- Sweden

- /

- Trade Distributors

- /

- OM:OEM B

Discovering Sweden's Hidden Stock Gems In October 2024

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures and the U.S. sees record highs in key indices, European stocks have also rebounded, driven by hopes for interest rate cuts amid slowing business activity. In this dynamic environment, Sweden's market has quietly offered some intriguing opportunities that may not yet be on the radar of many investors. When evaluating stocks in such a setting, it's essential to consider companies with strong fundamentals and growth potential that can capitalize on both local and global economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Creades (OM:CRED A)

Simply Wall St Value Rating: ★★★★★★

Overview: Creades AB is a private equity and venture capital investment firm specializing in early, mid, and late venture, emerging growth, middle market, growth capital, and buyout investments with a market cap of SEK11.32 billion.

Operations: Creades AB generates revenue primarily from its investments in online retailers, amounting to SEK1.11 billion. The firm's financial performance is influenced by its strategic focus on various stages of venture and growth capital investments.

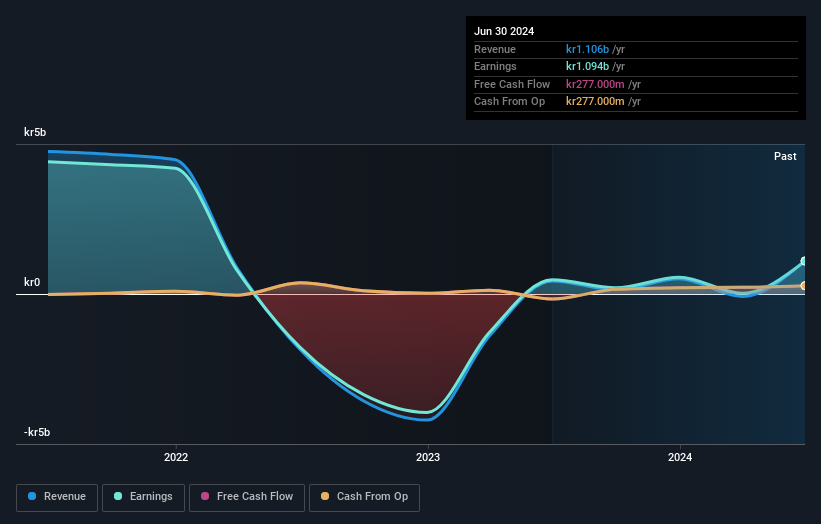

Creades has shown impressive performance, with earnings growth of 129.4% over the past year, outpacing the Diversified Financial industry’s 80.2%. The company is debt-free and boasts a low Price-To-Earnings ratio of 10.3x compared to the Swedish market's 23.9x. Recent results highlight a turnaround, reporting SEK 771 million in net income for Q2 2024 versus a net loss of SEK 299 million last year, and basic EPS from continuing operations at SEK 5.68 up from a loss per share of SEK -2.20 previously.

- Click to explore a detailed breakdown of our findings in Creades' health report.

Gain insights into Creades' historical performance by reviewing our past performance report.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

Overview: ITAB Shop Concept AB (publ) specializes in providing solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK7.47 billion.

Operations: Revenue for ITAB Shop Concept AB (publ) is primarily derived from the Furniture & Fixtures segment, which generated SEK 6.39 billion. The company focuses on solution design and customized shop fittings among other offerings.

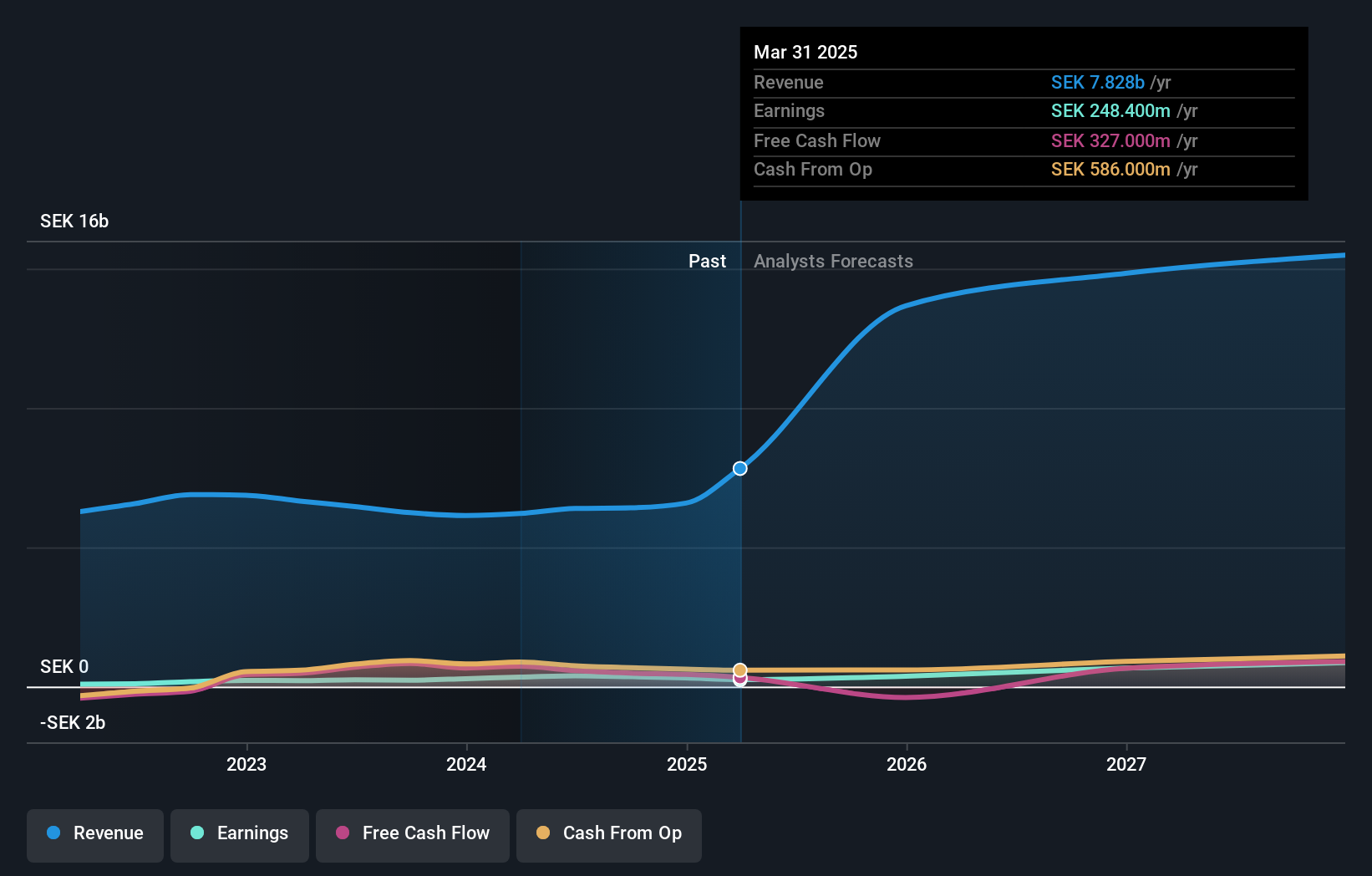

ITAB Shop Concept, a notable player in the commercial services sector, has shown impressive growth with earnings surging 56.7% over the past year, outpacing its industry average of -2%. The net debt to equity ratio stands at a satisfactory 8.8%, and ITAB's interest payments are well covered by EBIT at 21x coverage. Recent deals include a EUR 20 million framework agreement for shop-in-shop concepts across Europe and another EUR 22 million contract in the UK for financial service providers' branch refurbishments.

- Delve into the full analysis health report here for a deeper understanding of ITAB Shop Concept.

Assess ITAB Shop Concept's past performance with our detailed historical performance reports.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

Overview: OEM International AB (publ), along with its subsidiaries, supplies products and systems for industrial applications and has a market cap of SEK16.61 billion.

Operations: OEM International generates revenue primarily from Sweden (SEK 3.28 billion), Finland, the Baltic States, and China (SEK 1.05 billion), and Denmark, Norway, the British Isles, and East Central Europe (SEK 1.20 billion). The company’s net profit margin is a notable financial metric to consider when analyzing its profitability.

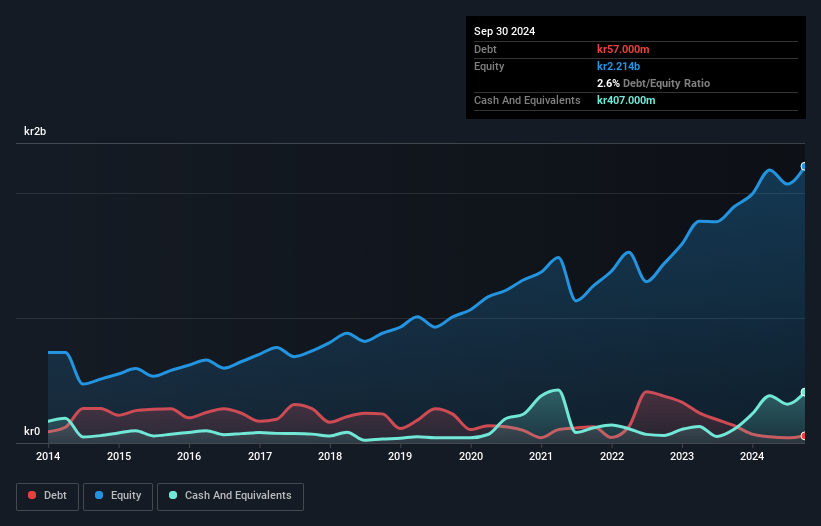

OEM International, a relatively small player in the Swedish market, has demonstrated notable financial resilience. With EBIT covering interest payments 243 times over and trading at 60.6% below its estimated fair value, the company shows strong potential. Despite reducing its debt to equity ratio from 29.7% to 2% over five years, it faced a -5.9% earnings growth last year against an industry average of 1.3%. Recent earnings reveal sales of SEK 1,331 million for Q2 with net income at SEK 139 million compared to SEK 157 million previously.

- Click here and access our complete health analysis report to understand the dynamics of OEM International.

Evaluate OEM International's historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 58 Swedish Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:OEM B

OEM International

Operates as a technology trading company in Sweden, Finland, Ireland, the United Kingdom, Denmark, Poland, Norway, the Czech Republic, China, Estonia, Slovakia, Hungary, Lithuania, the Netherlands, and Latvia.

Flawless balance sheet and fair value.