- Sweden

- /

- Real Estate

- /

- OM:FABG

High Insider Ownership Growth Stocks To Watch In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are grappling with geopolitical tensions and consumer spending concerns, leading to fluctuating indices and cautious investor sentiment. Amid these uncertainties, identifying growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Fabege (OM:FABG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabege AB (publ) is a Swedish property company specializing in the development, investment, and management of commercial premises, with a market cap of SEK27.18 billion.

Operations: The company generates revenue primarily from Management at SEK3.07 billion, followed by Project at SEK28 million, Birger Bostad at SEK244 million, and Processing at SEK243 million.

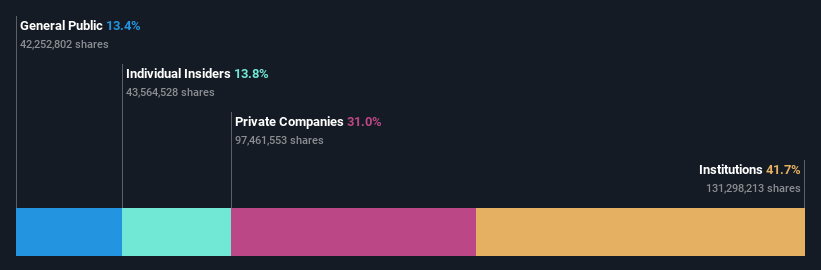

Insider Ownership: 14.0%

Fabege's recent earnings report shows a turnaround with net income of SEK 455 million compared to a loss last year, and revenue slightly declining to SEK 864 million. The company has secured an eight-year lease with SBAB Bank, adding SEK 20.8 million in net letting effect. Insider activity indicates more buying than selling recently, though not substantial. Despite low forecasted revenue growth at 2.1% annually, Fabege is expected to become profitable over the next three years, outperforming the Swedish market growth rate.

- Dive into the specifics of Fabege here with our thorough growth forecast report.

- Our expertly prepared valuation report Fabege implies its share price may be too high.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) is a company that offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK31.08 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, generating €1.46 billion, and Diagnostic Services, contributing €658 million.

Insider Ownership: 11.1%

Medicover's strategic focus on growth is evident with its 2025 earnings guidance projecting organic revenue above €2.2 billion, building on 2024 sales of €2.09 billion. Despite a slight dip in net income to €16.7 million, the company anticipates significant annual profit growth at 32.4%, outpacing the Swedish market's 9.6%. The leadership transition to John Stubbington as CEO from May 2025 aligns with Medicover's forward-looking strategy, although insider trading activity remains limited recently.

- Take a closer look at Medicover's potential here in our earnings growth report.

- Our valuation report here indicates Medicover may be overvalued.

Dalian Haosen Intelligent Manufacturing (SHSE:688529)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dalian Haosen Intelligent Manufacturing Co., Ltd. operates in the intelligent manufacturing sector, focusing on providing advanced manufacturing solutions, with a market cap of CN¥3.13 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment information for Dalian Haosen Intelligent Manufacturing Co., Ltd.

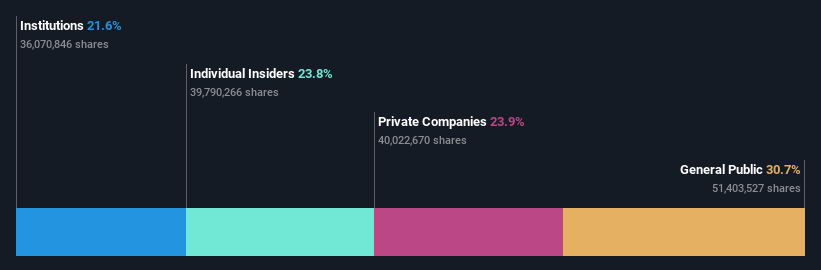

Insider Ownership: 23.8%

Dalian Haosen Intelligent Manufacturing is poised for growth with a forecasted 17.3% annual revenue increase, exceeding the CN market's 13.4%. Despite this, earnings currently struggle to cover interest payments, and its dividend yield of 0.6% isn't well-supported by earnings or cash flow. However, the company is expected to achieve profitability within three years with an impressive projected annual profit growth of 87.12%, although insider trading activity has been minimal recently.

- Delve into the full analysis future growth report here for a deeper understanding of Dalian Haosen Intelligent Manufacturing.

- In light of our recent valuation report, it seems possible that Dalian Haosen Intelligent Manufacturing is trading beyond its estimated value.

Seize The Opportunity

- Access the full spectrum of 1453 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FABG

Fabege

A property company, focuses primarily on the development, investment, and management of commercial premises in Sweden.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives