- Sweden

- /

- Capital Markets

- /

- OM:MANG

Is Now The Time To Put Mangold Fondkommission (STO:MANG) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Mangold Fondkommission (STO:MANG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Mangold Fondkommission

Mangold Fondkommission's Improving Profits

Over the last three years, Mangold Fondkommission has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Mangold Fondkommission's EPS shot from kr90.69 to kr180, over the last year. Year on year growth of 99% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

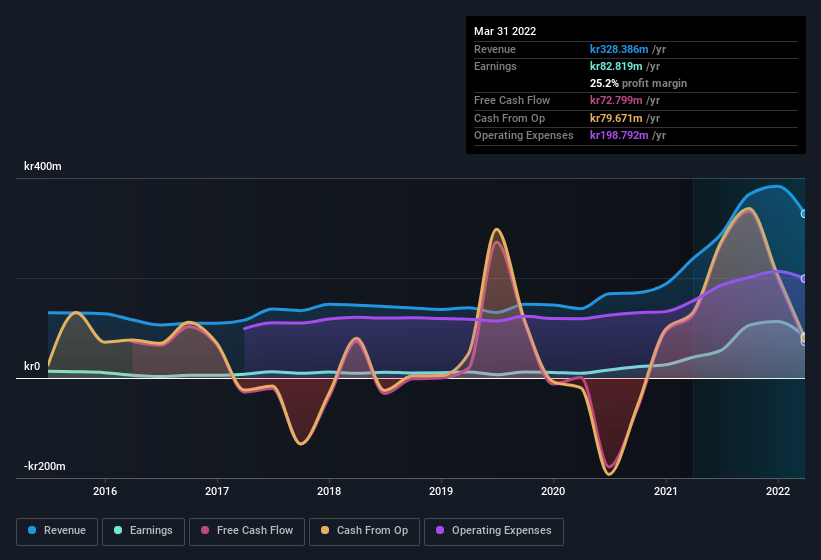

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Mangold Fondkommission's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note Mangold Fondkommission's EBIT margins were flat over the last year, revenue grew by a solid 38% to kr328m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Mangold Fondkommission is no giant, with a market capitalization of kr1.8b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Mangold Fondkommission Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While Mangold Fondkommission insiders did net -kr432k selling stock over the last year, they invested kr2.4m, a much higher figure. On balance, to me, this signals their optimism. Zooming in, we can see that the biggest insider purchase was by CEO & MD Per-Anders Tammerlov for kr540k worth of shares, at about kr3,398 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Mangold Fondkommission insiders own more than a third of the company. In fact, they own 66% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about kr1.2b riding on the stock, at current prices. That's nothing to sneeze at!

Is Mangold Fondkommission Worth Keeping An Eye On?

Mangold Fondkommission's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Mangold Fondkommission deserves timely attention. Of course, just because Mangold Fondkommission is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Mangold Fondkommission isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MANG

Mangold Fondkommission

Provides financial services to companies, institutions, and private individuals in Sweden.

Excellent balance sheet with questionable track record.