- Sweden

- /

- Diversified Financial

- /

- OM:CRED A

Discovering Undiscovered Gems on None in February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap indices like the S&P 600 are capturing investor attention with their potential for growth amidst broader market volatility. In this environment, identifying undiscovered gems becomes crucial as these stocks often exhibit resilience and unique value propositions that can stand out even when larger indices face headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kirac Galvaniz Telekominikasyon Metal Makine Insaat Elektrik Sanayi ve Ticaret Anonim Sirketi | 14.19% | 33.12% | 44.33% | ★★★★★☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Plejd (NGM:PLEJD)

Simply Wall St Value Rating: ★★★★★★

Overview: Plejd AB (publ) is a technology company that specializes in developing smart lighting control products and services, operating in Sweden, Norway, Finland, the Netherlands, Germany, and internationally with a market cap of approximately SEK4.43 billion.

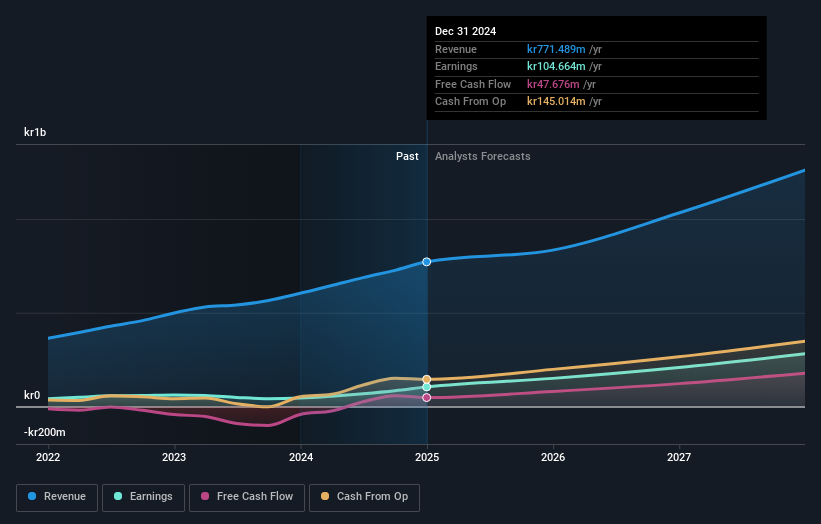

Operations: Plejd generates revenue primarily from its electronic security devices, amounting to SEK726.23 million.

Plejd, a promising player in the electrical industry, showcases impressive financial health with no debt over the past five years, allowing it to focus on growth without interest payment concerns. Its earnings surged 104% last year, outpacing the industry's -20% performance. This robust growth is expected to continue at 38% annually. Despite significant insider selling recently, Plejd's high-quality earnings and positive free cash flow indicate strong operational efficiency. The company seems well-positioned for future expansion as it leverages its debt-free status and solid profit trajectory within a challenging market landscape.

- Dive into the specifics of Plejd here with our thorough health report.

Examine Plejd's past performance report to understand how it has performed in the past.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

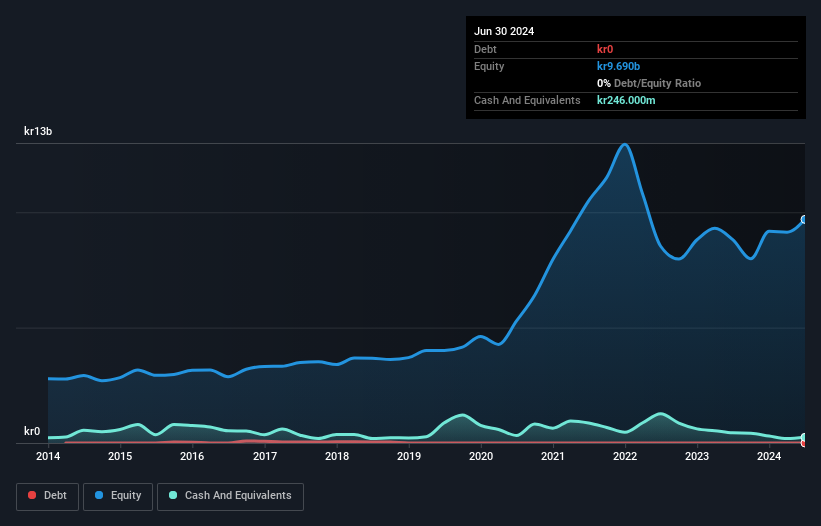

Overview: Creades AB is a private equity and venture capital investment firm that focuses on early to late-stage venture, emerging growth, middle market, growth capital, and buyout investments with a market cap of approximately SEK10.87 billion.

Operations: Creades generates revenue primarily from its investments in online retailers, amounting to SEK1.26 billion. The firm's market cap stands at approximately SEK10.87 billion.

Creades, a nimble player in the financial sector, has shown impressive earnings growth of 115% over the past year, outpacing its industry peers. Despite this recent surge, earnings have decreased by an average of 25% annually over five years. The company remains debt-free and boasts a favorable price-to-earnings ratio of 9x against Sweden's market average of 23.6x. Recent results reveal a stark revenue drop to SEK 344 million from SEK 1.26 billion last year, with net income at SEK 287 million down from SEK 1.19 billion previously—indicating challenges despite high-quality earnings and positive free cash flow dynamics.

- Navigate through the intricacies of Creades with our comprehensive health report here.

Evaluate Creades' historical performance by accessing our past performance report.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

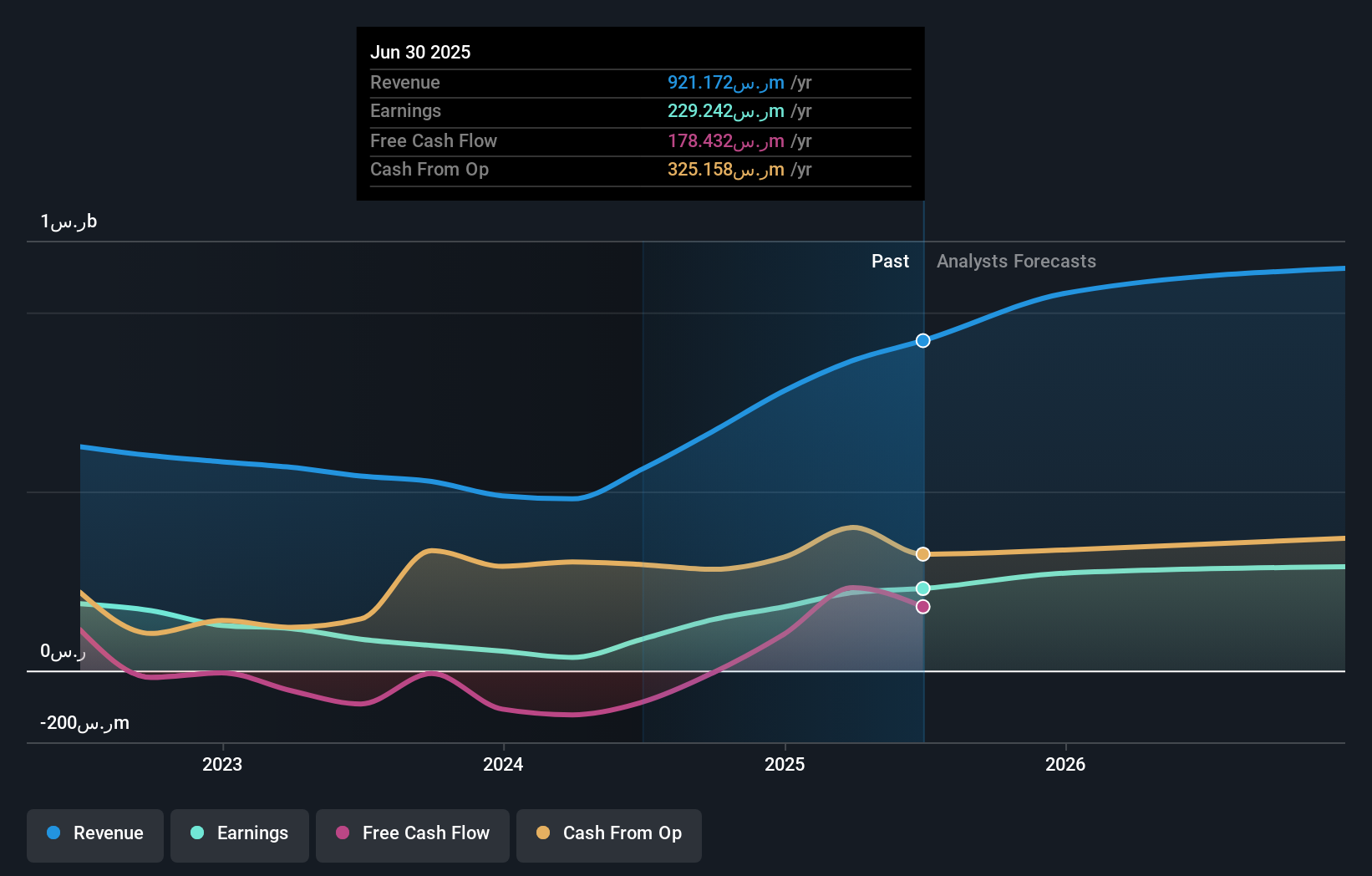

Overview: Al Masane Al Kobra Mining Company operates in the production of non-ferrous metal ores and precious metals in Saudi Arabia, with a market capitalization of SAR5.82 billion.

Operations: Al Masane Al Kobra Mining generates revenue primarily from its Al Masane Mine and Mount Guyan Mine, contributing SAR353.54 million and SAR190.02 million, respectively. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Al Masane Al Kobra Mining, a nimble player in the mining sector, has demonstrated robust financial health with high-quality earnings and an impressive debt-to-equity ratio drop from 62.8% to 4.3% over five years. Despite not being free cash flow positive recently, its interest payments are well-covered by EBIT at 42.8 times coverage. The company's earnings have surged by 18.5% annually over the past five years and are projected to grow at a rate of 41%. Recent events like CEO Geoffrey McDonald Day's presentation at the Future Minerals Forum highlight AMAK's strategic vision for growth in this dynamic industry landscape.

Key Takeaways

- Navigate through the entire inventory of 4688 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CRED A

Creades

A private equity and venture capital investment firm specializing in early, mid & late venture, emerging growth, middle market, growth capital and buyout investments.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives