- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9996

VEF Leads Our Selection Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets experience mixed outcomes, with major U.S. indexes reaching record highs and others facing declines, investors are keenly observing economic indicators such as job growth and interest rate expectations. In this complex landscape, identifying stocks with potential requires a focus on financial health and growth prospects. Penny stocks, though an older term, remain relevant for those seeking affordable entry points into smaller or newer companies that may offer both value and potential upside when backed by strong fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £811.93M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.555 | A$65.06M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £164.05M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

VEF (OM:VEFAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VEF AB (publ) is a venture capital firm focusing on early venture, emerging growth, and growth capital investments with a market cap of approximately SEK2.41 billion.

Operations: The company's revenue segment is derived entirely from its investments in equity securities, amounting to $67.74 million.

Market Cap: SEK2.41B

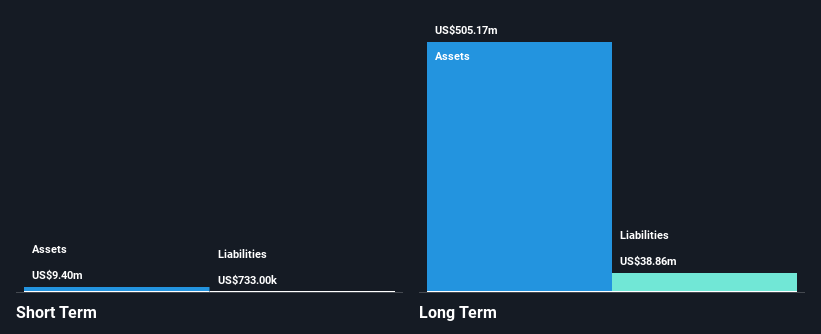

VEF AB has recently transitioned to profitability, reporting a net income of US$38.23 million for Q3 2024, reversing a prior net loss. Despite this positive shift, its short-term assets of US$9.4 million are insufficient to cover long-term liabilities of US$38.9 million, indicating potential liquidity concerns. The company's debt to equity ratio has increased over five years but remains satisfactory at 6.3%. Analysts anticipate significant stock price growth, though the return on equity is low at 10.9%. VEF's earnings quality is high and interest payments are well covered by EBIT (9.5x).

- Click here to discover the nuances of VEF with our detailed analytical financial health report.

- Learn about VEF's historical performance here.

Belle (PSE:BEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Belle Corporation, with a market cap of ₱16.48 billion, operates in the real estate development sector both in the Philippines and internationally through its subsidiaries.

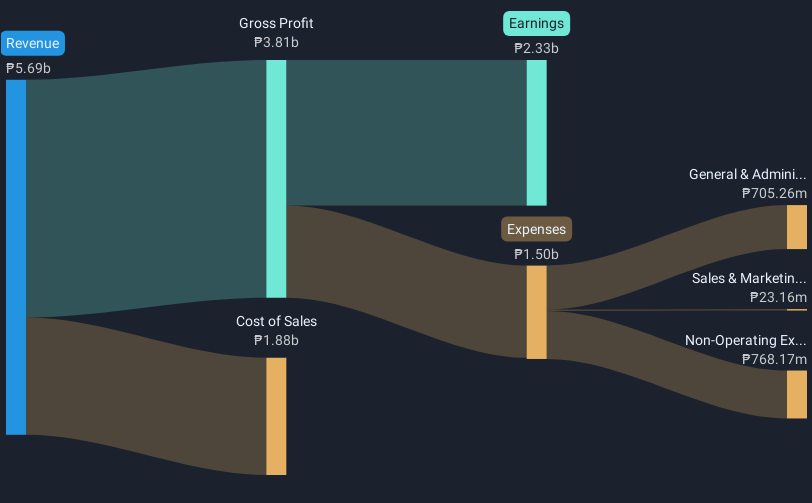

Operations: The company generates revenue from Gaming and Gaming Related Activities amounting to ₱2.47 billion and Real Estate Development and Property Management totaling ₱2.92 billion.

Market Cap: ₱16.48B

Belle Corporation's recent earnings report shows a net income of ₱650.81 million for Q3 2024, improving from ₱498.97 million the previous year, despite a slight revenue decrease to ₱1.37 billion from ₱1.41 billion. The company's short-term and long-term liabilities are well-covered by assets totaling ₱13.4 billion, indicating strong financial stability in the real estate sector. Belle's earnings growth of 15.2% over the past year surpasses its five-year average decline, suggesting an upward trend in profitability with high-quality earnings and satisfactory debt management reflected in its net debt to equity ratio of 16%.

- Dive into the specifics of Belle here with our thorough balance sheet health report.

- Gain insights into Belle's past trends and performance with our report on the company's historical track record.

Peijia Medical (SEHK:9996)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Peijia Medical Limited focuses on the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices, with a market cap of HK$2.66 billion.

Operations: The company generates revenue from its Neurointerventional Business, which accounts for CN¥309.30 million, and its Transcatheter Valve Therapeutic Business, contributing CN¥208.16 million.

Market Cap: HK$2.66B

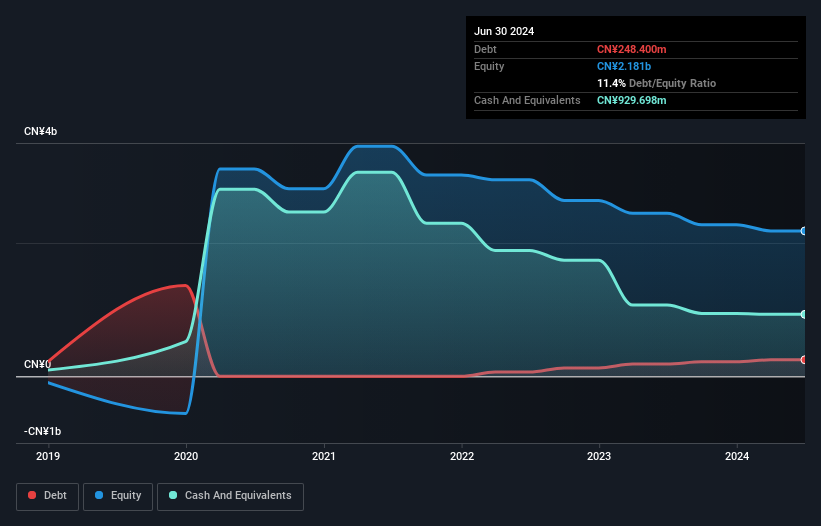

Peijia Medical Limited, with a market cap of HK$2.66 billion, is currently unprofitable but has shown significant improvement by reducing losses at a rate of 38.7% annually over the past five years. The company holds more cash than its total debt and maintains short-term assets of CN¥1.2 billion, comfortably covering both short and long-term liabilities. Despite trading at 72.5% below estimated fair value, Peijia's revenue from its Neurointerventional and Transcatheter Valve Therapeutic businesses indicates potential growth opportunities. Recent board changes include Dr. Yu Zhiyun's resignation as a non-executive director to focus on other commitments while remaining a consultant.

- Get an in-depth perspective on Peijia Medical's performance by reading our balance sheet health report here.

- Understand Peijia Medical's earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 5,705 companies within our Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9996

Peijia Medical

Engages in the research and development of transcatheter valve therapeutic and neuro interventional procedural medical devices.

Excellent balance sheet and fair value.