- Sweden

- /

- Healthtech

- /

- OM:SECT B

High Growth Tech Stocks Featuring Global Innovations

Reviewed by Simply Wall St

In a week where global markets showed resilience despite the U.S. government shutdown, small-cap stocks in the Russell 2000 Index outperformed broader indices like the S&P 500, buoyed by expectations of potential Federal Reserve rate cuts. In this environment, high growth tech stocks that leverage innovative technologies and adapt to changing economic conditions may offer compelling opportunities for investors seeking exposure to dynamic sectors poised for growth.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Zhongji Innolight | 28.78% | 30.84% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.64% | 43.11% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

WithSecure Oyj (HLSE:WITH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WithSecure Oyj is a global provider in the corporate security sector, with a market capitalization of €298.24 million.

Operations: WithSecure Oyj generates revenue primarily from Elements Company (€105.12 million) and Cloud Protection for Salesforce (€12.01 million).

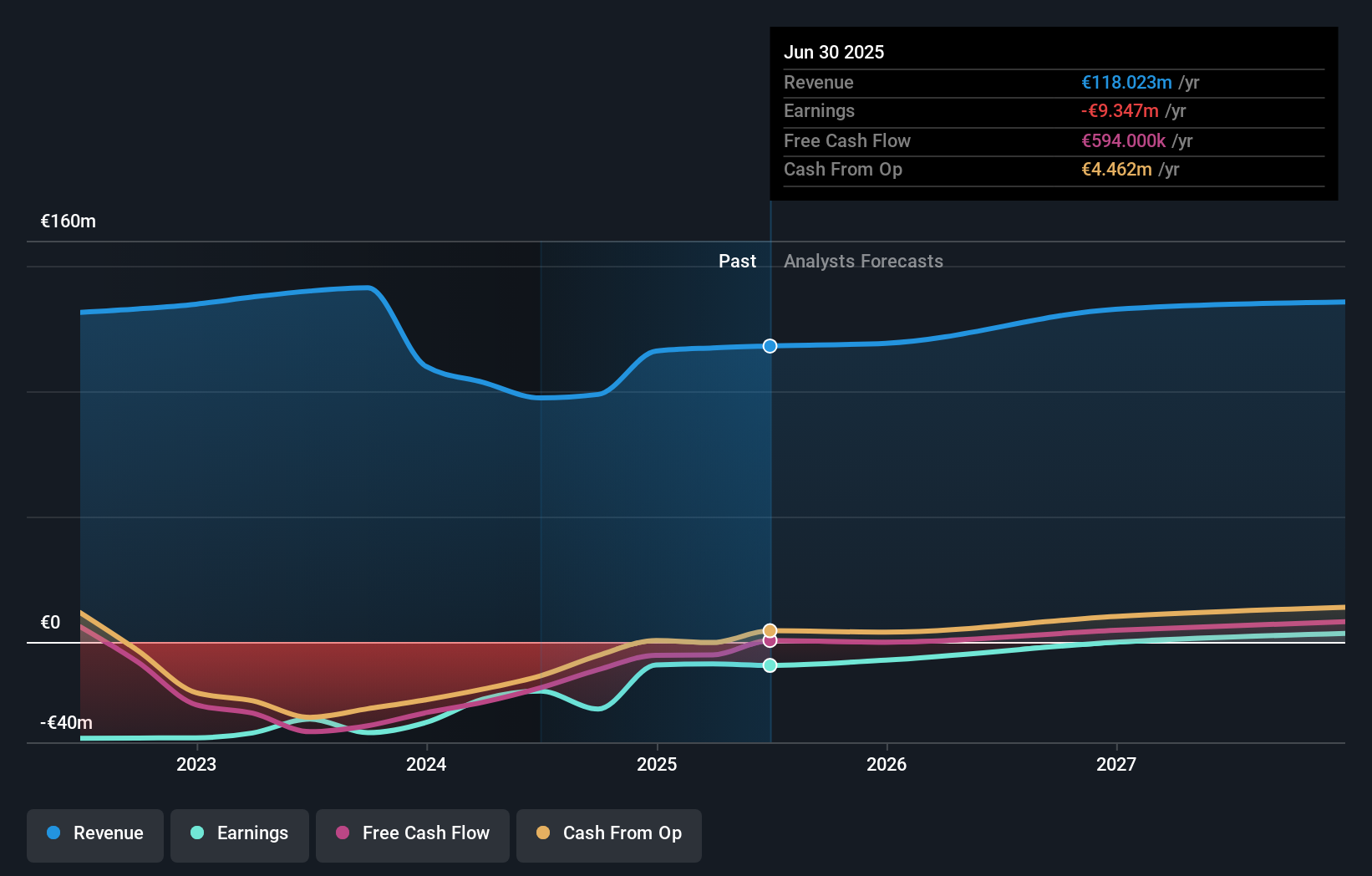

WithSecure Oyj, amid a dynamic tech landscape, is navigating through significant restructuring and strategic acquisitions to realign its business model and cost structures. The company recently announced a reduction of 55 positions expected to save approximately €6.5 million annually, alongside a major acquisition by CVC Capital Partners for about €300 million, signaling robust strategic shifts. Despite these efforts and a forecasted revenue growth of 5.7% per year outpacing the Finnish market's 4%, WithSecure faces challenges with current unprofitability and a highly volatile share price. However, its commitment to turning profitable with an anticipated earnings growth of 93.94% annually showcases potential resilience and adaptability in the evolving cybersecurity sector.

- Get an in-depth perspective on WithSecure Oyj's performance by reading our health report here.

Explore historical data to track WithSecure Oyj's performance over time in our Past section.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

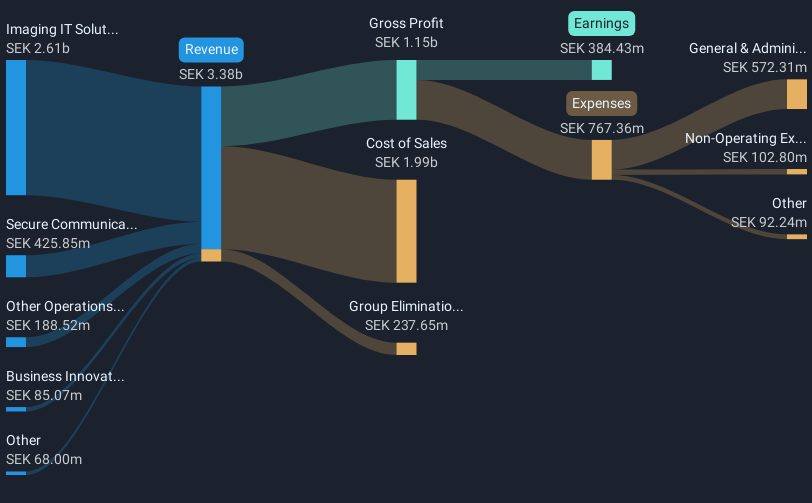

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market capitalization of SEK58.76 billion.

Operations: Sectra AB (publ) generates revenue primarily from Imaging IT Solutions, contributing SEK2.82 billion, and Secure Communications, which adds SEK422.26 million. The company's focus on these sectors highlights its emphasis on providing specialized solutions in medical IT and cybersecurity across Europe.

Sectra's recent strategic moves, including the expansion of its enterprise imaging solution with AI services at UMG Göttingen and the $21 million contract for Sectra One Cloud in the US, underscore its commitment to integrating advanced technology into healthcare. These developments not only enhance workflow efficiencies but also position Sectra favorably within digital healthcare markets. The company's robust financial performance is evident from a 14.5% annual revenue growth and a significant 31% increase in earnings over the past year, surpassing industry averages. Moreover, Sectra's focus on R&D has led to innovations like the Sectra Amplifier Service, which streamlines clinical workflows by integrating AI applications—a testament to its forward-thinking approach in a competitive sector.

- Navigate through the intricacies of Sectra with our comprehensive health report here.

Assess Sectra's past performance with our detailed historical performance reports.

oRo (TSE:3983)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: oRo Co., Ltd. offers cloud and digital transformation solutions in Japan, with a market capitalization of ¥38.87 billion.

Operations: oRo Co., Ltd. generates revenue primarily through its Cloud Solution Business, which contributed ¥5.29 billion, and Marketing Solutions, adding ¥2.68 billion.

With a robust 14.6% forecast in annual revenue growth and an even more impressive 24.8% in earnings growth, oRo stands out for its dynamic financial trajectory compared to the slower JP market average of 4.4% and 8.1%, respectively. The company's commitment to innovation is evident from its substantial investment in R&D, aligning with industry trends towards enhanced tech capabilities. Recent actions underscore this focus, with oRo repurchasing shares worth ¥999.96 million, reinforcing confidence in its strategic direction amidst competitive market challenges.

- Click to explore a detailed breakdown of our findings in oRo's health report.

Examine oRo's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Investigate our full lineup of 242 Global High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SECT B

Sectra

Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives