- Germany

- /

- Healthcare Services

- /

- XTRA:M12

Undiscovered Gems In Europe Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

As European markets face headwinds from political turmoil and trade tensions, the pan-European STOXX Europe 600 Index has recently seen a decline following record highs. Despite these challenges, small-cap stocks can often present unique opportunities for investors willing to explore beyond the well-trodden paths of major indices, as they may offer growth potential driven by innovation and niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sparta | NA | nan | nan | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.08% | 60.90% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

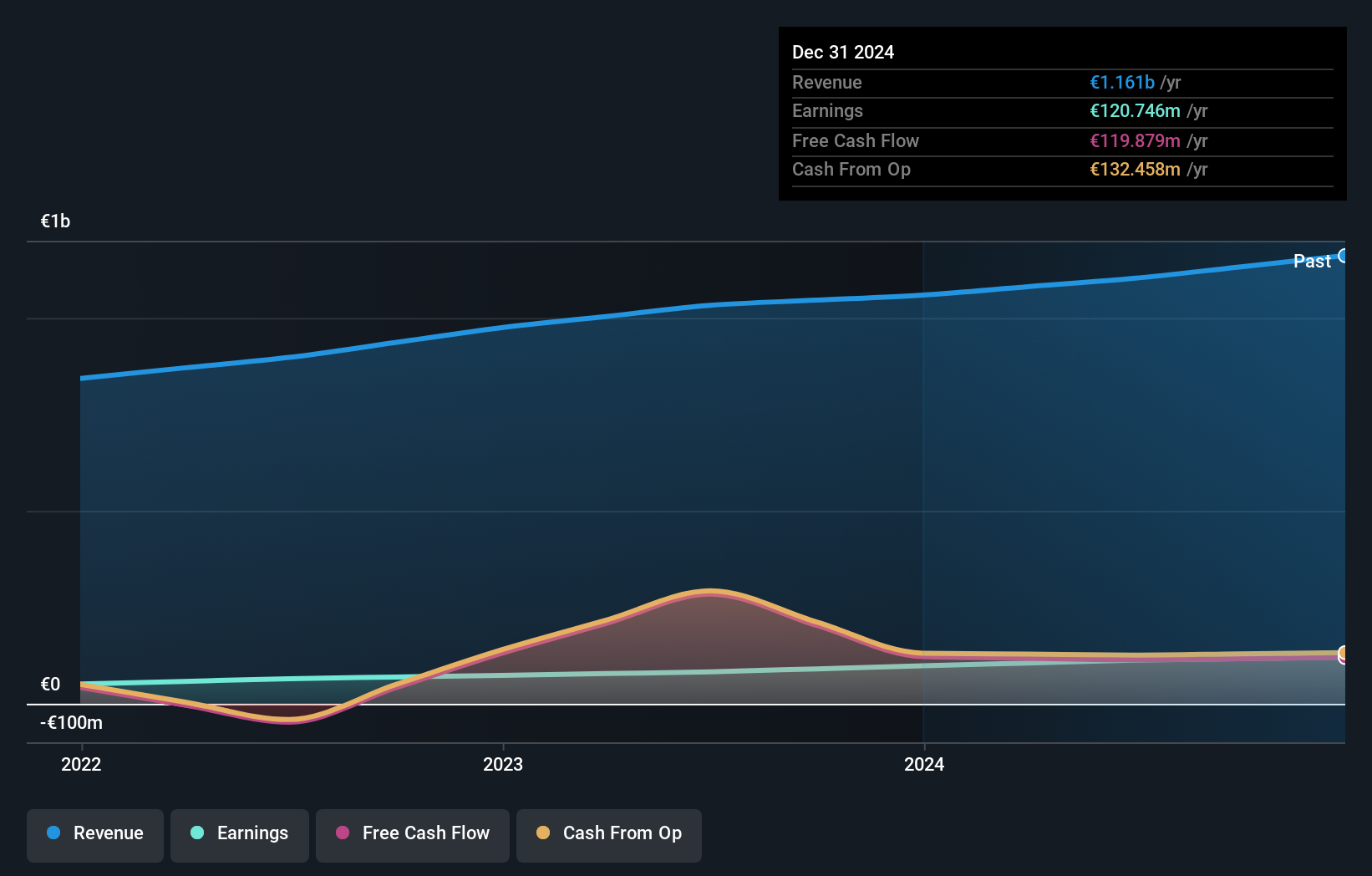

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of approximately €1.10 billion.

Operations: VIEL & Cie derives its revenue primarily from professional intermediation (€1.16 billion) and stock exchange online services (€72.80 million).

With its recent addition to the CAC Small and All-Tradable Indexes, VIEL & Cie is gaining attention. The company reported a revenue of €655.2 million for the first half of 2025, up from €598.8 million last year, with net income rising to €69.2 million from €65.4 million in the same period. Over five years, its debt-to-equity ratio improved from 89.9% to 79.4%, indicating prudent financial management while maintaining high-quality earnings and positive free cash flow positions it well below estimated fair value by 16%. Earnings growth at 10.6% outpaces industry averages, showcasing robust performance in capital markets.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

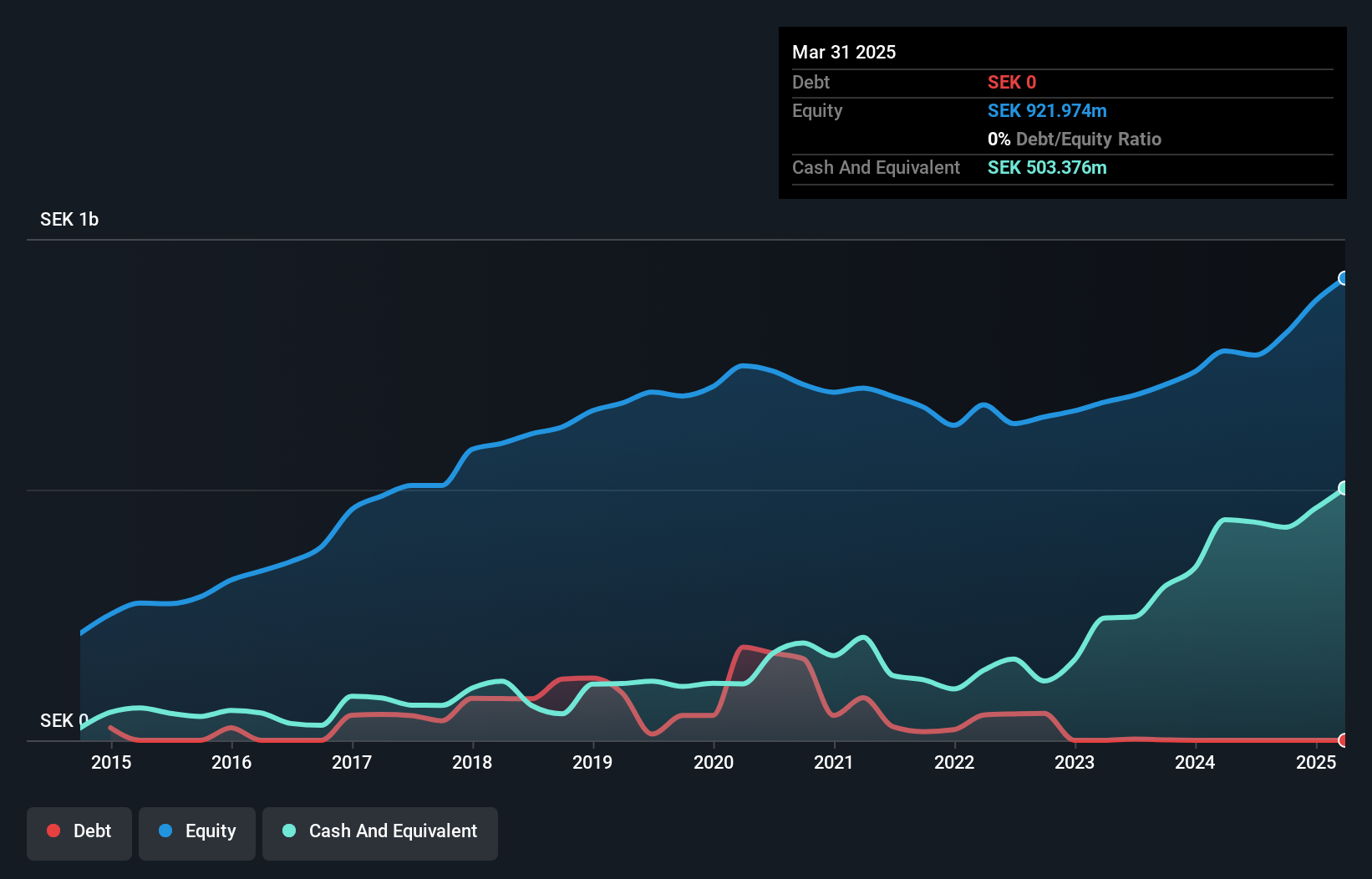

Overview: RaySearch Laboratories AB (publ) is a medical technology company that offers software solutions for cancer treatment on a global scale, with a market cap of approximately SEK8.50 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.25 billion.

RaySearch Laboratories, a notable player in oncology software, is making waves with its innovative offerings like RayStation and RayCare. Recent product launches at ASTRO 2025 showcased advancements such as adaptive radiotherapy and AI-driven image segmentation, highlighting the company's focus on personalized cancer treatment. Financially, RaySearch has shown resilience with a net income of SEK 87.57 million for the first half of 2025 despite challenges. The company is debt-free now compared to a debt-to-equity ratio of 23.6% five years ago, and its earnings growth of 27.6% outpaced the industry average of 14.4%.

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★☆

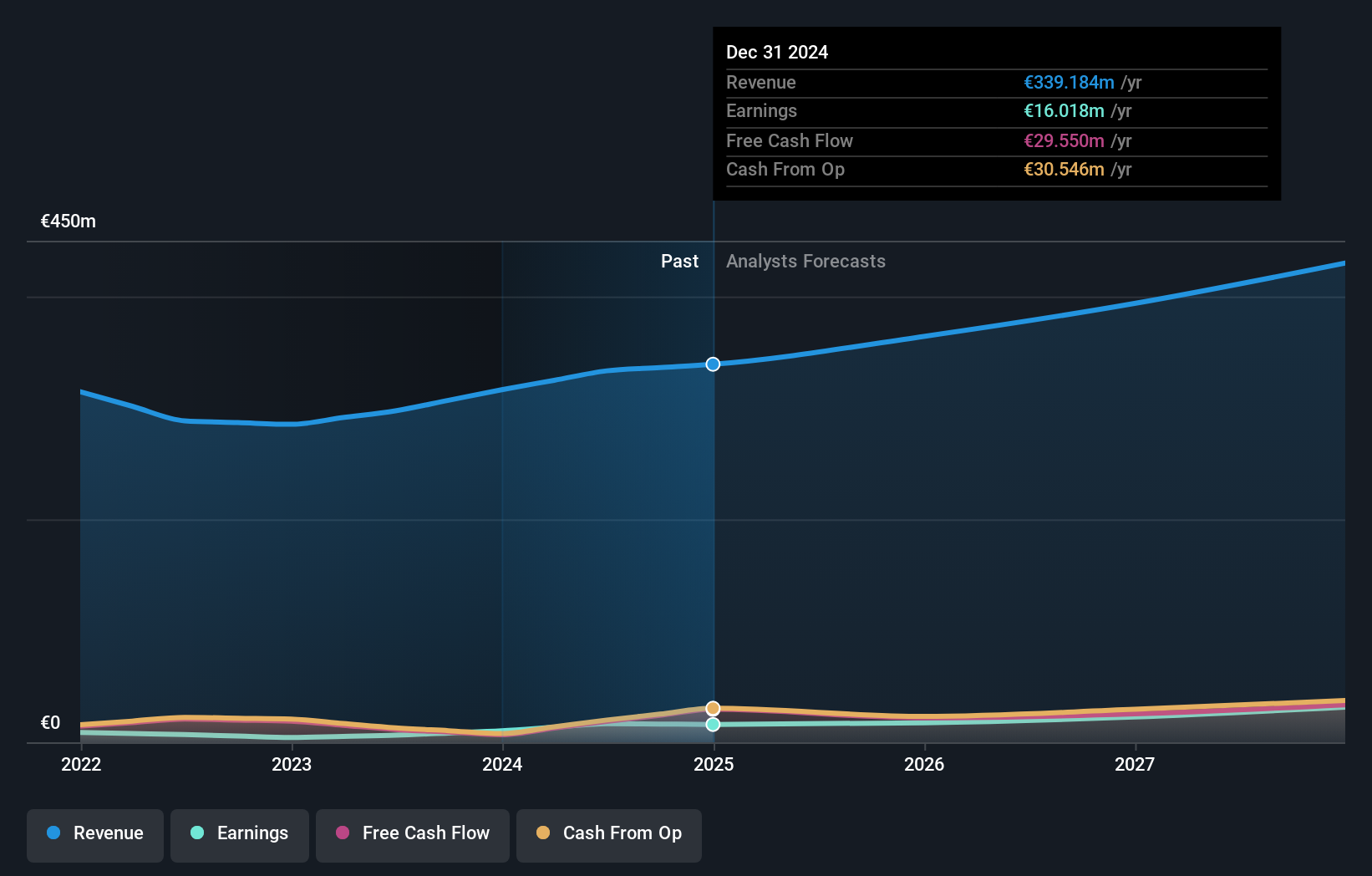

Overview: M1 Kliniken AG operates in the field of aesthetic medicine and plastic surgery across several countries including Germany, Austria, and the United Kingdom, with a market capitalization of €292.06 million.

Operations: M1 Kliniken AG generates revenue primarily from its Trade segment, which accounts for €247.44 million, and its Beauty segment, contributing €91.75 million.

M1 Kliniken, a healthcare company, has shown impressive earnings growth of 55.9% over the past year, outpacing the broader industry which saw a -5.7% shift. The company's debt to equity ratio increased from 0.1% to 8% over five years, yet it holds more cash than total debt, indicating financial stability. With interest payments well covered by EBIT at 27.8 times, M1 Kliniken seems well-positioned financially. Trading at a significant discount of 72.7% below its estimated fair value suggests potential upside for investors seeking opportunities in burgeoning sectors like healthcare in Europe.

- Get an in-depth perspective on M1 Kliniken's performance by reading our health report here.

Gain insights into M1 Kliniken's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Discover the full array of 331 European Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M12

M1 Kliniken

Provides aesthetic medicine and plastic surgery services in Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania, and Australia.

Undervalued with high growth potential.

Market Insights

Community Narratives