- Sweden

- /

- Consumer Finance

- /

- OM:YIELD

Take Care Before Jumping Onto SaveLend Group AB (publ) (STO:YIELD) Even Though It's 26% Cheaper

The SaveLend Group AB (publ) (STO:YIELD) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

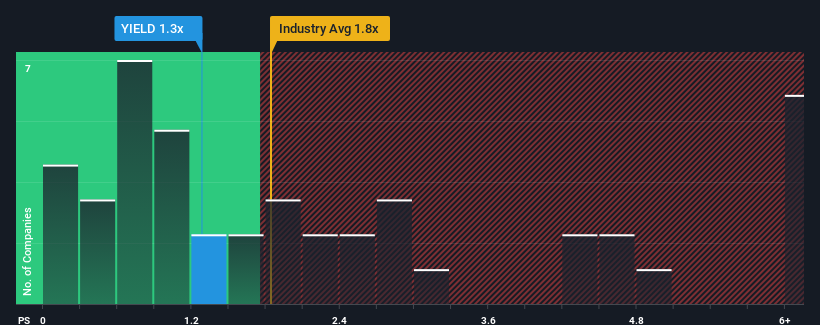

After such a large drop in price, SaveLend Group's price-to-sales (or "P/S") ratio of 1.3x might make it look like a buy right now compared to the Consumer Finance industry in Sweden, where around half of the companies have P/S ratios above 1.8x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for SaveLend Group

What Does SaveLend Group's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, SaveLend Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on SaveLend Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like SaveLend Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Pleasingly, revenue has also lifted 246% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 26% per annum during the coming three years according to the one analyst following the company. That's shaping up to be materially higher than the 14% per annum growth forecast for the broader industry.

In light of this, it's peculiar that SaveLend Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does SaveLend Group's P/S Mean For Investors?

The southerly movements of SaveLend Group's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

SaveLend Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 1 warning sign for SaveLend Group you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:YIELD

SaveLend Group

Through its subsidiaries, operates as a fintech company in the fixed income investment segment in Sweden, Poland, and Finland.

Reasonable growth potential and fair value.

Market Insights

Community Narratives