- Sweden

- /

- Medical Equipment

- /

- OM:SPEC

European Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, the European market is marked by cautious optimism amidst ongoing geopolitical developments and trade policy shifts. Despite these uncertainties, investors continue to explore opportunities in various segments, including penny stocks—a term that may seem outdated but still holds relevance for those seeking growth at lower price points. Typically representing smaller or newer companies, penny stocks can offer significant potential when backed by strong financials and fundamentals. In this article, we highlight three European penny stocks that stand out for their balance sheet strength and potential for impressive returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.85 | SEK288.69M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.255 | €312.08M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.70 | €53.03M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.85 | SEK288.5M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.06 | SEK1.97B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.43 | €24.77M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.10 | €88.61M | ★★★★★☆ |

| Scana (OB:SCANA) | NOK2.30 | NOK1.06B | ★★★★★★ |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Cellularline (BIT:CELL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cellularline S.p.A. manufactures and sells smartphone and tablet accessories across various regions including Europe, the Middle East, North America, and internationally with a market cap of €56.91 million.

Operations: The company generates revenue of €164.29 million from its Electronic Components & Parts segment.

Market Cap: €56.91M

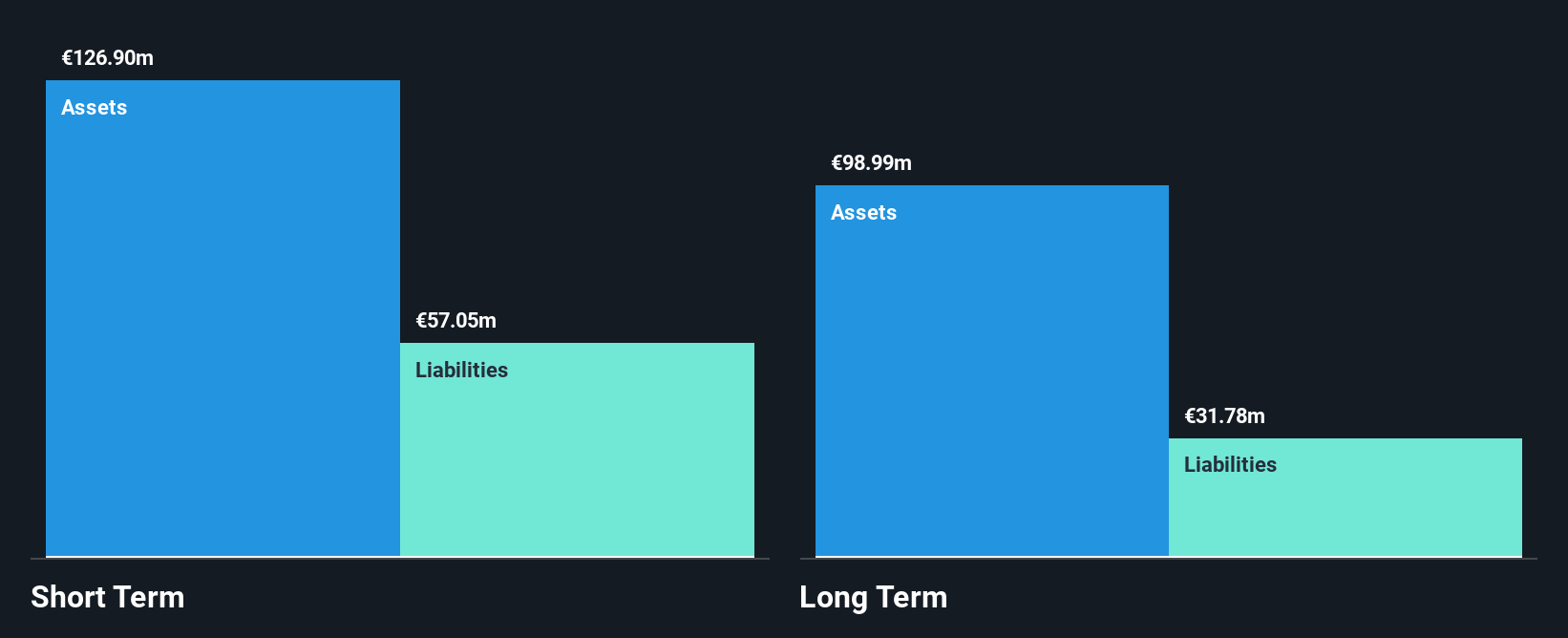

Cellularline S.p.A. has a market cap of €56.91 million and generates €164.29 million in revenue, indicating it is not pre-revenue. The company recently became profitable, though its earnings have declined by 40% annually over the past five years, and it faces challenges with low return on equity at 3.8%. Cellularline's short-term assets exceed both its short-term and long-term liabilities, suggesting solid liquidity management. However, interest coverage is weak at 2.3 times EBIT compared to debt obligations. Trading below the Italian market's P/E ratio suggests potential value for investors mindful of volatility and an inexperienced management team.

- Get an in-depth perspective on Cellularline's performance by reading our balance sheet health report here.

- Gain insights into Cellularline's outlook and expected performance with our report on the company's earnings estimates.

Nanexa (OM:NANEXA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanexa AB (publ) is a nanotechnology drug delivery company with a market cap of SEK192.69 million.

Operations: The company generates revenue of SEK46.69 million from its drug delivery systems segment.

Market Cap: SEK192.69M

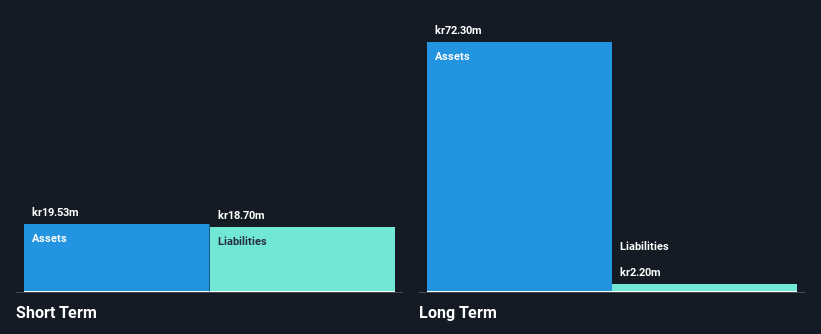

Nanexa AB, with a market cap of SEK192.69 million, is a pre-revenue company in the nanotechnology drug delivery sector. Despite its unprofitability and high volatility compared to most Swedish stocks, Nanexa has managed to reduce its debt significantly over the past five years and maintains more cash than total debt. Recent earnings reports show declining revenue but a reduced net loss year-over-year. The company recently raised SEK35 million through an equity offering, which may help extend its limited cash runway. Its board and management team are experienced, potentially aiding strategic development amid ongoing product trials like NEX-22 for diabetes treatment.

- Click here to discover the nuances of Nanexa with our detailed analytical financial health report.

- Learn about Nanexa's historical performance here.

SpectraCure (OM:SPEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SpectraCure AB (publ) focuses on developing cancer treatment systems and has a market cap of SEK195.23 million.

Operations: SpectraCure AB (publ) has not reported any revenue segments.

Market Cap: SEK195.23M

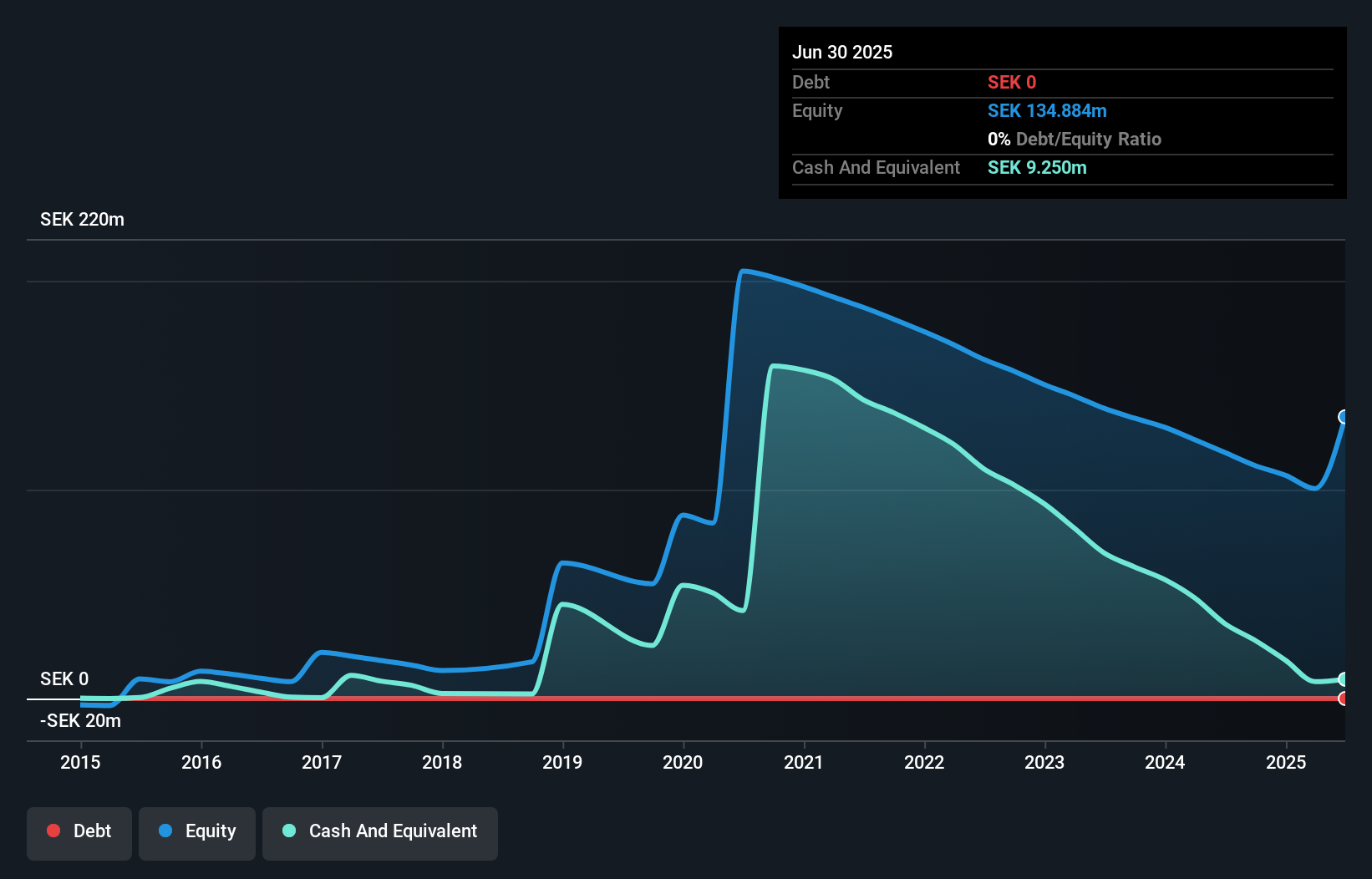

SpectraCure AB, with a market cap of SEK195.23 million, is a pre-revenue company focused on cancer treatment systems. Recent earnings reveal revenue of SEK1.53 million and a net loss of SEK23 million for 2024. The company remains debt-free but faces high volatility and has less than one year of cash runway based on current free cash flow trends. Despite an inexperienced board, the management team is seasoned, which may aid in navigating financial challenges. SpectraCure's short-term assets exceed both long-term and short-term liabilities, providing some financial stability amid its unprofitable status and fluctuating share price.

- Dive into the specifics of SpectraCure here with our thorough balance sheet health report.

- Understand SpectraCure's track record by examining our performance history report.

Make It Happen

- Reveal the 431 hidden gems among our European Penny Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SPEC

Moderate with adequate balance sheet.

Market Insights

Community Narratives