3 Swedish Exchange Stocks That Could Be Up To 30.3% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

The Swedish stock market has been navigating a period of mixed performance, with inflation nearing the European Central Bank's target and economic sentiment showing signs of improvement. Amid this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. In this article, we explore three Swedish exchange stocks that could be up to 30.3% below intrinsic value estimates, offering a closer look at what makes them stand out in the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK41.00 | SEK80.20 | 48.9% |

| CTT Systems (OM:CTT) | SEK270.00 | SEK498.68 | 45.9% |

| QleanAir (OM:QAIR) | SEK26.70 | SEK51.38 | 48% |

| Concentric (OM:COIC) | SEK228.00 | SEK412.08 | 44.7% |

| Nolato (OM:NOLA B) | SEK52.10 | SEK98.74 | 47.2% |

| Dometic Group (OM:DOM) | SEK65.95 | SEK130.84 | 49.6% |

| Serstech (OM:SERT) | SEK1.36 | SEK2.65 | 48.7% |

| Mentice (OM:MNTC) | SEK27.50 | SEK51.05 | 46.1% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| BHG Group (OM:BHG) | SEK14.91 | SEK27.24 | 45.3% |

Let's dive into some prime choices out of the screener.

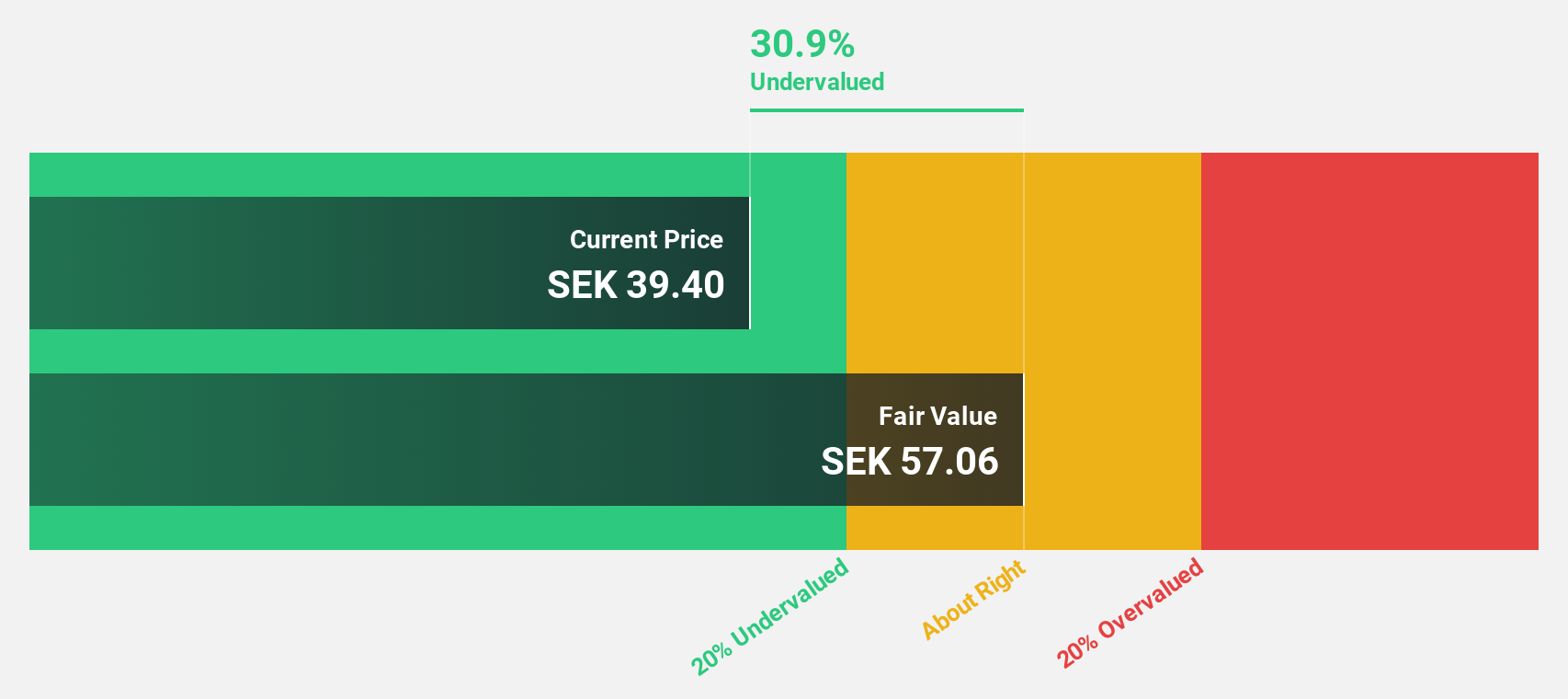

EQT (OM:EQT)

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK376.02 billion.

Operations: EQT AB (publ) generates revenue primarily from its Private Capital segment (€1.28 billion), Real Assets segment (€878.70 million), and Central operations (€37.20 million).

Estimated Discount To Fair Value: 10.6%

EQT AB (publ) appears undervalued based on discounted cash flow analysis, trading at SEK 318.3 compared to an estimated fair value of SEK 356.23. Recent earnings reports show significant growth, with net income rising from EUR 120 million to EUR 282 million year-over-year. Despite substantial insider selling in the past quarter, EQT's revenue and earnings are forecasted to grow faster than the Swedish market, bolstered by strategic M&A activities and a share repurchase program aimed at optimizing capital structure.

- The growth report we've compiled suggests that EQT's future prospects could be on the up.

- Dive into the specifics of EQT here with our thorough financial health report.

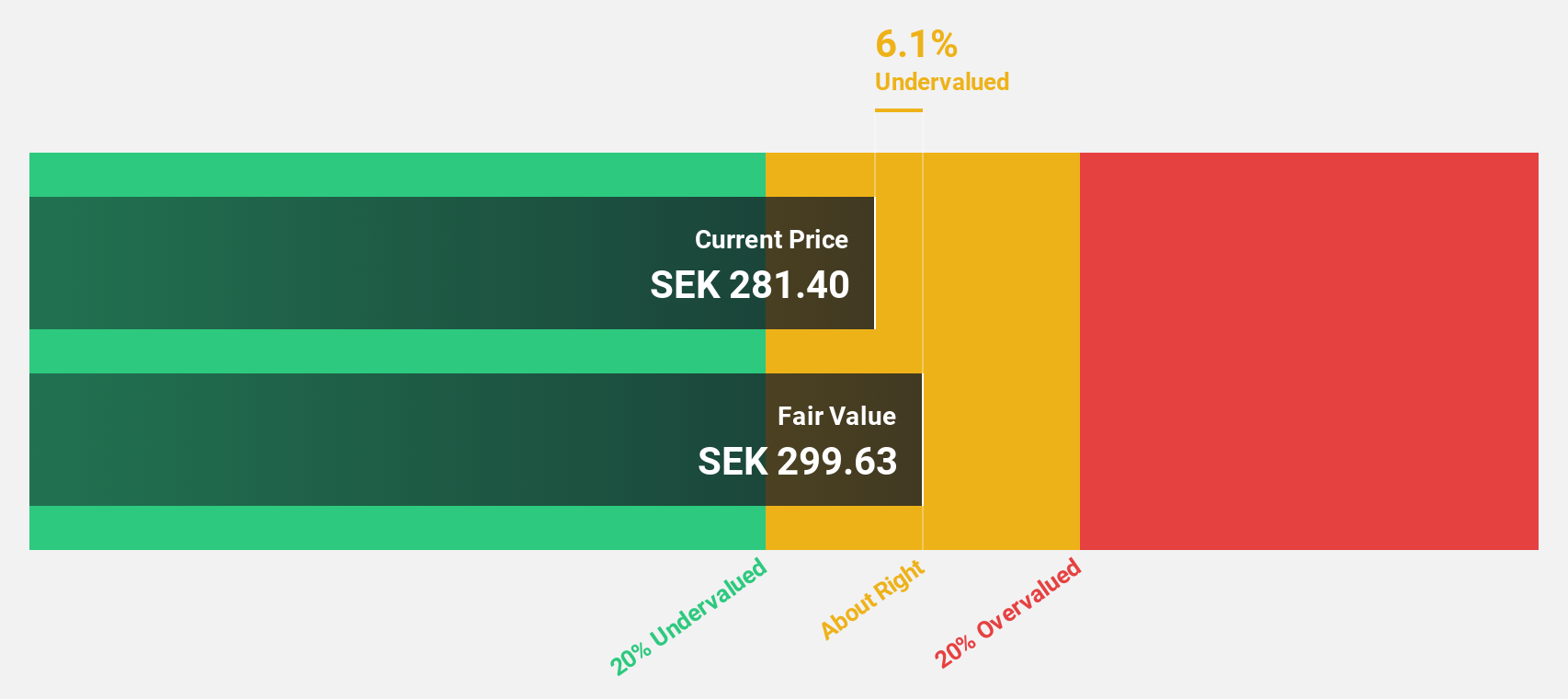

Troax Group (OM:TROAX)

Overview: Troax Group AB (publ) produces and sells mesh panels internationally, with a market cap of SEK12.81 billion.

Operations: Troax Group AB generates €270.77 million in revenue from its mesh panels segment across the Nordic region, the United Kingdom, North America, Continental Europe, and other international markets.

Estimated Discount To Fair Value: 10.6%

Troax Group is trading at SEK 214, below its estimated fair value of SEK 239.5. Revenue growth is forecasted at 10.2% annually, outpacing the Swedish market's 0.9%. Earnings are expected to grow significantly at 21.7% per year, surpassing the market's average of 15.1%. Recent earnings reports show a slight decline in net income and EPS compared to last year, but sales have increased from EUR 68.5 million to EUR 71.9 million for Q2-2024.

- Insights from our recent growth report point to a promising forecast for Troax Group's business outlook.

- Get an in-depth perspective on Troax Group's balance sheet by reading our health report here.

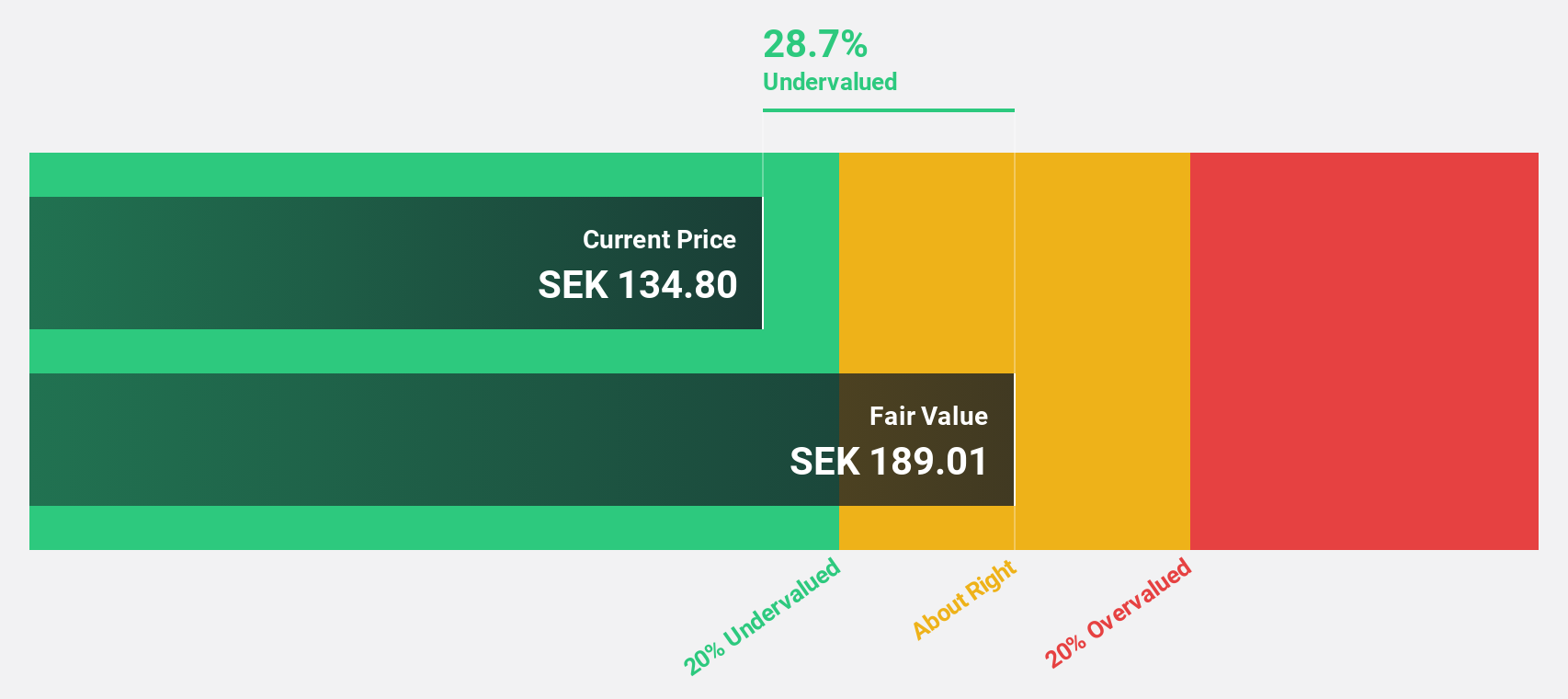

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of approximately SEK22.47 billion.

Operations: The company's revenue segments include Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

Estimated Discount To Fair Value: 30.3%

Vimian Group is trading at SEK 43, significantly below its estimated fair value of SEK 61.71. Despite recent shareholder dilution, the company has become profitable this year and reported Q2 sales of EUR 90.99 million, up from EUR 81.31 million last year. Earnings are forecast to grow substantially at 62.9% annually, outpacing both its revenue growth rate of 11.9% and the broader Swedish market's earnings growth rate of 15.1%.

- Upon reviewing our latest growth report, Vimian Group's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Vimian Group.

Seize The Opportunity

- Reveal the 40 hidden gems among our Undervalued Swedish Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Troax Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Troax Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TROAX

Troax Group

Through its subsidiaries, produces and sells mesh panels in the Nordic region, the United Kingdom, North America, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives