3 Swedish Growth Stocks With Insider Ownership As High As 35%

Reviewed by Simply Wall St

In recent weeks, the European markets have experienced notable declines amid renewed fears about global economic growth, with Sweden's market also feeling the pressure. Despite these challenges, some Swedish growth companies stand out due to their high insider ownership, which can be a strong indicator of confidence in their long-term potential. Investors often look for stocks where insiders hold significant shares as it suggests that those with the most knowledge and insight into the company believe in its future success. In light of current market uncertainties, such insider confidence can provide an added layer of reassurance for potential investors.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.5% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.1% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.5% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.3% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Here we highlight a subset of our preferred stocks from the screener.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) develops biological drugs for central nervous system disorders in Sweden and has a market cap of SEK 16.08 billion.

Operations: BioArctic's revenue from biotechnology amounts to SEK 299.35 million.

Insider Ownership: 34%

BioArctic, a Swedish growth company with high insider ownership, has shown significant progress in recent months. The company's Q2 2024 earnings report revealed a substantial increase in sales to SEK 49.84 million from SEK 2.71 million the previous year, though it still posted a net loss of SEK 68.43 million. Recent product developments include promising phase-1 study results for exidavnemab and regulatory approval for Leqembi® in multiple countries, enhancing its Alzheimer's treatment portfolio. Despite high volatility and current losses, analysts forecast strong revenue growth (42.4% per year) and profitability within three years, positioning BioArctic as a potentially valuable investment opportunity in Sweden's biotech sector.

- Take a closer look at BioArctic's potential here in our earnings growth report.

- Our expertly prepared valuation report BioArctic implies its share price may be lower than expected.

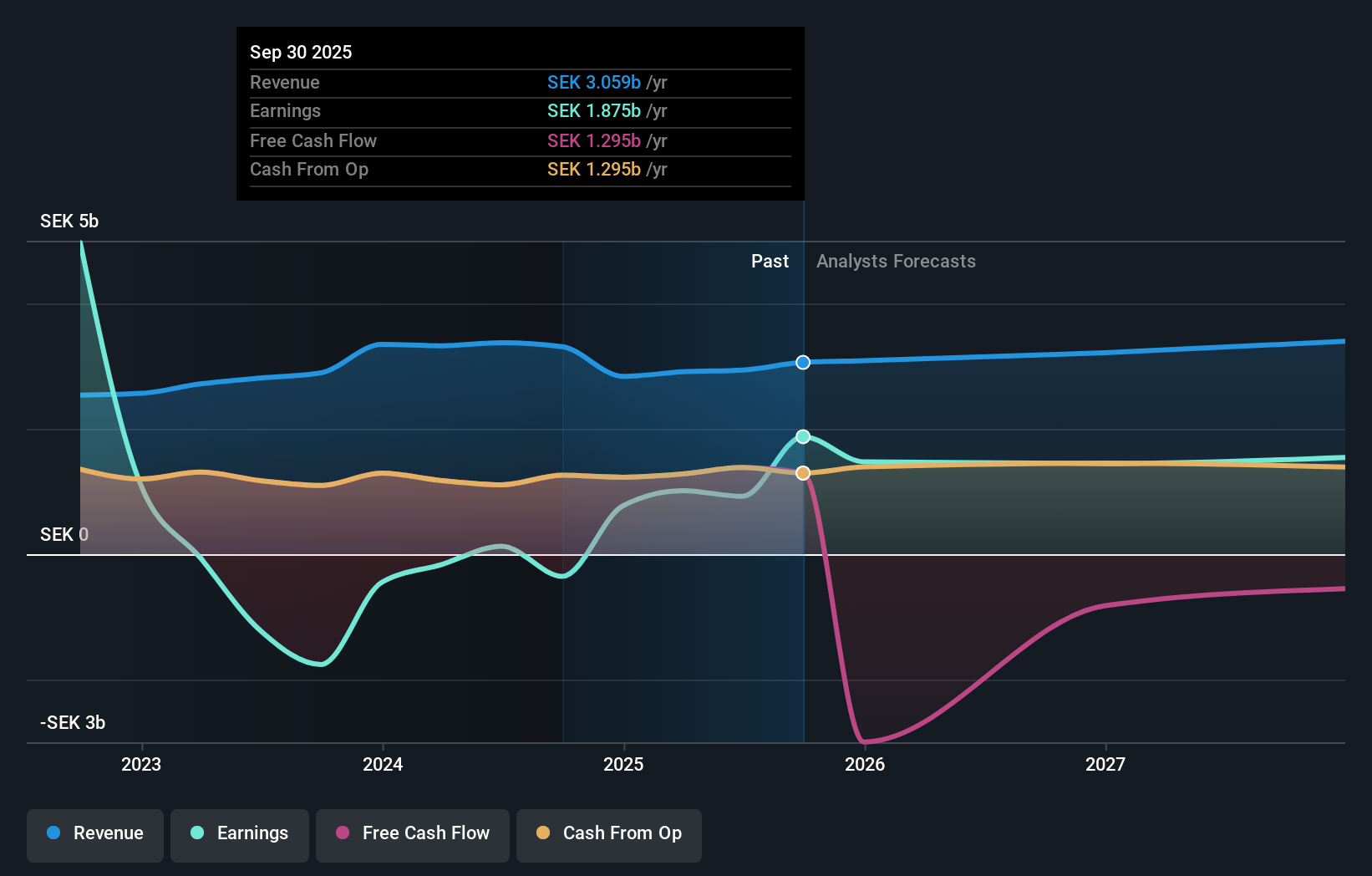

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medicover AB (publ) operates healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK28.38 billion.

Operations: Medicover's revenue is primarily derived from Healthcare Services (€1.32 billion) and Diagnostic Services (€610 million).

Insider Ownership: 11.1%

Medicover, a Swedish growth company with high insider ownership, is expected to see substantial earnings growth of 38.6% annually, outpacing the Swedish market. The company recently reported Q2 2024 sales of €509.4 million and net income of €6.3 million, showing year-over-year improvement. However, interest payments are not well covered by earnings and large one-off items impact financial results. Medicover's revenue for 2025 is forecast to exceed €2.2 billion organically; new CFO Anand Patel will join in October 2024.

- Get an in-depth perspective on Medicover's performance by reading our analyst estimates report here.

- Our valuation report here indicates Medicover may be overvalued.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market cap of SEK 36.27 billion.

Operations: Wallenstam AB (publ) generates revenue from its operations in Stockholm (SEK 938 million) and Gothenburg (SEK 1.94 billion).

Insider Ownership: 35%

Wallenstam, a Swedish growth company with high insider ownership, reported Q2 2024 sales of SEK 737 million and net income of SEK 74 million, reversing a net loss from the previous year. The company's revenue is forecast to grow at 3.2% annually, outpacing the Swedish market's average. Recent developments include sustainable office spaces attracting new tenants and environmental certifications. However, interest payments are not well covered by earnings and return on equity is expected to be low in three years.

- Click here to discover the nuances of Wallenstam with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Wallenstam is trading beyond its estimated value.

Next Steps

- Reveal the 91 hidden gems among our Fast Growing Swedish Companies With High Insider Ownership screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOA B

BioArctic

Develops biological drugs for patients with disorders of the central nervous system in Sweden.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives