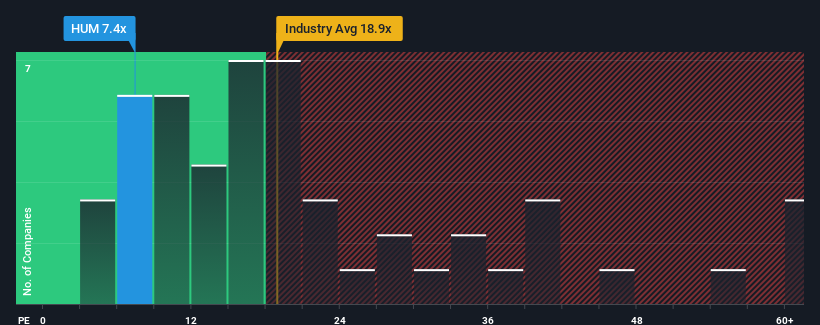

Humana AB (publ)'s (STO:HUM) price-to-earnings (or "P/E") ratio of 7.4x might make it look like a strong buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 22x and even P/E's above 40x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Humana's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Humana

Is There Any Growth For Humana?

In order to justify its P/E ratio, Humana would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 19% each year, which is noticeably less attractive.

With this information, we find it odd that Humana is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Humana's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Humana currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Humana (of which 1 is a bit unpleasant!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Humana, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HUM

Humana

Provides individual and family care services for children and adults in Sweden, Finland, Norway, and Denmark.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives