- Sweden

- /

- Medical Equipment

- /

- OM:BACTI B

Bactiguard Holding AB (publ)'s (STO:BACTI B) 30% Share Price Surge Not Quite Adding Up

Bactiguard Holding AB (publ) (STO:BACTI B) shareholders have had their patience rewarded with a 30% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 19% over that time.

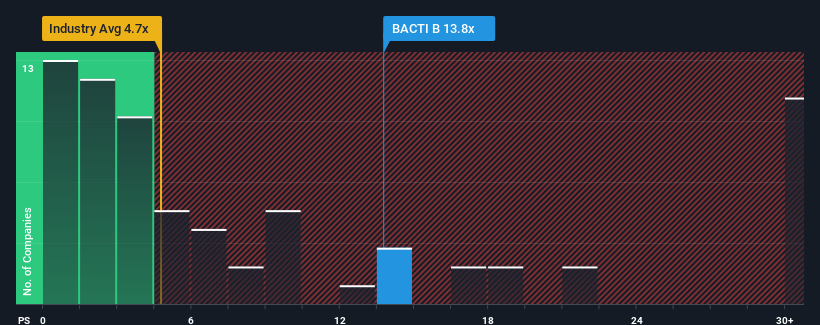

After such a large jump in price, Bactiguard Holding's price-to-sales (or "P/S") ratio of 13.8x might make it look like a strong sell right now compared to other companies in the Medical Equipment industry in Sweden, where around half of the companies have P/S ratios below 4.7x and even P/S below 1.8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Bactiguard Holding

How Bactiguard Holding Has Been Performing

Recent times haven't been great for Bactiguard Holding as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bactiguard Holding.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bactiguard Holding's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 36% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 2.1% over the next year. Meanwhile, the broader industry is forecast to expand by 20%, which paints a poor picture.

In light of this, it's alarming that Bactiguard Holding's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Bactiguard Holding's P/S Mean For Investors?

Bactiguard Holding's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Bactiguard Holding currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Bactiguard Holding that you should be aware of.

If these risks are making you reconsider your opinion on Bactiguard Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bactiguard Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BACTI B

Bactiguard Holding

A medTech company, provides infection prevention technology and solutions in orthopedics, cardiology, neurology, urology, and vascular access areas in the United States, Sweden, Malaysia, India, Bangladesh, Indonesia, the Kingdom of Saudi Arabia, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives