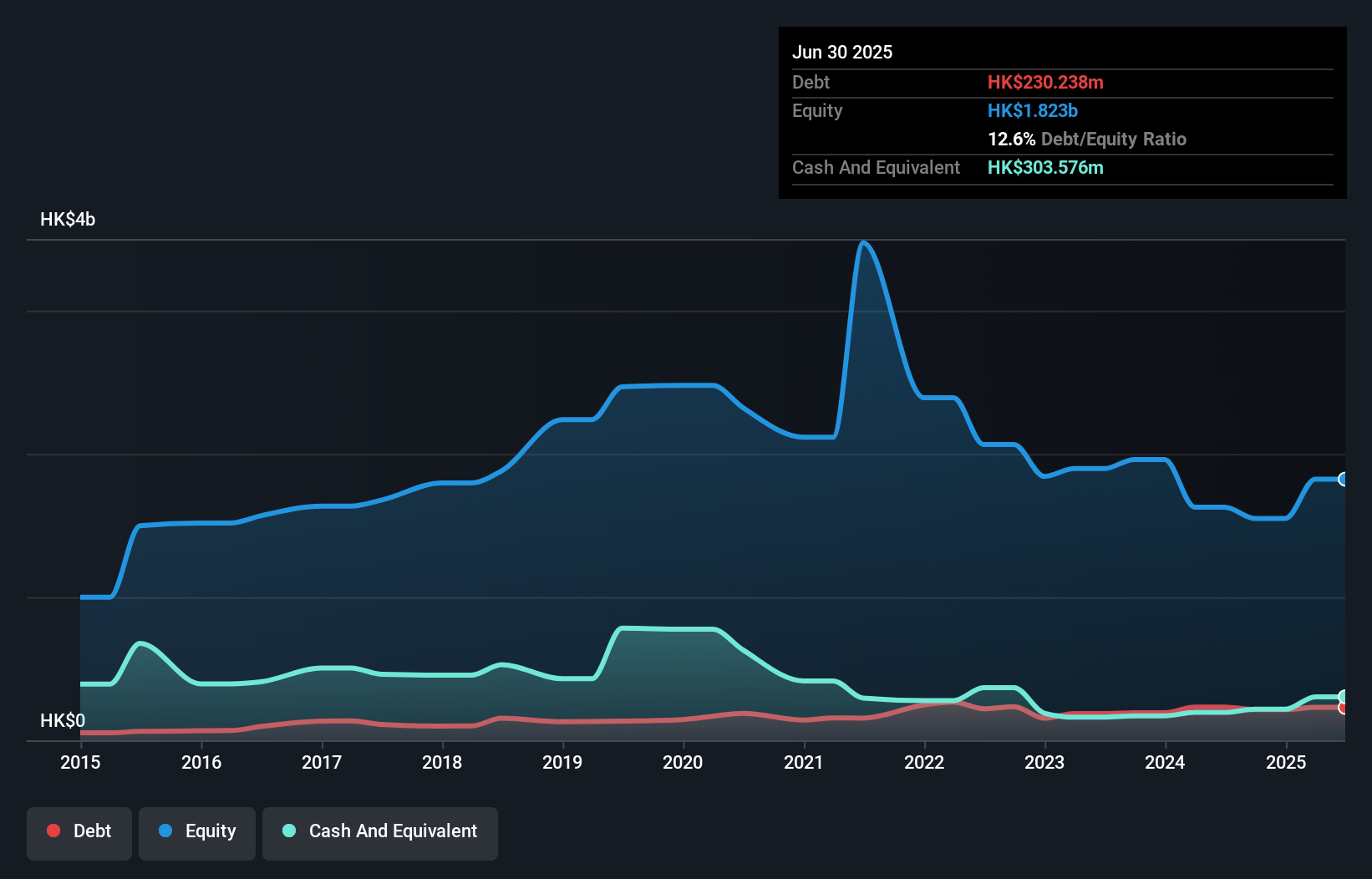

Lee's Pharmaceutical Holdings, with a market cap of HK$812.59 million, benefits from stable earnings quality and well-covered interest payments (6.5x EBIT coverage). Despite a decline in earnings by 14.9% annually over the past five years, recent profit growth of 61.9% suggests potential recovery. The management team is seasoned with an average tenure of 10.2 years, though the board lacks experience with an average tenure of 2.9 years. Short-term assets comfortably cover both short and long-term liabilities, while its debt level remains satisfactory at a net debt to equity ratio of 2.2%.

- Jump into the full analysis health report here for a deeper understanding of Lee's Pharmaceutical Holdings.

- Gain insights into Lee's Pharmaceutical Holdings' historical outcomes by reviewing our past performance report.

Terminal X Online (TASE:TRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Terminal X Online Ltd. operates as an online retailer providing clothing, footwear, fashion accessories, cosmetics, and beauty products for men, women, and teenagers under various brands with a market cap of ₪604.65 million.

Operations: The company generates revenue of ₪472.00 million from its online retail operations, which include clothing, footwear, fashion accessories, cosmetics, and beauty products for a diverse customer base.

Market Cap: ₪604.65M

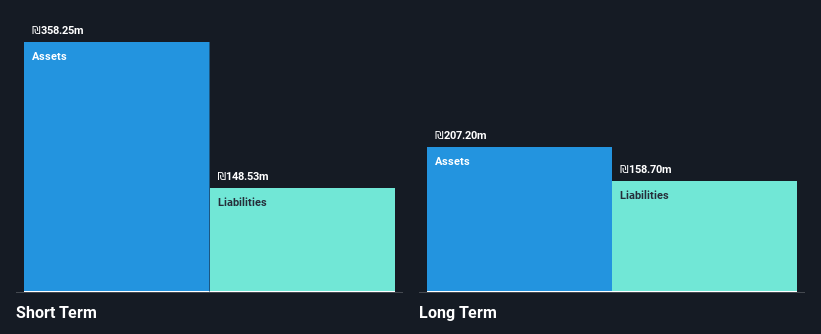

Terminal X Online Ltd. has shown significant progress, reporting a net income of ₪3.38 million for Q3 2024 compared to a loss last year, indicating improved profitability. The company trades at a substantial discount to its estimated fair value and maintains strong financial health with more cash than total debt and short-term assets exceeding liabilities. Its board and management are experienced, contributing to stable operations. Although Return on Equity is low at 7.1%, the company's debt is well covered by operating cash flow, reflecting sound financial management without shareholder dilution in the past year.

- Get an in-depth perspective on Terminal X Online's performance by reading our balance sheet health report here.

- Learn about Terminal X Online's historical performance here.

Make It Happen

- Unlock our comprehensive list of 5,733 Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SpectraCure, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SPEC

Moderate with adequate balance sheet.

Market Insights

Community Narratives