- Sweden

- /

- Medical Equipment

- /

- OM:CMH

We Think Chordate Medical Holding (NGM:CMH) Needs To Drive Business Growth Carefully

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Chordate Medical Holding (NGM:CMH) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Chordate Medical Holding

How Long Is Chordate Medical Holding's Cash Runway?

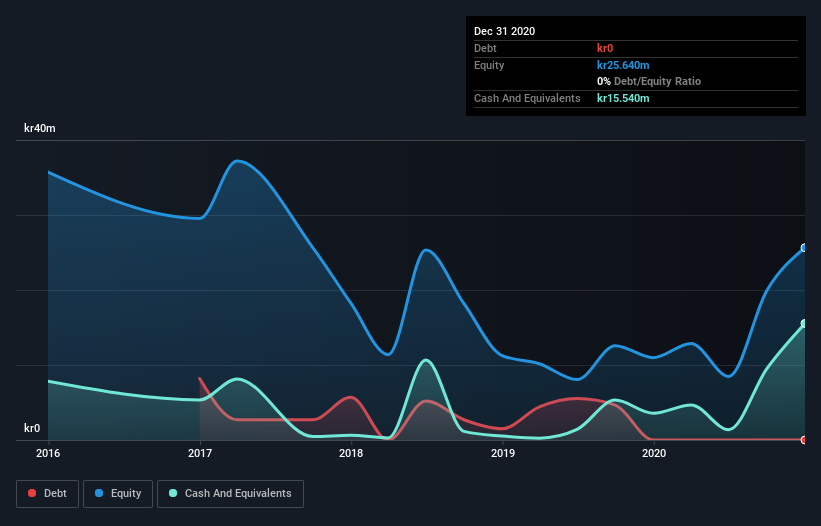

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2020, Chordate Medical Holding had cash of kr16m and no debt. Importantly, its cash burn was kr21m over the trailing twelve months. So it had a cash runway of approximately 9 months from December 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. Depicted below, you can see how its cash holdings have changed over time.

How Is Chordate Medical Holding's Cash Burn Changing Over Time?

Whilst it's great to see that Chordate Medical Holding has already begun generating revenue from operations, last year it only produced kr3.6m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. With the cash burn rate up 9.7% in the last year, it seems that the company is ratcheting up investment in the business over time. However, the company's true cash runway will therefore be shorter than suggested above, if spending continues to increase. Chordate Medical Holding makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

Can Chordate Medical Holding Raise More Cash Easily?

Since its cash burn is increasing (albeit only slightly), Chordate Medical Holding shareholders should still be mindful of the possibility it will require more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Chordate Medical Holding has a market capitalisation of kr195m and burnt through kr21m last year, which is 11% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Chordate Medical Holding's Cash Burn?

Even though its cash runway makes us a little nervous, we are compelled to mention that we thought Chordate Medical Holding's cash burn relative to its market cap was relatively promising. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, we conducted an in-depth investigation of the company, and identified 6 warning signs for Chordate Medical Holding (4 are potentially serious!) that you should be aware of before investing here.

Of course Chordate Medical Holding may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Chordate Medical Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CMH

Chordate Medical Holding

A medical technology company, engages in the development of products and solutions for the treatment of chronic migraine and rhinitis in Sweden.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives