- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

3 Swedish Growth Stocks With Up To 37% Insider Ownership

Reviewed by Simply Wall St

As global markets experience turbulence, with the S&P 500 Index suffering its worst weekly drop in 18 months and European indices also showing declines, investors are increasingly looking for stable opportunities. In this context, Swedish growth companies with high insider ownership offer a compelling option due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.5% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.1% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We're going to check out a few of the best picks from our screener tool.

Better Collective (OM:BETCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Better Collective A/S, with a market cap of SEK13.23 billion, operates as a digital sports media company across Europe, North America, and internationally.

Operations: The company's revenue segments include €109.72 million from Paid Media and €245.06 million from Publishing.

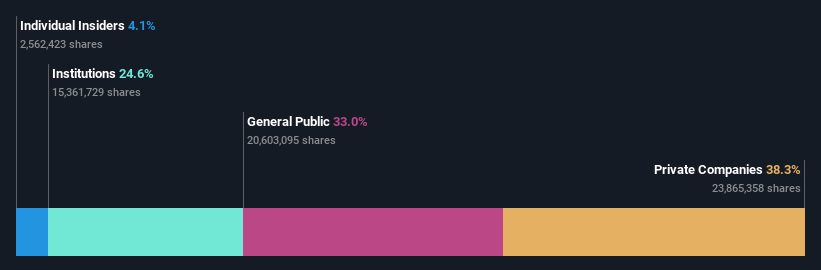

Insider Ownership: 37.9%

Better Collective reported Q2 2024 earnings with sales of €99.12 million, up from €78.12 million a year ago, and net income of €10.29 million compared to €8.3 million last year. Despite lower profit margins (8% vs 18.1%), the company shows strong insider ownership with more shares bought than sold recently, indicating confidence in its growth prospects. However, shareholders have faced dilution over the past year and debt coverage by operating cash flow remains a concern.

- Get an in-depth perspective on Better Collective's performance by reading our analyst estimates report here.

- Our valuation report here indicates Better Collective may be undervalued.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK382.99 billion.

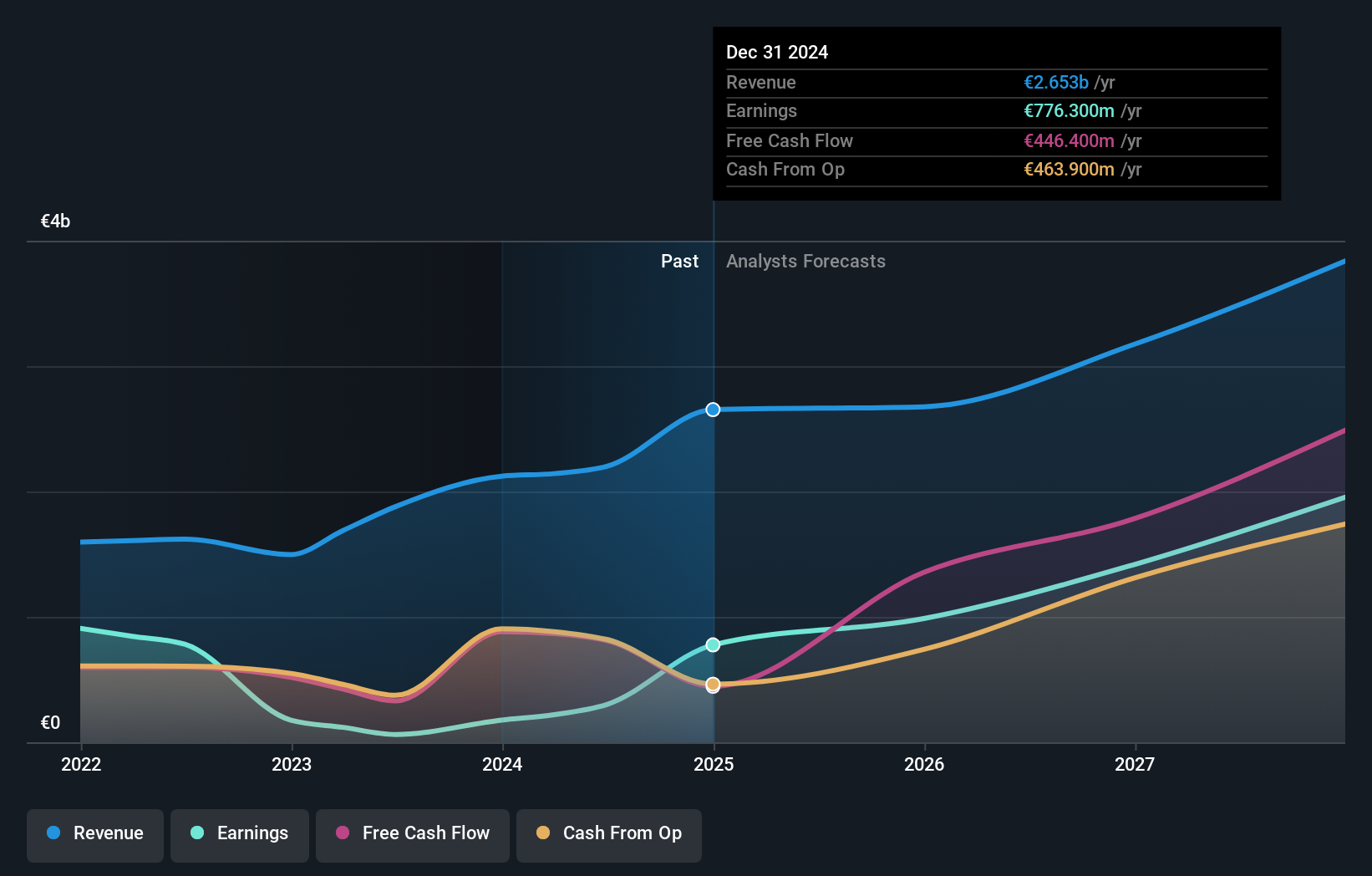

Operations: Revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Insider Ownership: 30.9%

EQT has demonstrated strong growth with earnings up 384.2% over the past year and is forecasted to grow 35.89% annually, outpacing the Swedish market. Despite no substantial insider buying in the last three months, significant insider ownership remains a positive indicator. The company is trading at 9.3% below its estimated fair value and has been active in M&A discussions, including competing for Singapore Post's $1 billion Australian business and considering options for AGS Health and Nord Anglia Education Limited’s reinvestment plans.

- Dive into the specifics of EQT here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that EQT is trading beyond its estimated value.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and other parts of Europe with a market cap of SEK50.63 billion.

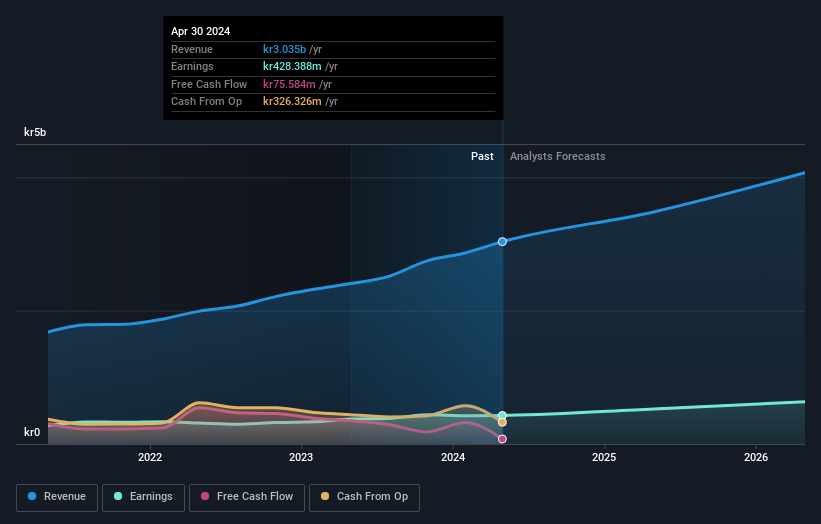

Operations: Sectra generates revenue primarily from its Imaging IT Solutions segment (SEK2.67 billion) and Secure Communications segment (SEK388.55 million), alongside contributions from Business Innovation (SEK90.77 million).

Insider Ownership: 30.3%

Sectra has shown solid growth, with earnings up 17% over the past year and forecasted to grow 21.21% annually, outpacing the Swedish market's 15.4%. Recent quarterly results reported sales of SEK 736.75 million and net income of SEK 80.4 million, reflecting a positive trajectory. While there has been no substantial insider trading in the last three months, high insider ownership remains a strong indicator of confidence in Sectra's future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Sectra.

- Upon reviewing our latest valuation report, Sectra's share price might be too optimistic.

Next Steps

- Explore the 93 names from our Fast Growing Swedish Companies With High Insider Ownership screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Better Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETCO

Better Collective

Operates as a digital sports media company in Europe, North America, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives