- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Hoist Finance (OM:HOFI): 15% Earnings Growth Outlook Reinforces Undervalued Narrative This Earnings Season

Reviewed by Simply Wall St

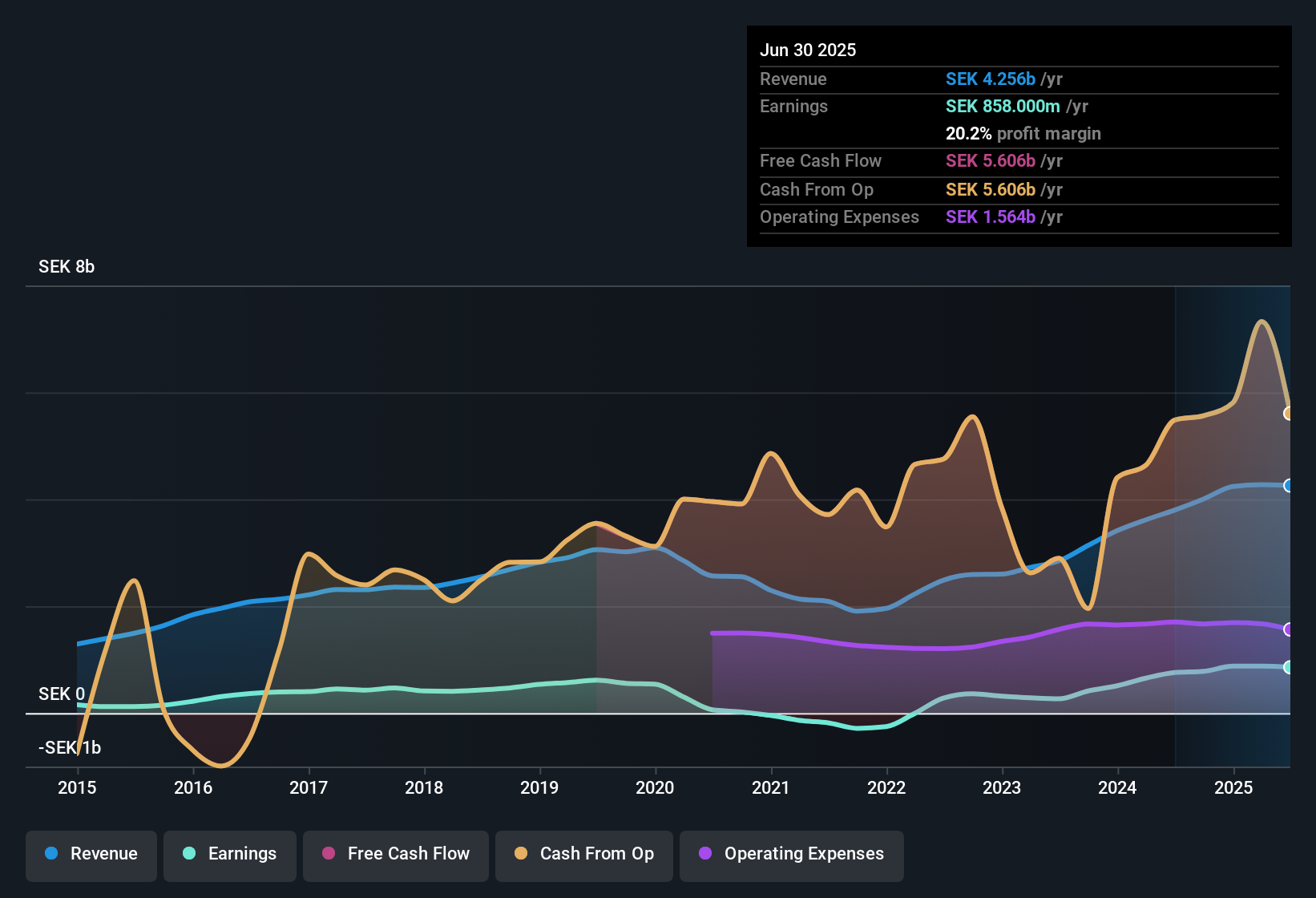

Hoist Finance (OM:HOFI) delivered earnings that are forecast to grow at 15% per year, outpacing the Swedish market's 12.6% growth expectation. Revenue is projected to rise by 11.8% per year, handily beating the broader market's 3.9% average, and profit margins remain stable at 20.2%. Investors are watching as continued profit and revenue growth, alongside attractive valuation, set the stage for the company’s outlook this earnings season.

See our full analysis for Hoist Finance.Next, we will see how these headline numbers stack up against the leading narratives in the market, and where expectations might shift as a result.

See what the community is saying about Hoist Finance

Profit Growth Slows Against Five-Year Trend

- Earnings climbed 13.2% over the past year, which is notably less than the 61.1% average annual increase Hoist achieved over the last five years.

- Consensus narrative highlights that efficiency gains and diversification are supporting sustainable profit growth.

- Analysts see ongoing automation and outsourcing as key for boosting margins, especially given the company’s stable 20.2% net margin this year compared to last year’s 20%.

- However, the moderation in annual growth rate compared to the prior five-year pace prompts closer scrutiny of whether historical averages can be maintained.

- Despite the step-down in year-on-year growth, analysts remain upbeat that new digital and pan-European initiatives will reinforce margin stability and help performance hold up above typical market levels. 📊 Read the full Hoist Finance Consensus Narrative.

Funding Costs Weigh On Margins

- Net funding cost as a percentage of portfolio book value rose from 3.4% to 4.4% in Q2 2025, narrowing the cushion for net interest margins even as profit margins hold steady at 20.2%.

- Consensus narrative points out rising funding costs and regulatory requirements as a risk to future profitability.

- If interest rates or new bond costs continue to climb, Hoist may face ongoing pressure to offset these costs with higher efficiency or pricing power.

- For now, the lack of material margin erosion and minor risk factors suggest management is navigating these headwinds adequately, but the story could change if costs rise faster than revenues over time.

Valuation Discount Versus Peers and Fair Value

- Hoist trades at a price-to-earnings ratio of 9.6x, below both its peer average of 27.4x and industry average of 9.9x, while its SEK93.95 share price is meaningfully under both the DCF fair value of SEK136.50 and analyst price target of SEK118.50.

- Consensus narrative argues that with recurring revenue growth forecast and minor risks identified, the current discount provides headroom for rerating.

- Analysts expect earnings to reach SEK1.4 billion by 2028, implying the stock could rise by 18.9% to the price target if those forecasts are met.

- The large gap to DCF fair value provides further potential upside if Hoist’s growth and margin forecasts continue to materialize at or above expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hoist Finance on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the numbers tell a different story? Share your own view and put your narrative together in just a few minutes. Do it your way

A great starting point for your Hoist Finance research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Hoist Finance’s slowing profit growth, rising funding costs, and moderation compared to its impressive five-year trend highlight challenges in delivering consistent and stable expansion.

If steady performance is your priority, use our stable growth stocks screener (2099 results) to discover companies that maintain reliable earnings and revenue growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives