European Stocks Possibly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

Amid recent fluctuations in global markets, European stocks have faced pressure from concerns over AI valuations and shifting interest rate expectations. Despite these challenges, the expansion of business activity in the eurozone suggests potential opportunities for investors seeking stocks that may be priced below their intrinsic value estimates. Identifying such stocks often involves assessing fundamental factors like earnings potential and market positioning relative to current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Mo-BRUK (WSE:MBR) | PLN306.50 | PLN599.59 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK65.00 | SEK127.47 | 49% |

| Kitron (OB:KIT) | NOK59.25 | NOK116.55 | 49.2% |

| HMS Bergbau (XTRA:HMU) | €52.50 | €103.54 | 49.3% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.10 | 48.8% |

| Elekta (OM:EKTA B) | SEK58.50 | SEK114.24 | 48.8% |

| EcoUp Oyj (HLSE:ECOUP) | €1.34 | €2.64 | 49.2% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

| Allcore (BIT:CORE) | €1.355 | €2.65 | 48.8% |

Here we highlight a subset of our preferred stocks from the screener.

Elekta (OM:EKTA B)

Overview: Elekta AB (publ) is a medical technology company that offers clinical solutions for treating cancer and brain disorders across various regions, with a market cap of approximately SEK22.35 billion.

Operations: The company's revenue segments are divided into APAC with SEK5.93 billion, Americas with SEK4.83 billion, and Europe, Middle East and Africa (EMEA) with SEK6.81 billion.

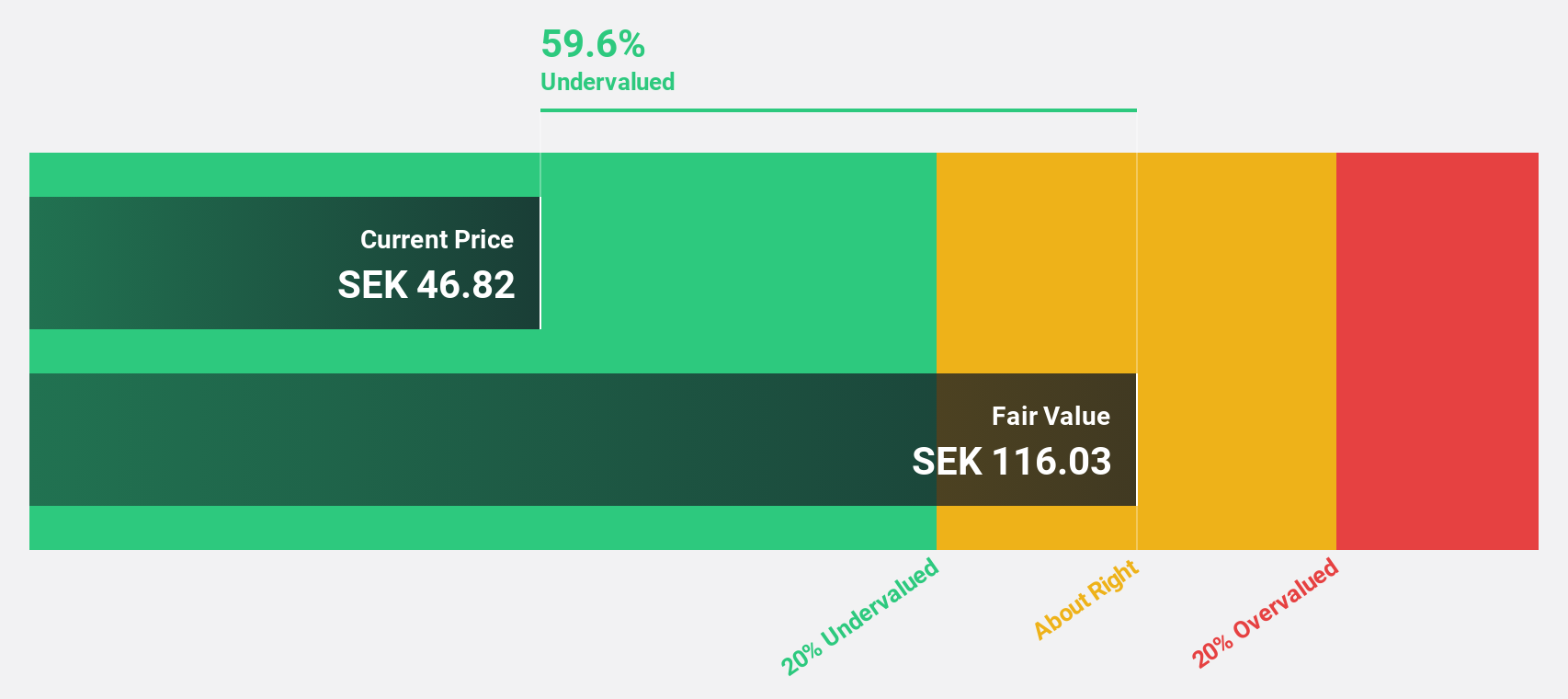

Estimated Discount To Fair Value: 48.8%

Elekta AB appears undervalued based on discounted cash flow analysis, trading significantly below its estimated fair value of SEK 114.24 at SEK 58.5. Despite a challenging sales environment, recent earnings show improvement with net income rising to SEK 230 million in Q2 from SEK 212 million a year ago. However, profit margins have decreased and the dividend coverage is weak, highlighting potential financial pressure despite expected earnings growth of over 20% annually in the coming years.

- The analysis detailed in our Elekta growth report hints at robust future financial performance.

- Get an in-depth perspective on Elekta's balance sheet by reading our health report here.

RaySearch Laboratories (OM:RAY B)

Overview: RaySearch Laboratories AB (publ) is a medical technology company that provides software solutions for cancer treatment worldwide, with a market cap of SEK7.92 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, which amounts to SEK1.29 billion.

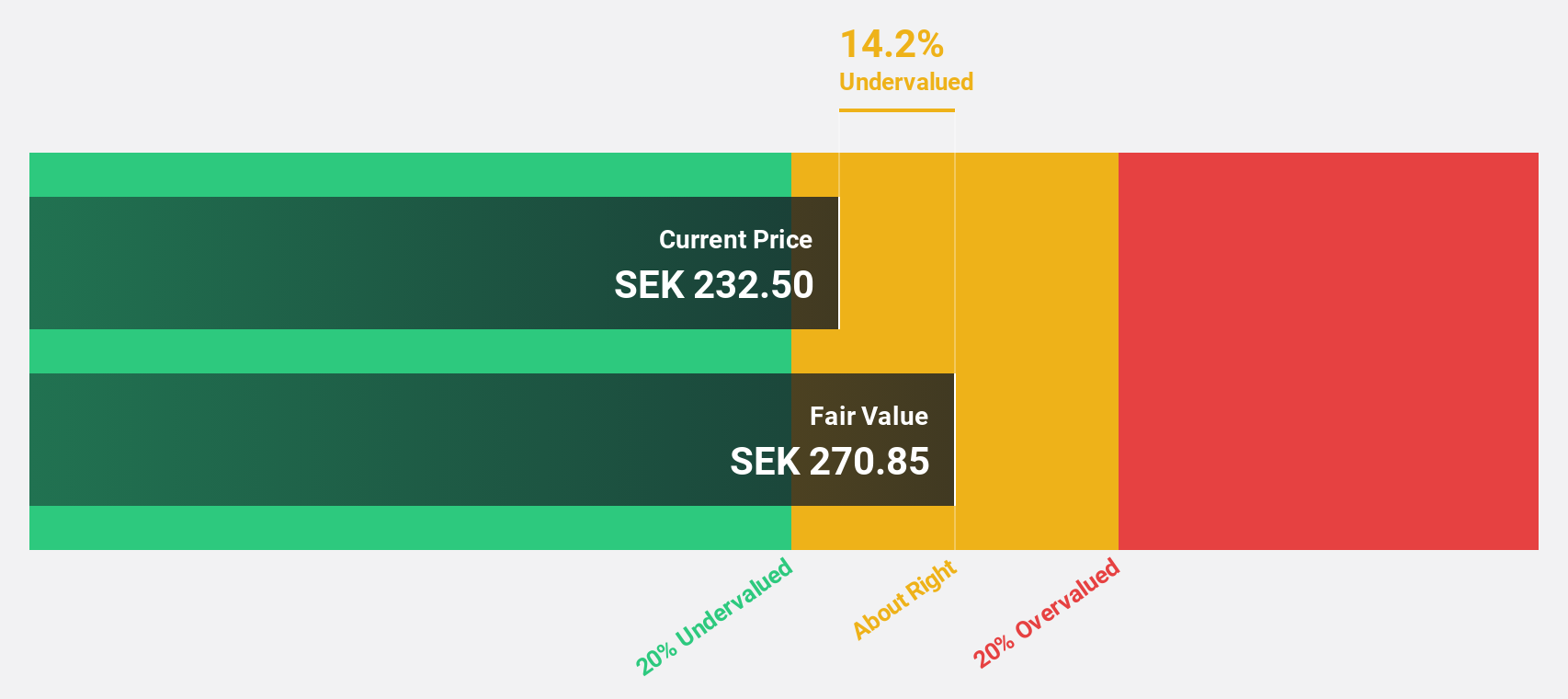

Estimated Discount To Fair Value: 14.7%

RaySearch Laboratories AB is trading at SEK 231, below its estimated fair value of SEK 270.92, suggesting it may be undervalued based on cash flows. The company's earnings have grown by 25.2% over the past year, and its revenue is forecast to grow at 13.9% annually, outpacing the Swedish market's growth rate of 3.8%. Recent earnings reports show increased sales and net income in Q3 compared to the previous year, indicating strong financial performance.

- According our earnings growth report, there's an indication that RaySearch Laboratories might be ready to expand.

- Take a closer look at RaySearch Laboratories' balance sheet health here in our report.

Vitrolife (OM:VITR)

Overview: Vitrolife AB (publ) is a company that provides assisted reproduction products across Europe, the Middle East, Africa, Asia-Pacific, and the Americas with a market cap of SEK20.45 billion.

Operations: Vitrolife generates revenue from three main segments: Genetics (SEK1.44 billion), Consumables (SEK1.38 billion), and Technologies (SEK694 million).

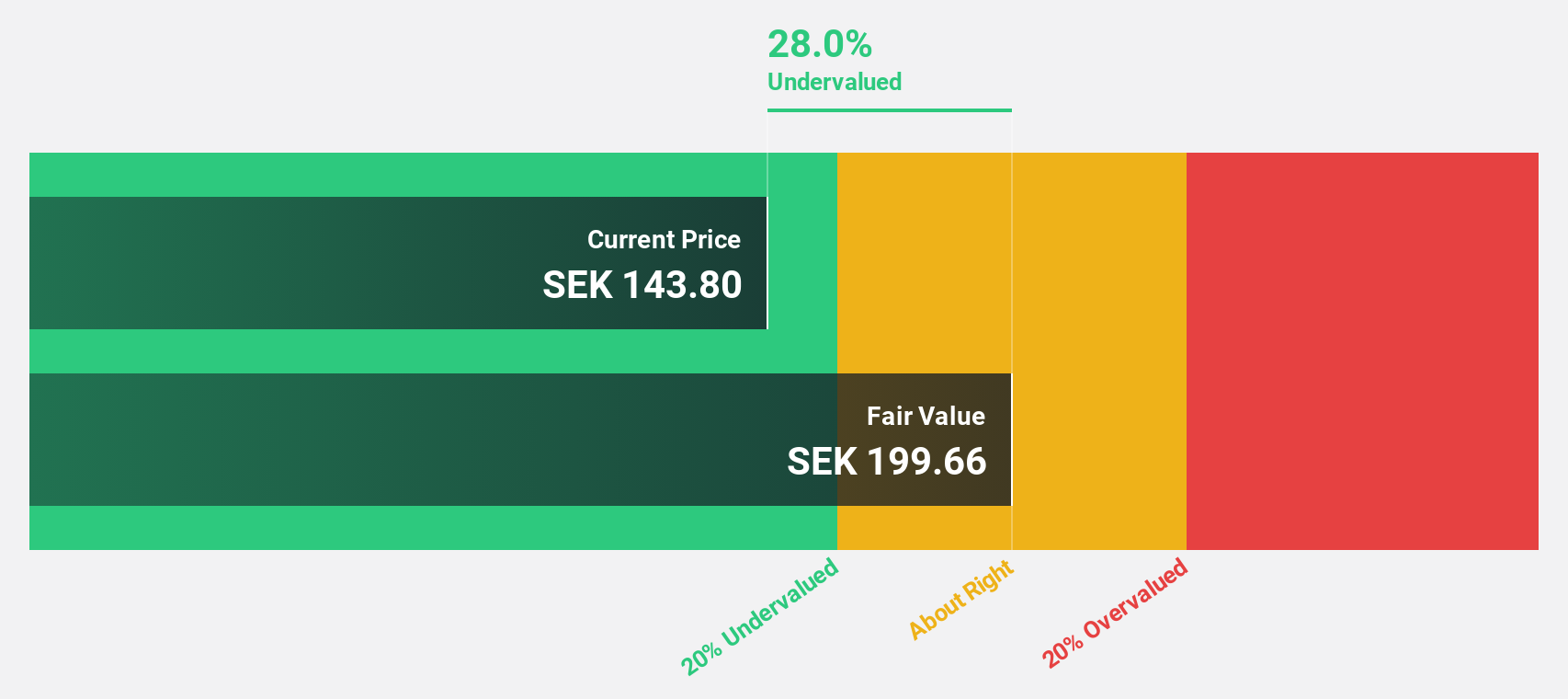

Estimated Discount To Fair Value: 25.6%

Vitrolife AB is trading at SEK 151, which is below its estimated fair value of SEK 202.99, highlighting potential undervaluation based on cash flows. Despite a recent dip in sales and net income for Q3 compared to last year, the company's earnings are forecast to grow significantly at 23% annually over the next three years. This growth rate surpasses both the Swedish market's average and Vitrolife's projected revenue growth of 6.8% per year.

- Upon reviewing our latest growth report, Vitrolife's projected financial performance appears quite optimistic.

- Dive into the specifics of Vitrolife here with our thorough financial health report.

Summing It All Up

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 197 more companies for you to explore.Click here to unveil our expertly curated list of 200 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Vitrolife

Provides assisted reproduction products in Europe, the Middle East, Africa, Asia-Pacific, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.