- Sweden

- /

- Medical Equipment

- /

- OM:ADDV A

Little Excitement Around ADDvise Group AB (publ)'s (STO:ADDV A) Revenues As Shares Take 25% Pounding

Unfortunately for some shareholders, the ADDvise Group AB (publ) (STO:ADDV A) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

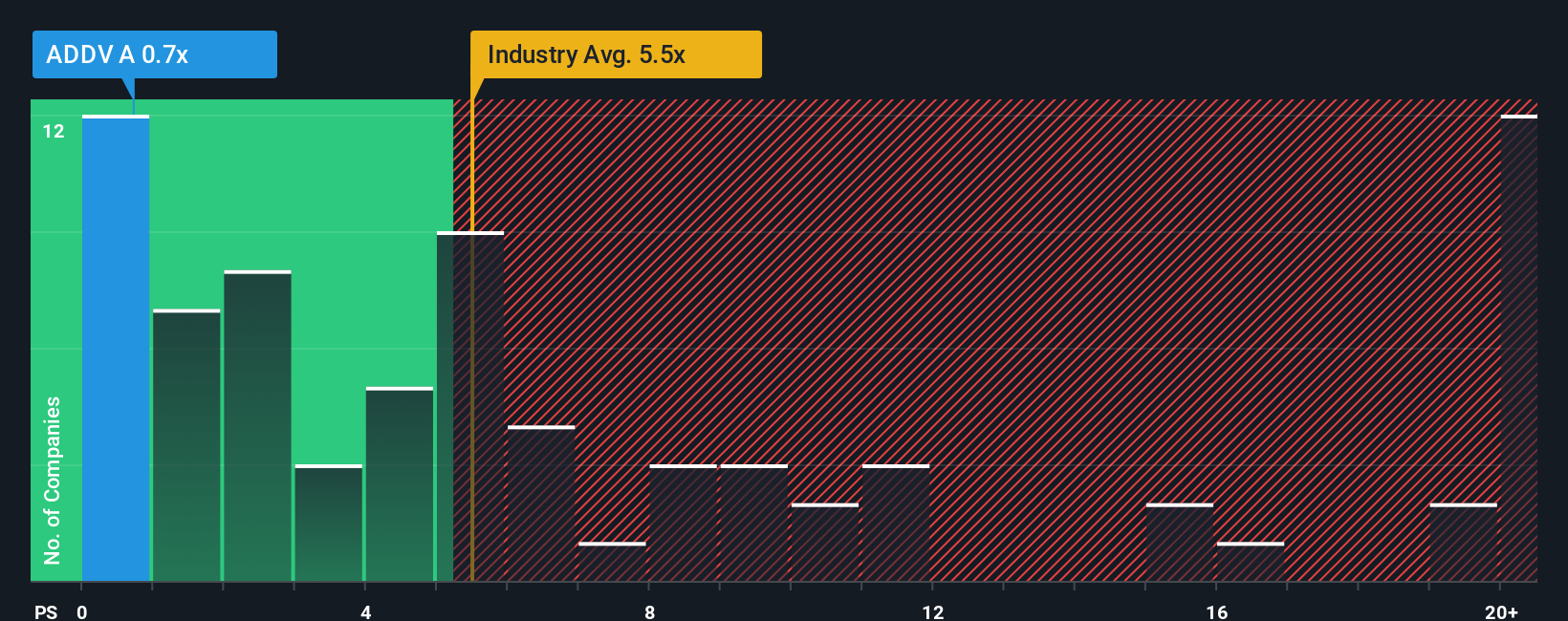

After such a large drop in price, ADDvise Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Medical Equipment industry in Sweden have P/S ratios greater than 5.5x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for ADDvise Group

How ADDvise Group Has Been Performing

Recent revenue growth for ADDvise Group has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think ADDvise Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ADDvise Group?

The only time you'd be truly comfortable seeing a P/S as depressed as ADDvise Group's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a decent 7.9% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 154% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 2.6% per annum as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 31% each year, which is noticeably more attractive.

With this information, we can see why ADDvise Group is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From ADDvise Group's P/S?

Shares in ADDvise Group have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that ADDvise Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for ADDvise Group (2 are a bit concerning!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ADDV A

ADDvise Group

Supplies medical devices, equipment, and consumables to public and private laboratories and research facilities, healthcare, and pharmaceuticals in North America, Europe, South America, Sweden, and internationally.

Medium-low risk and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)