- Sweden

- /

- Medical Equipment

- /

- OM:EPIS B

Shareholders May Be More Conservative With Episurf Medical AB (publ)'s (STO:EPIS B) CEO Compensation For Now

Key Insights

- Episurf Medical will host its Annual General Meeting on 9th of April

- Total pay for CEO Pal Ryfors includes kr3.80m salary

- Total compensation is 228% above industry average

- Episurf Medical's three-year loss to shareholders was 77% while its EPS was down 0.4% over the past three years

In the past three years, the share price of Episurf Medical AB (publ) (STO:EPIS B) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 9th of April, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

Check out our latest analysis for Episurf Medical

Comparing Episurf Medical AB (publ)'s CEO Compensation With The Industry

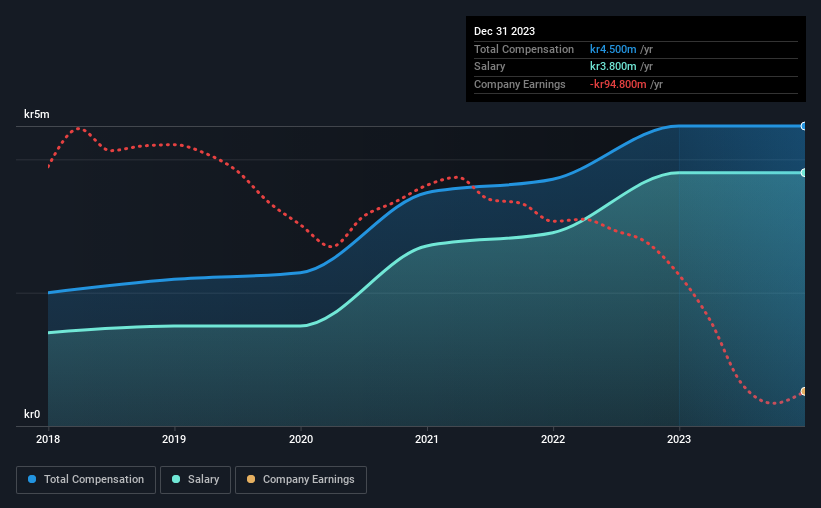

At the time of writing, our data shows that Episurf Medical AB (publ) has a market capitalization of kr213m, and reported total annual CEO compensation of kr4.5m for the year to December 2023. There was no change in the compensation compared to last year. We note that the salary portion, which stands at kr3.80m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Swedish Medical Equipment industry with market capitalizations under kr2.1b, the reported median total CEO compensation was kr1.4m. This suggests that Pal Ryfors is paid more than the median for the industry. Moreover, Pal Ryfors also holds kr2.4m worth of Episurf Medical stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr3.8m | kr3.8m | 84% |

| Other | kr700k | kr700k | 16% |

| Total Compensation | kr4.5m | kr4.5m | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. It's interesting to note that Episurf Medical pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Episurf Medical AB (publ)'s Growth Numbers

Episurf Medical AB (publ) saw earnings per share stay pretty flat over the last three years. It achieved revenue growth of 56% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Episurf Medical AB (publ) Been A Good Investment?

The return of -77% over three years would not have pleased Episurf Medical AB (publ) shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 5 warning signs (and 3 which are a bit unpleasant) in Episurf Medical we think you should know about.

Switching gears from Episurf Medical, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Episurf Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EPIS B

Episurf Medical

A medical device company, designs and manufactures implants and surgical instruments in Germany, Sweden, rest of Europe, the United States, and internationally.

Medium-low with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives