3 Stocks Estimated To Be Up To 45.6% Undervalued Offering Investment Opportunities

Reviewed by Simply Wall St

In a period marked by mixed performances across global markets, with the S&P 500 and Nasdaq Composite recently closing out strong years despite some year-end volatility, investors are keenly observing opportunities for value investments. Identifying undervalued stocks becomes particularly appealing in such an environment, where potential price discrepancies can offer significant investment opportunities amidst fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1888.00 | ¥3757.10 | 49.7% |

| Decisive Dividend (TSXV:DE) | CA$5.98 | CA$11.88 | 49.7% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2887.97 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.45 | SEK122.25 | 49.7% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF59.80 | CHF118.90 | 49.7% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

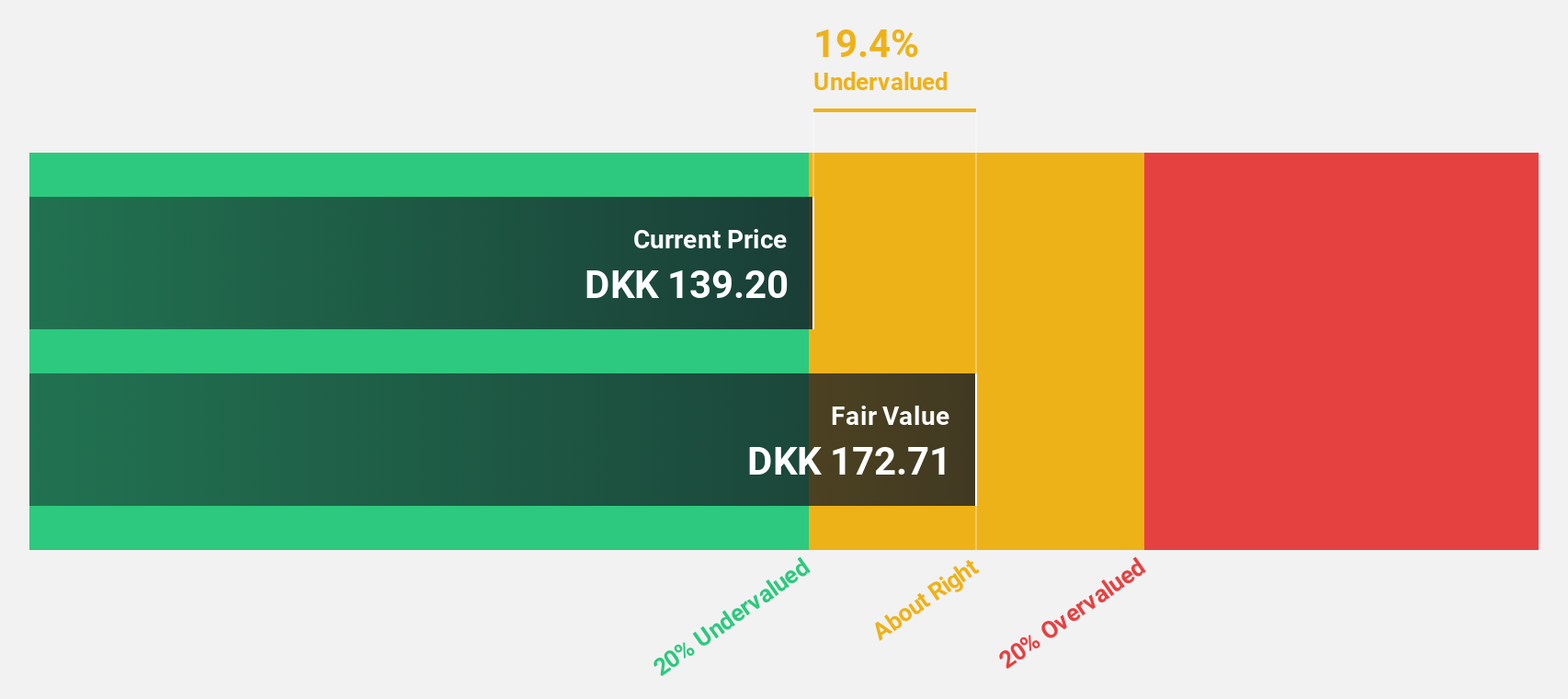

cBrain (CPSE:CBRAIN)

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors both in Denmark and internationally, with a market cap of DKK3.60 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which amounts to DKK246.58 million.

Estimated Discount To Fair Value: 42.3%

cBrain is trading at DKK183.8, significantly below its estimated fair value of DKK318.75, indicating it may be undervalued based on cash flows. Despite recent share price volatility, the company forecasts robust revenue growth of 22.7% annually and earnings growth of 29.8%, outpacing the Danish market averages. With a high return on equity projected at 29.6% in three years and consistent past earnings growth, cBrain presents a compelling case for value-focused investors.

- Insights from our recent growth report point to a promising forecast for cBrain's business outlook.

- Click here to discover the nuances of cBrain with our detailed financial health report.

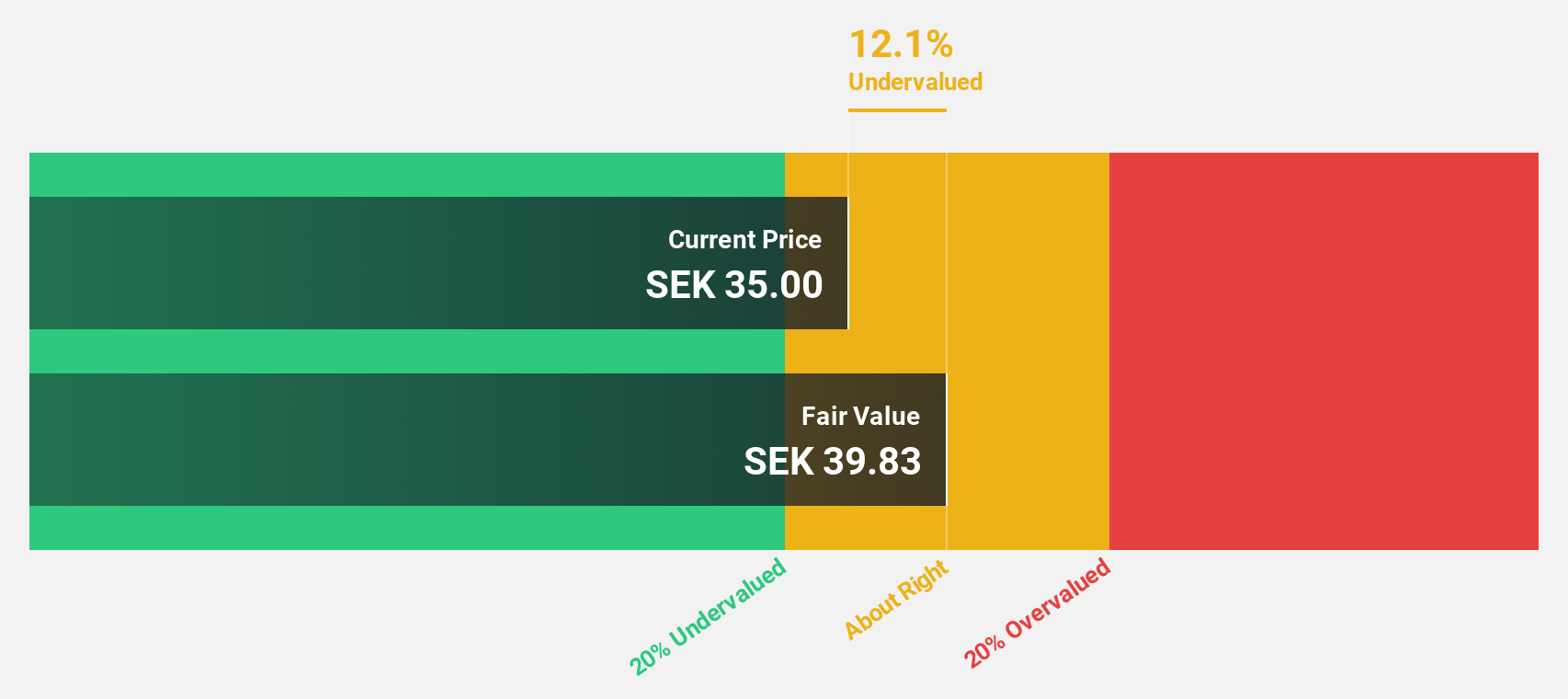

Ratos (OM:RATO B)

Overview: Ratos AB (publ) is a private equity firm focused on buyouts, turnarounds, add-on acquisitions, and middle market transactions, with a market cap of SEK10.78 billion.

Operations: The company's revenue is derived from three main segments: Consumer (SEK5.46 billion), Industry (SEK10.41 billion), and Construction & Services (SEK16.49 billion).

Estimated Discount To Fair Value: 32%

Ratos AB, trading at SEK32.2, is priced 32% below its estimated fair value of SEK47.33, highlighting potential undervaluation based on cash flows. Despite a recent net loss in Q3 2024 and declining sales compared to the previous year, earnings are forecast to grow significantly at 23.9% annually over the next three years, surpassing Swedish market averages. However, revenue growth remains modest at 4.5%, with a low projected return on equity of 9.1%.

- In light of our recent growth report, it seems possible that Ratos' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Ratos' balance sheet health report.

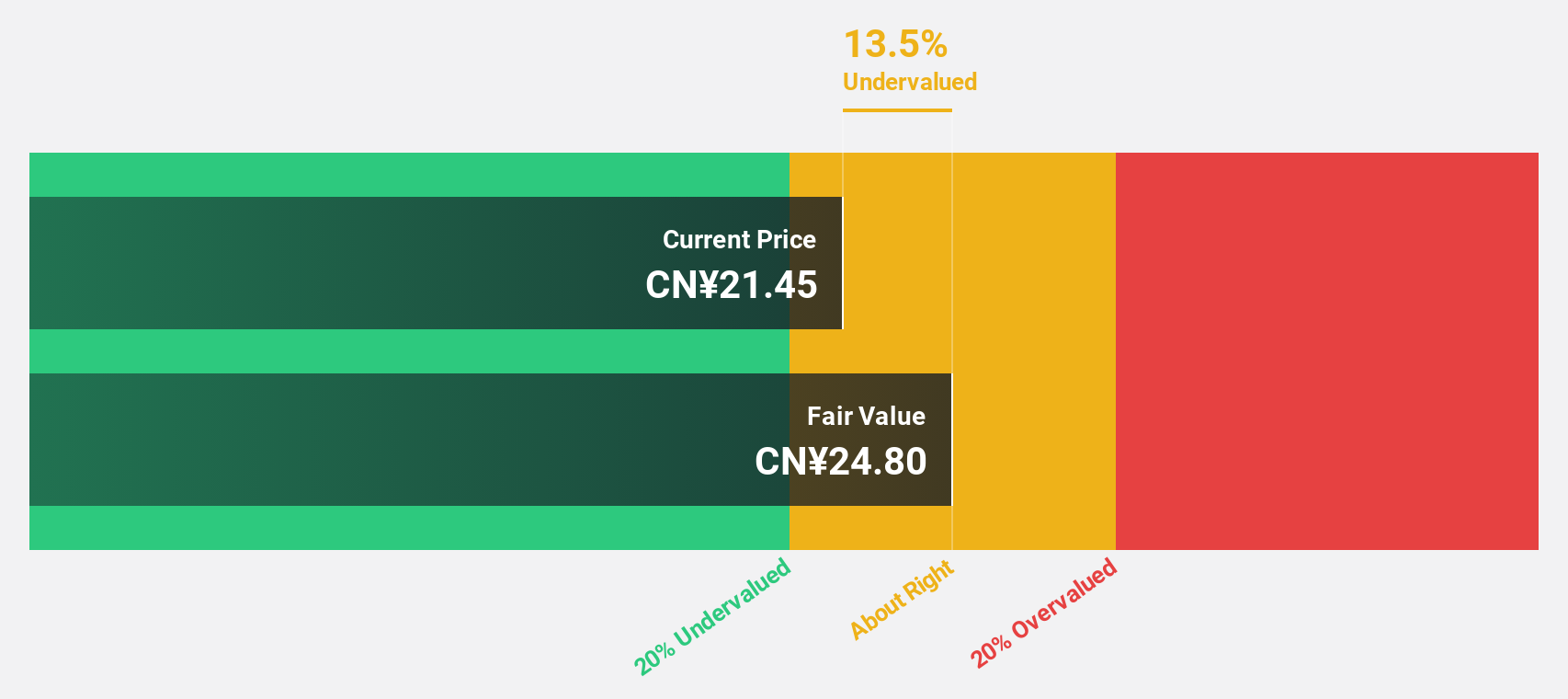

Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016)

Overview: Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. operates in the biotechnology sector, focusing on the production and distribution of health-related products, with a market cap of CN¥5.83 billion.

Operations: The company's revenue segments are not specified in the provided text.

Estimated Discount To Fair Value: 45.6%

Shandong Bailong Chuangyuan Bio-Tech, trading at CN¥18.05, is 45.6% below its fair value estimate of CN¥33.16, suggesting undervaluation based on cash flows. The company reported substantial revenue growth to CN¥820.39 million for the first nine months of 2024 from CN¥653.79 million a year ago and net income increased to CN¥182.59 million from CN¥141.34 million, with earnings expected to grow significantly at 30.56% annually over the next three years despite a low dividend coverage by free cash flows.

- According our earnings growth report, there's an indication that Shandong Bailong Chuangyuan Bio-Tech might be ready to expand.

- Dive into the specifics of Shandong Bailong Chuangyuan Bio-Tech here with our thorough financial health report.

Summing It All Up

- Unlock our comprehensive list of 881 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605016

Shandong Bailong Chuangyuan Bio-Tech

Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives