- Sweden

- /

- Capital Markets

- /

- OM:BURE

If You Like EPS Growth Then Check Out Bure Equity (STO:BURE) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Bure Equity (STO:BURE). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Bure Equity

How Quickly Is Bure Equity Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Bure Equity's stratospheric annual EPS growth of 58%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

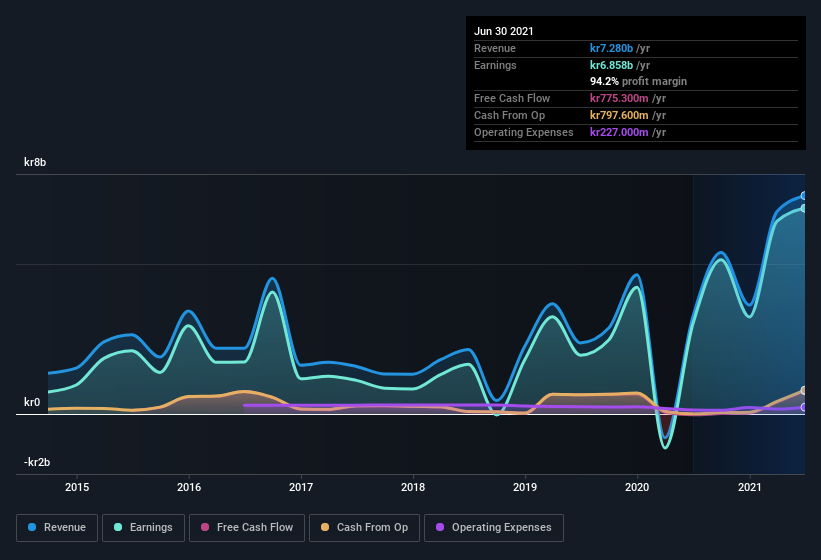

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that Bure Equity's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bure Equity shareholders can take confidence from the fact that EBIT margins are up from 93% to 95%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Bure Equity's balance sheet strength, before getting too excited.

Are Bure Equity Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Bure Equity insiders spent kr596k more buying shares than they received from selling them. On balance, that's a good sign. We also note that it was the CEO & President, Henrik Blomquist, who made the biggest single acquisition, paying kr1.2m for shares at about kr358 each.

Along with the insider buying, another encouraging sign for Bure Equity is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth kr7.3b. That equates to 25% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Does Bure Equity Deserve A Spot On Your Watchlist?

Bure Equity's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Bure Equity belongs on the top of your watchlist. You still need to take note of risks, for example - Bure Equity has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bure Equity, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Bure Equity, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bure Equity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BURE

Bure Equity

A private equity and venture capital firm specializing in secondary direct, later stage, middle market, mature, buyouts, mid venture, late venture, PIPES, bridge, industry consolidation, recapitalizations, growth capital, special situation and turnarounds.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion