- Sweden

- /

- Capital Markets

- /

- OM:CAT B

Catella AB (publ) Just Reported A Surprise Profit And Analysts Updated Their Estimates

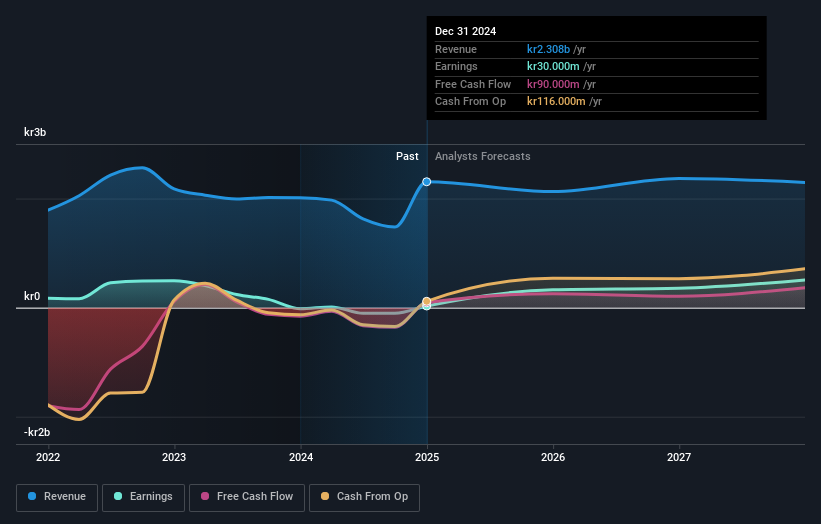

Investors in Catella AB (publ) (STO:CAT B) had a good week, as its shares rose 9.5% to close at kr29.45 following the release of its full-year results. Revenues of 38% beat expectations by kr2.3b and was sufficient to generate a statutory profit of kr0.33 - a pleasant surprise given that the analysts were forecasting a loss! This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Catella

After the latest results, the consensus from Catella's four analysts is for revenues of kr2.13b in 2025, which would reflect a perceptible 7.8% decline in revenue compared to the last year of performance. Statutory earnings per share are predicted to leap 1,058% to kr3.93. In the lead-up to this report, the analysts had been modelling revenues of kr2.10b and earnings per share (EPS) of kr4.07 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

It might be a surprise to learn that the consensus price target was broadly unchanged at kr45.50, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Catella analyst has a price target of kr56.00 per share, while the most pessimistic values it at kr35.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Catella shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Catella's past performance and to peers in the same industry. One more thing stood out to us about these estimates, and it's the idea that Catella's decline is expected to accelerate, with revenues forecast to fall at an annualised rate of 7.8% to the end of 2025. This tops off a historical decline of 4.5% a year over the past five years. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 11% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Catella to suffer worse than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Catella's revenue is expected to perform worse than the wider industry. The consensus price target held steady at kr45.50, with the latest estimates not enough to have an impact on their price targets.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Catella going out to 2027, and you can see them free on our platform here..

You still need to take note of risks, for example - Catella has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CAT B

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026