- Sweden

- /

- Healthtech

- /

- OM:PTRK

Physitrack (STO:PTRK) Is Doing The Right Things To Multiply Its Share Price

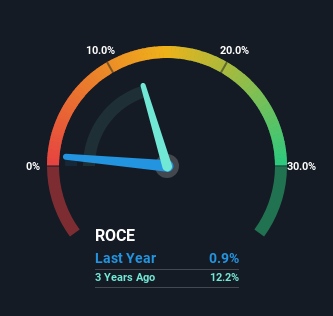

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Physitrack (STO:PTRK) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Physitrack:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0087 = €286k ÷ (€39m - €5.8m) (Based on the trailing twelve months to December 2023).

Thus, Physitrack has an ROCE of 0.9%. In absolute terms, that's a low return and it also under-performs the Healthcare Services industry average of 9.1%.

Check out our latest analysis for Physitrack

In the above chart we have measured Physitrack's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Physitrack .

So How Is Physitrack's ROCE Trending?

We're delighted to see that Physitrack is reaping rewards from its investments and is now generating some pre-tax profits. About five years ago the company was generating losses but things have turned around because it's now earning 0.9% on its capital. In addition to that, Physitrack is employing 2,303% more capital than previously which is expected of a company that's trying to break into profitability. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 15%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. This tells us that Physitrack has grown its returns without a reliance on increasing their current liabilities, which we're very happy with.

In Conclusion...

To the delight of most shareholders, Physitrack has now broken into profitability. Investors may not be impressed by the favorable underlying trends yet because over the last year the stock has only returned 0.9% to shareholders. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

One more thing, we've spotted 2 warning signs facing Physitrack that you might find interesting.

While Physitrack isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PTRK

Physitrack

Provides digital healthcare solutions in the United Kingdom, Europe, North America, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026