- Sweden

- /

- Capital Markets

- /

- OM:CAT B

Analysts Have Just Cut Their Catella AB (publ) (STO:CAT B) Revenue Estimates By 12%

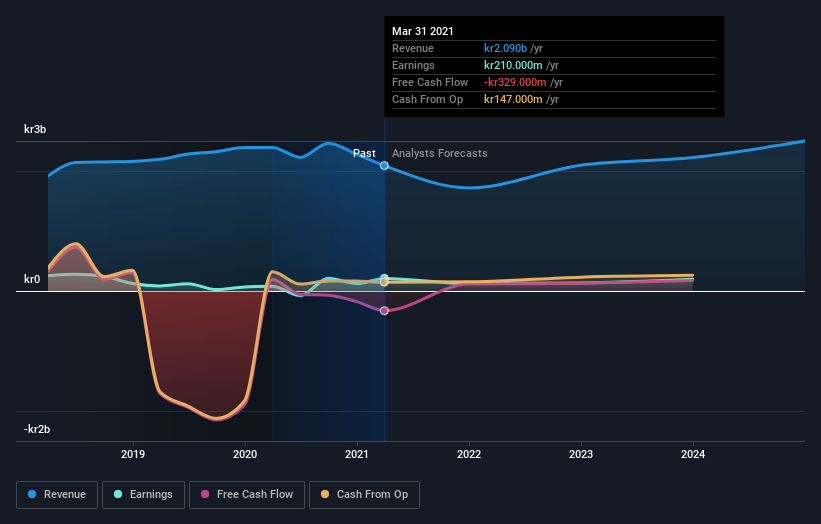

One thing we could say about the analysts on Catella AB (publ) (STO:CAT B) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the downgrade, the consensus from twin analysts covering Catella is for revenues of kr1.7b in 2021, implying an uncomfortable 18% decline in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of kr2.0b in 2021. It looks like forecasts have become a fair bit less optimistic on Catella, given the substantial drop in revenue estimates.

See our latest analysis for Catella

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 23% by the end of 2021. This indicates a significant reduction from annual growth of 4.3% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 23% annually for the foreseeable future. It's pretty clear that Catella's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They also expect company revenue to perform worse than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Catella after today.

There might be good reason for analyst bearishness towards Catella, like concerns around earnings quality. For more information, you can click here to discover this and the 1 other risk we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Catella or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CAT B

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives