- Sweden

- /

- Capital Markets

- /

- OM:CAT B

Undervalued Swedish Stocks With Intrinsic Value Estimates For September 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and renewed fears of a slowdown, the Swedish stock market has not been immune to these broader trends. Despite this challenging environment, opportunities still exist for discerning investors who can identify undervalued stocks with strong intrinsic value. In such volatile times, a good stock is one that demonstrates robust fundamentals and resilience against market fluctuations. This article highlights three Swedish stocks that appear undervalued based on their intrinsic value estimates for September 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sleep Cycle (OM:SLEEP) | SEK40.40 | SEK79.94 | 49.5% |

| CTT Systems (OM:CTT) | SEK275.00 | SEK498.69 | 44.9% |

| QleanAir (OM:QAIR) | SEK27.50 | SEK51.84 | 47% |

| Concentric (OM:COIC) | SEK228.00 | SEK412.24 | 44.7% |

| Litium (OM:LITI) | SEK8.22 | SEK16.43 | 50% |

| Nolato (OM:NOLA B) | SEK54.15 | SEK99.11 | 45.4% |

| Mentice (OM:MNTC) | SEK27.60 | SEK51.14 | 46% |

| Svedbergs Group (OM:SVED BTA B) | SEK36.30 | SEK65.51 | 44.6% |

| BHG Group (OM:BHG) | SEK14.44 | SEK27.05 | 46.6% |

| MilDef Group (OM:MILDEF) | SEK81.70 | SEK162.36 | 49.7% |

Here's a peek at a few of the choices from the screener.

Catella (OM:CAT B)

Overview: Catella AB (publ) is a real estate investment firm with a market cap of SEK2.61 billion.

Operations: Catella AB (publ) generates revenue through three primary segments: Corporate Finance (SEK422 million), Investment Management (SEK1.02 billion), and Principal Investments (SEK491 million).

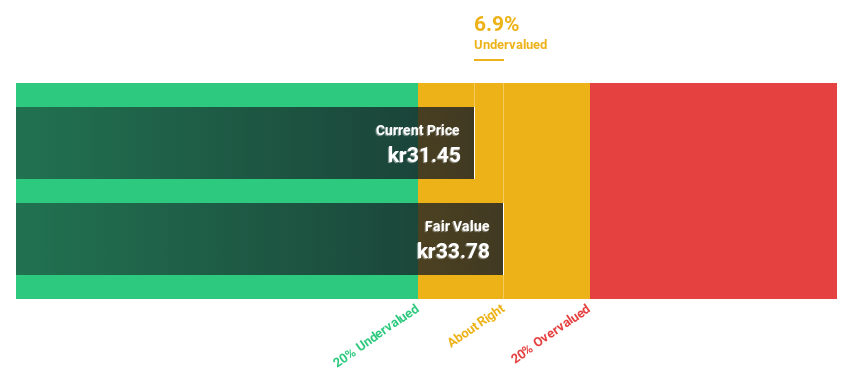

Estimated Discount To Fair Value: 10.1%

Catella AB is trading below its estimated fair value of SEK 32.8, currently priced at SEK 29.5, representing a 10.1% undervaluation based on discounted cash flow analysis. Despite recent leadership changes and a net loss of SEK 33 million in Q2 2024, revenue is forecast to grow at 13.3% annually, outpacing the Swedish market's growth rate. However, debt coverage by operating cash flow remains weak and dividends are not well supported by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Catella is poised for substantial financial growth.

- Get an in-depth perspective on Catella's balance sheet by reading our health report here.

Nolato (OM:NOLA B)

Overview: Nolato AB (publ) develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products for various sectors including medical technology, pharmaceuticals, consumer electronics, telecoms, automotive, hygiene, and other industries with a market cap of SEK14.59 billion.

Operations: The company generates SEK5.34 billion in revenue from its Medical Solutions segment.

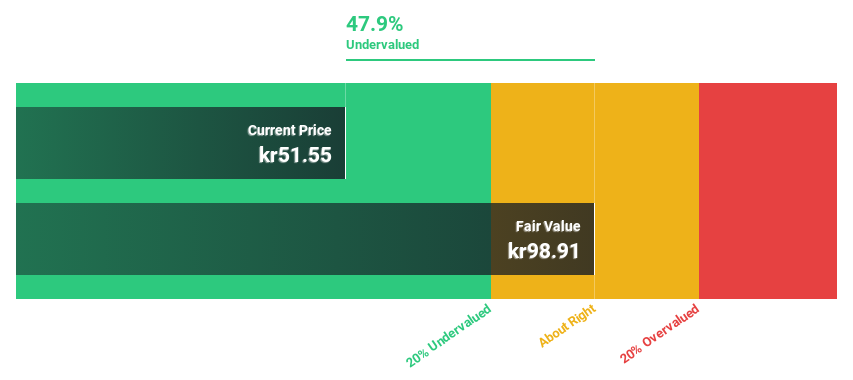

Estimated Discount To Fair Value: 45.4%

Nolato AB is trading at SEK 54.15, significantly below its fair value estimate of SEK 99.11, indicating a strong undervaluation based on discounted cash flow analysis. The company reported steady earnings growth with Q2 net income rising to SEK 169 million from SEK 155 million year-on-year, despite a slight dip in sales. Earnings are forecast to grow at an impressive 23.2% annually, outpacing the Swedish market's average growth rate of 15.4%. However, Nolato has an unstable dividend track record and its return on equity is expected to remain low at 14.6% in three years' time.

- In light of our recent growth report, it seems possible that Nolato's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Nolato.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health sector and has a market cap of SEK23.72 billion.

Operations: The company's revenue segments include Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

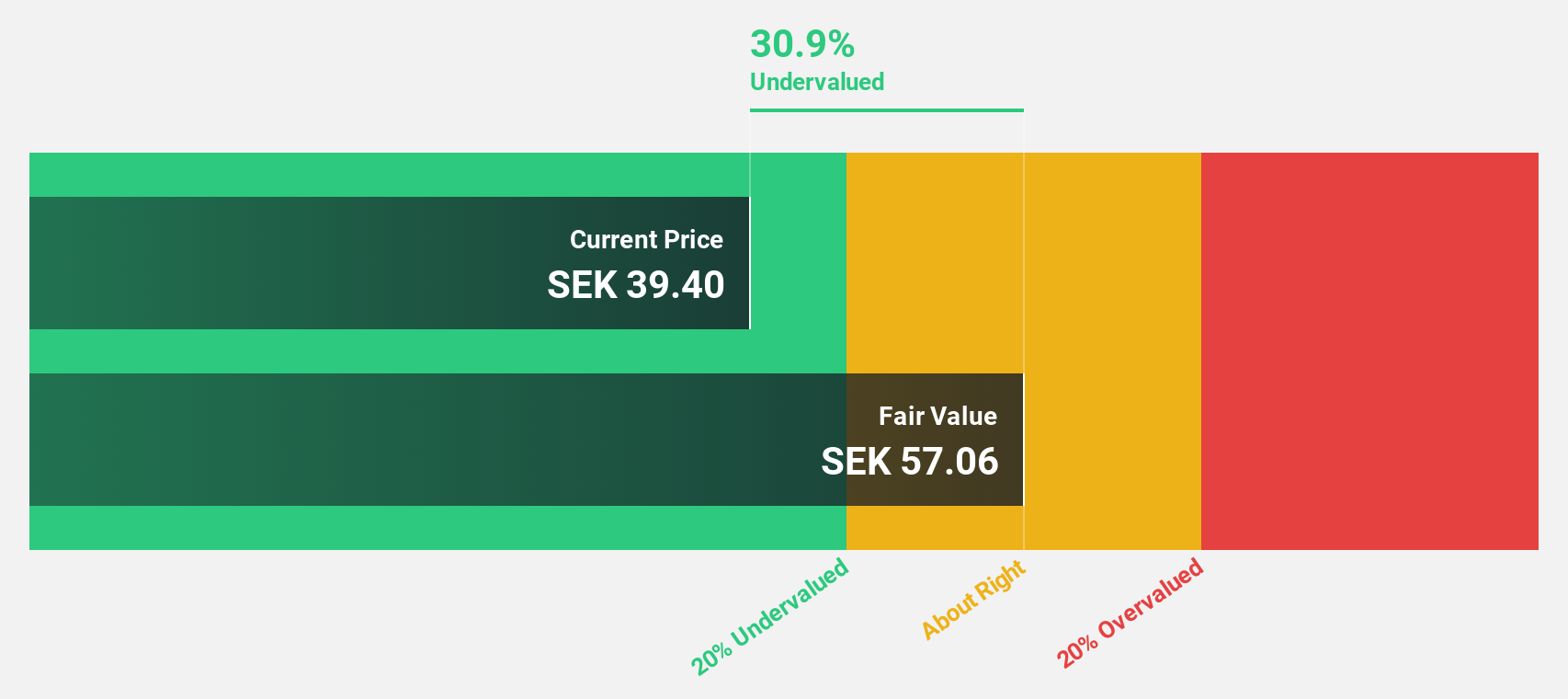

Estimated Discount To Fair Value: 26.9%

Vimian Group AB, trading at SEK 45.4, is significantly undervalued with a fair value estimate of SEK 62.1 based on discounted cash flow analysis. Recent earnings reports show strong performance with Q2 sales rising to EUR 90.99 million from EUR 81.31 million year-on-year and net income increasing to EUR 4.87 million from EUR 2.99 million. Despite past shareholder dilution and low future return on equity forecasts, Vimian's earnings are expected to grow significantly at over 20% annually, outpacing the Swedish market's average growth rate of 15.4%.

- Insights from our recent growth report point to a promising forecast for Vimian Group's business outlook.

- Take a closer look at Vimian Group's balance sheet health here in our report.

Taking Advantage

- Click this link to deep-dive into the 39 companies within our Undervalued Swedish Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CAT B

Reasonable growth potential second-rate dividend payer.

Market Insights

Community Narratives