- South Korea

- /

- Communications

- /

- KOSDAQ:A094360

High Growth Tech And 2 Other Promising Stocks With Potential

Reviewed by Simply Wall St

Amidst a backdrop of inflation concerns and political uncertainty, U.S. equities have faced a challenging start to the year, with small-cap stocks underperforming and major indices like the Nasdaq Composite experiencing significant declines. In this environment, identifying promising stocks requires careful consideration of companies that demonstrate strong fundamentals and resilience to market volatility, particularly in sectors like high growth tech that may offer potential opportunities despite broader economic headwinds.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1234 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chips&Media (KOSDAQ:A094360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chips&Media, Inc. develops and sells multimedia IP in South Korea and internationally, with a market cap of ₩374.58 billion.

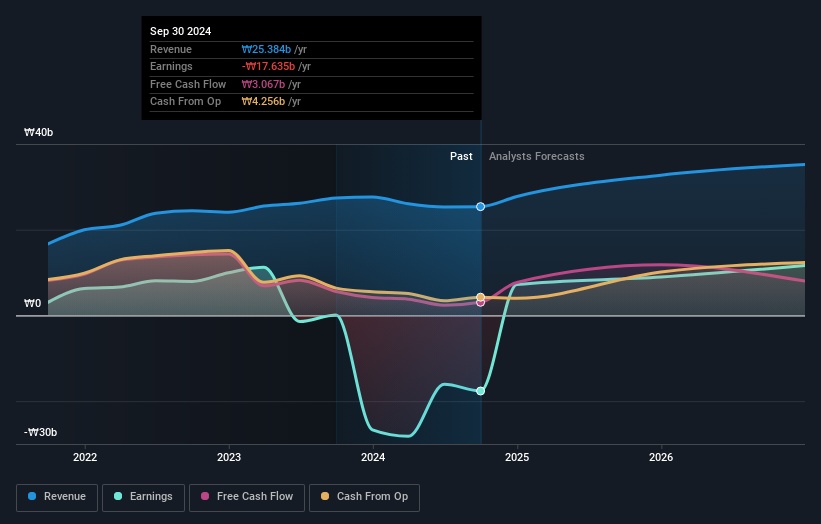

Operations: Chips&Media generates revenue primarily through the sale and licensing of semiconductor design assets (IP), with recent figures reaching ₩25.38 billion.

Chips&Media, a player in the tech sector, is navigating a landscape marked by intense volatility and aggressive competition. Despite this, the company has demonstrated robust financial maneuvers with an 82.42% forecasted annual earnings growth and an expected revenue increase of 14.4% per year, outpacing Korea's market average of 9.2%. Notably, its strategic share repurchase program aimed at stabilizing stock price and enhancing shareholder value reflects a proactive approach to capital management; since October 2024, Chips&Media has effectively repurchased shares worth KRW 2,991.38 million. This blend of strong growth metrics coupled with shareholder-focused strategies positions it intriguingly for future prospects amidst the dynamic tech industry landscape.

- Get an in-depth perspective on Chips&Media's performance by reading our health report here.

Assess Chips&Media's past performance with our detailed historical performance reports.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer care across various global regions, with a market cap of approximately SEK8 billion.

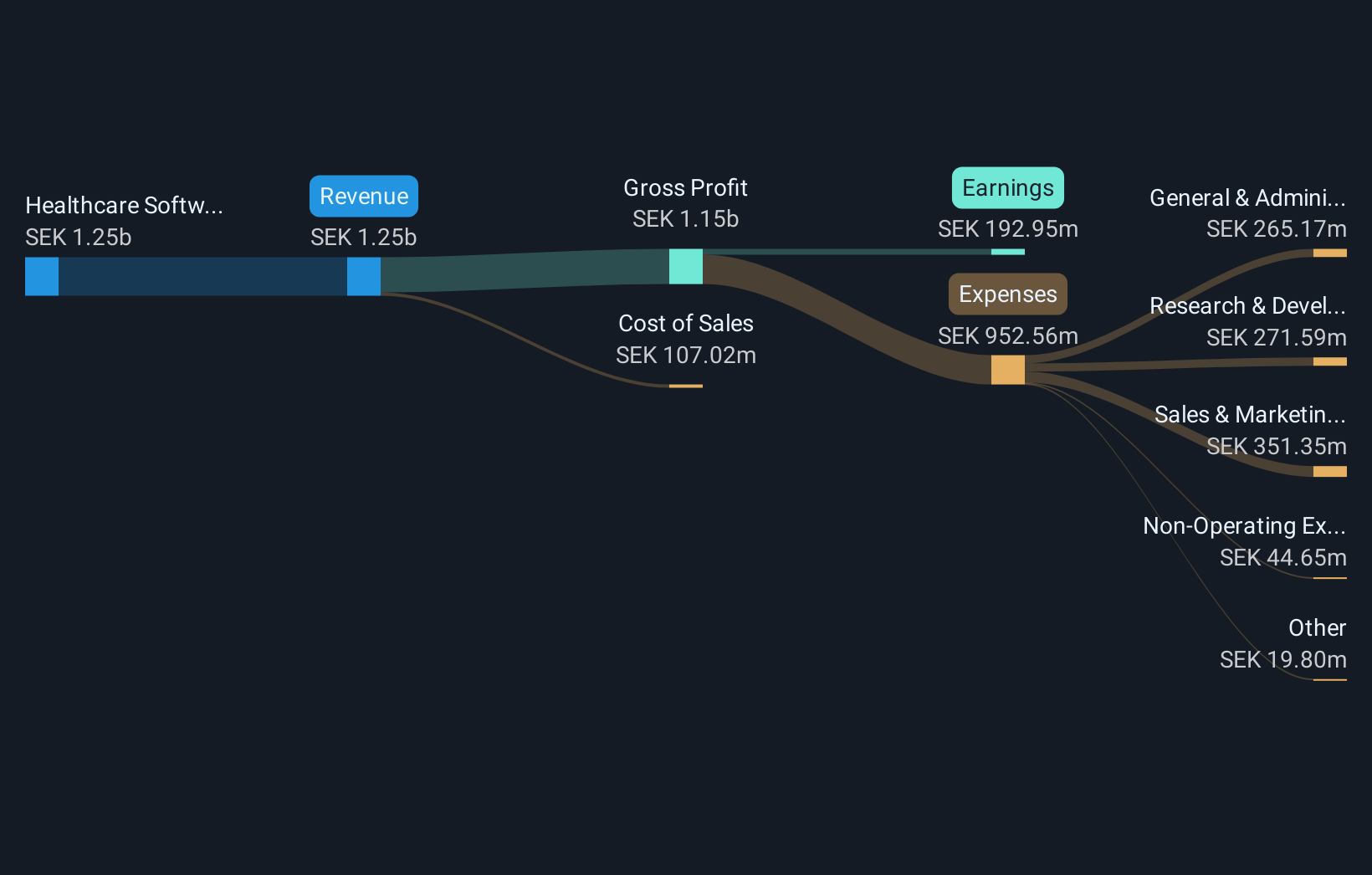

Operations: The company generates revenue primarily from its healthcare software segment, totaling SEK1.17 billion.

RaySearch Laboratories AB has been making significant strides in the oncology sector, recently securing multiple orders for its RayStation® treatment planning system, including a notable €1.7 million deal with Institut Curie. This momentum is mirrored in their financials; Q3 reports showed a leap in sales to SEK 293.3 million from SEK 252.88 million the previous year and net income more than doubling to SEK 45.39 million. These developments highlight RaySearch's robust position in precision oncology, driven by innovative solutions like DrugLog that enhance safety and efficacy in cancer treatments, positioning them well amidst evolving healthcare demands.

- Navigate through the intricacies of RaySearch Laboratories with our comprehensive health report here.

Explore historical data to track RaySearch Laboratories' performance over time in our Past section.

Anhui Wanyi Science and TechnologyLtd (SHSE:688600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Wanyi Science and Technology Co., Ltd. (SHSE:688600) is a company with a market capitalization of approximately CN¥1.84 billion, engaged in operations related to science and technology.

Operations: Anhui Wanyi Science and Technology Co., Ltd. focuses on science and technology operations, generating revenue through its specialized segments.

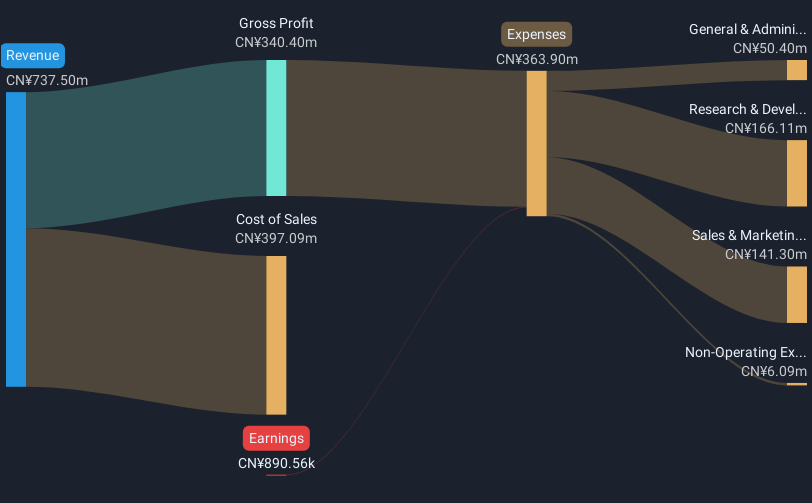

Anhui Wanyi Science and Technology Ltd., despite recent financial turbulence with a reported net loss of CNY 26.68 million from revenues of CNY 455.7 million, continues to focus on growth through strategic repurchases, having bought back shares worth CNY 103.92 million. This aligns with their aggressive R&D investment strategy, crucial for fostering innovation in their tech offerings. With earnings expected to grow by an impressive 78.21% annually, the company is poised for a turnaround, underscored by its recent expansion of the buyback plan to CNY 105 million and extending it until May 2025, signaling confidence in future profitability and commitment to shareholder value.

Key Takeaways

- Gain an insight into the universe of 1234 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A094360

Chips&Media

Develops and sells multimedia IP in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.