Even after rising 10% this past week, Midsona (STO:MSON B) shareholders are still down 85% over the past three years

It is doubtless a positive to see that the Midsona AB (publ) (STO:MSON B) share price has gained some 38% in the last three months. But only the myopic could ignore the astounding decline over three years. Indeed, the share price is down a whopping 85% in the last three years. So it sure is nice to see a bit of an improvement. Of course the real question is whether the business can sustain a turnaround. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

On a more encouraging note the company has added kr147m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Midsona

Midsona isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Midsona saw its revenue grow by 0.4% per year, compound. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 23%, compound, over three years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

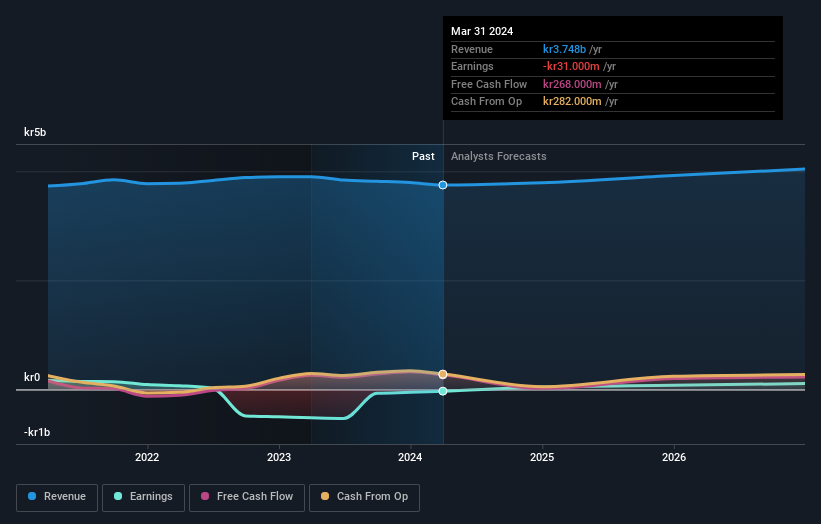

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Midsona's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Midsona has rewarded shareholders with a total shareholder return of 36% in the last twelve months. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Midsona better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MSON B

Midsona

Develops, produces, and markets organic products, consumer health products, and health foods in Sweden, Denmark, Norway, Finland, Germany, France, and Spain.

Flawless balance sheet and fair value.

Market Insights

Community Narratives