In a week marked by busy earnings reports and economic data, global markets saw major indexes mostly lower, with growth stocks lagging behind value shares. Amid such volatility, identifying growth companies with high insider ownership can be particularly appealing as it often signals confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK26.27 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, contributing €1.39 billion, and Diagnostic Services, which account for €631.90 million.

Insider Ownership: 11.1%

Earnings Growth Forecast: 41% p.a.

Medicover is trading significantly below its estimated fair value, indicating potential undervaluation. Despite recent insider selling, more shares have been bought than sold in the past quarter. The company forecasts substantial earnings growth of 41% annually over the next three years, outpacing the Swedish market's growth rate. However, recent financial results show a net loss for Q3 2024 despite increased sales of €527.8 million compared to last year’s €440.5 million.

- Delve into the full analysis future growth report here for a deeper understanding of Medicover.

- The analysis detailed in our Medicover valuation report hints at an deflated share price compared to its estimated value.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK5.04 billion.

Operations: The company's revenue is primarily derived from its Books segment, which accounts for SEK859.34 million.

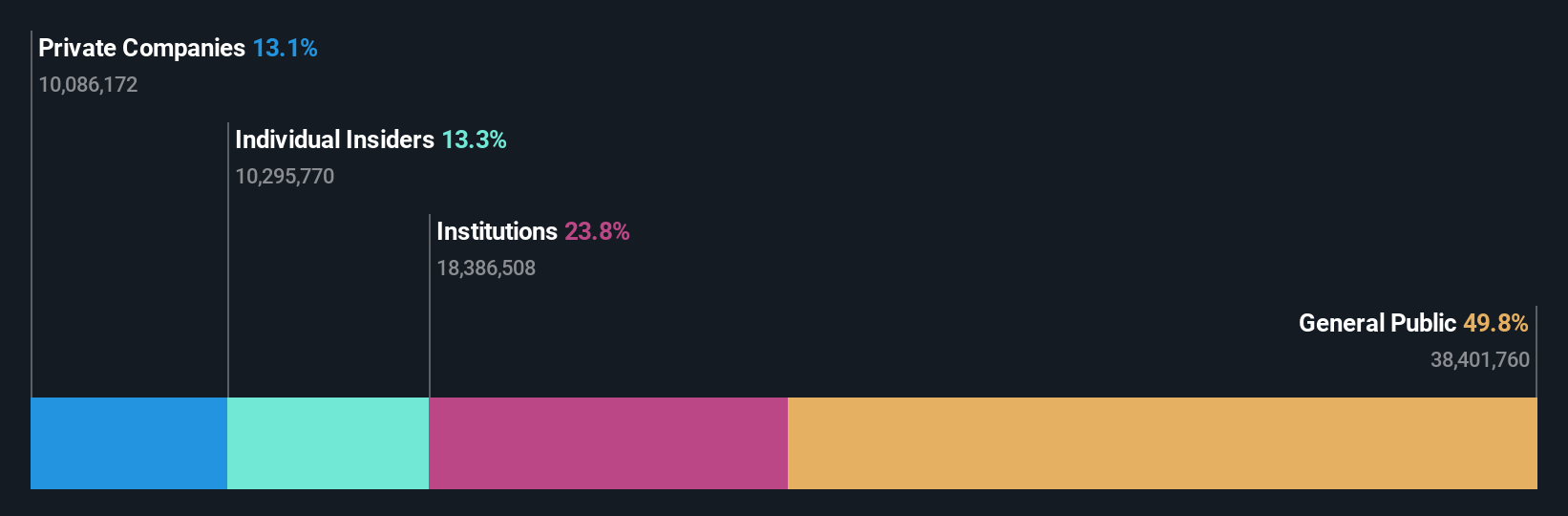

Insider Ownership: 18.7%

Earnings Growth Forecast: 98.3% p.a.

Storytel's recent financial performance shows a turnaround with Q3 2024 net income of SEK 51.36 million, contrasting last year's loss. Despite substantial insider selling recently, the company is trading significantly below its estimated fair value and forecasts robust profit growth of 98.31% annually over three years, surpassing market averages. Revenue is projected to grow at 9.6% per year, boosted by strategic partnerships like the one with Wellhub across various international markets.

- Click here and access our complete growth analysis report to understand the dynamics of Storytel.

- The valuation report we've compiled suggests that Storytel's current price could be inflated.

NSFOCUS Technologies Group (SZSE:300369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NSFOCUS Technologies Group Co., Ltd. offers Internet and application security services globally, with a market cap of CN¥7.19 billion.

Operations: The company generates revenue primarily from the Information Security Industry, amounting to CN¥1.75 billion.

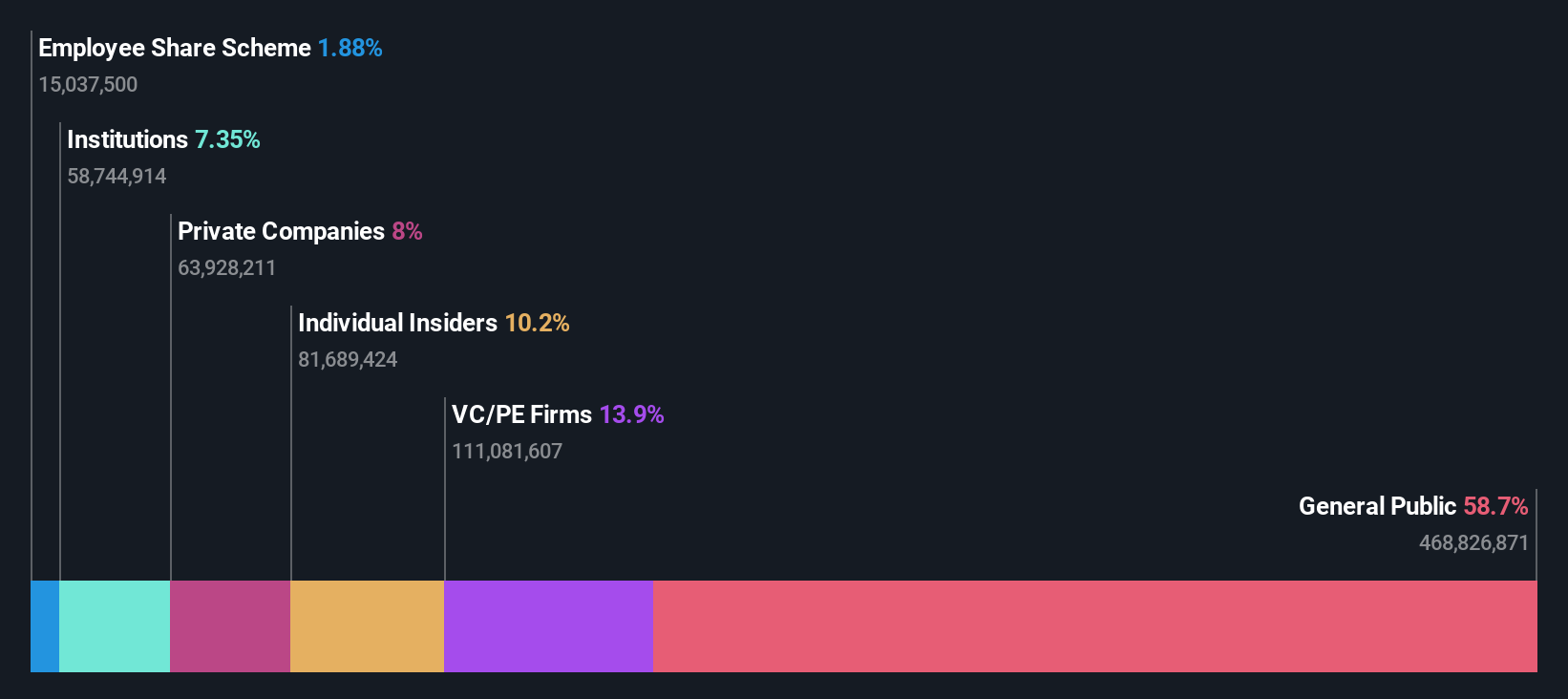

Insider Ownership: 10.2%

Earnings Growth Forecast: 127.3% p.a.

NSFOCUS Technologies Group's recent earnings reveal an improved net loss of CNY 326.02 million for the nine months ending September 2024, compared to a larger loss last year. Despite being dropped from the FTSE All-World Index, the company is trading at a favorable value relative to peers and anticipates revenue growth of 18.1% annually, outpacing China's market average. Profitability is expected within three years, although share price volatility remains high recently.

- Click to explore a detailed breakdown of our findings in NSFOCUS Technologies Group's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of NSFOCUS Technologies Group shares in the market.

Where To Now?

- Embark on your investment journey to our 1520 Fast Growing Companies With High Insider Ownership selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

High growth potential with adequate balance sheet.