- Sweden

- /

- Capital Markets

- /

- OM:STWK

Market Might Still Lack Some Conviction On Stockwik Förvaltning AB (publ) (STO:STWK) Even After 42% Share Price Boost

The Stockwik Förvaltning AB (publ) (STO:STWK) share price has done very well over the last month, posting an excellent gain of 42%. Looking back a bit further, it's encouraging to see the stock is up 56% in the last year.

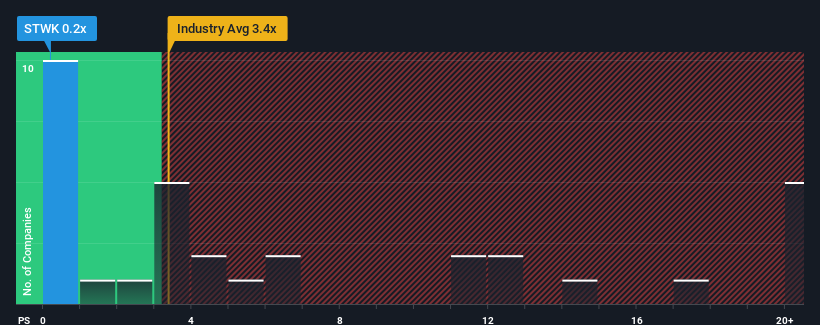

In spite of the firm bounce in price, Stockwik Förvaltning may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Capital Markets industry in Sweden have P/S ratios greater than 3.4x and even P/S higher than 13x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Stockwik Förvaltning

How Has Stockwik Förvaltning Performed Recently?

Recent times haven't been great for Stockwik Förvaltning as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Stockwik Förvaltning will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Stockwik Förvaltning's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.2% last year. Pleasingly, revenue has also lifted 60% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.3% over the next year. With the industry predicted to deliver 3.9% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that Stockwik Förvaltning is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Stockwik Förvaltning's P/S

Stockwik Förvaltning's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Stockwik Förvaltning currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Stockwik Förvaltning you should know about.

If these risks are making you reconsider your opinion on Stockwik Förvaltning, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:STWK

Stockwik Förvaltning

An investment company, engages in the real estate service, health, services, and industry businesses in Sweden.

Adequate balance sheet and fair value.

Market Insights

Community Narratives