- Sweden

- /

- Capital Markets

- /

- NGM:SPLTN

3 Undervalued Small Caps With Insider Buying Across Global Markets

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating economic indicators, small-cap stocks have experienced varied performance, with indices like the S&P 600 reflecting these dynamics. Amid this backdrop, investors often look for opportunities in undervalued small-cap companies that demonstrate potential resilience through insider buying, suggesting confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Sagicor Financial | 1.1x | 0.3x | 36.91% | ★★★★★★ |

| Paradeep Phosphates | 23.4x | 0.8x | 30.14% | ★★★★★☆ |

| Cheerwin Group | 11.0x | 1.4x | 47.98% | ★★★★☆☆ |

| Avia Avian | 17.1x | 3.9x | 6.60% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 45.13% | ★★★★☆☆ |

| HighPeak Energy | 10.8x | 1.6x | 35.86% | ★★★★☆☆ |

| USCB Financial Holdings | 19.2x | 5.5x | 48.22% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.9x | 1.6x | -38.35% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.3x | -910.07% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

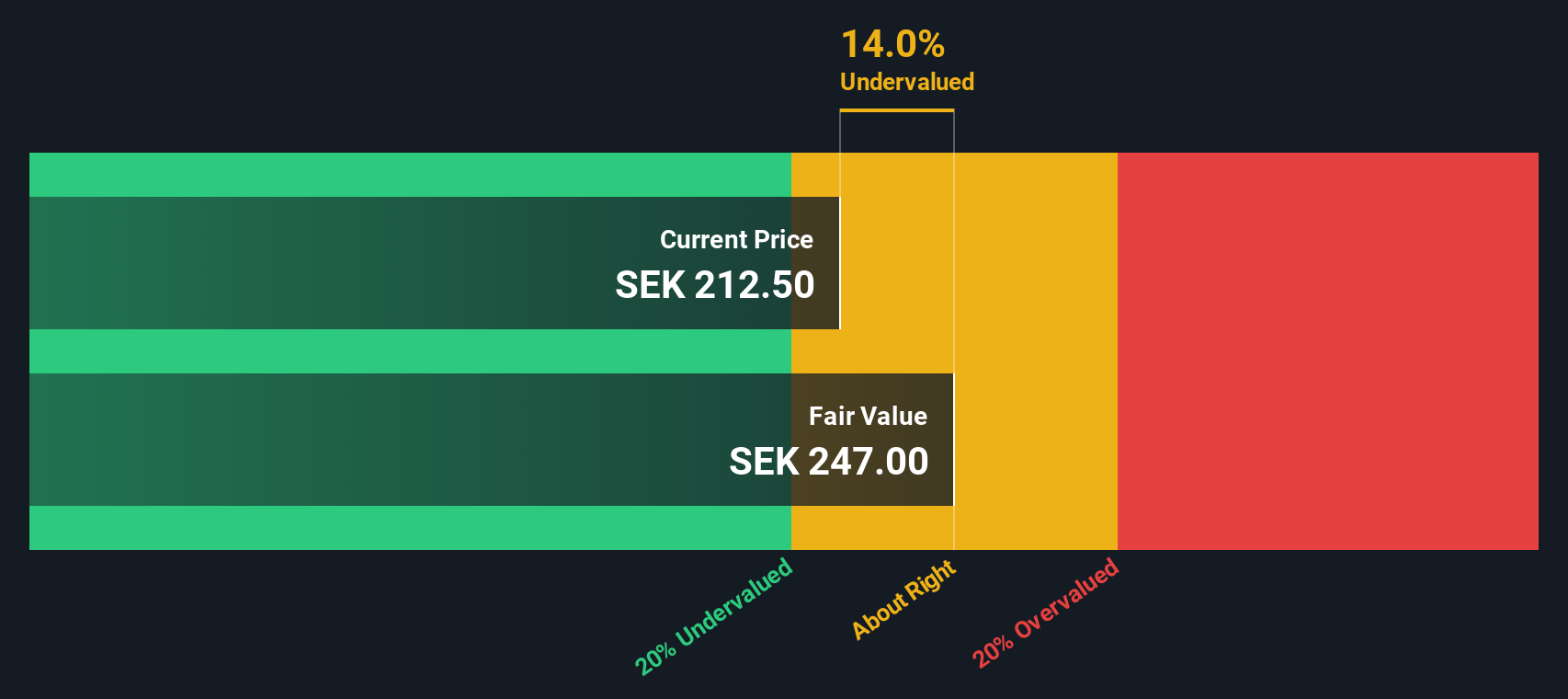

Investment AB Spiltan (NGM:SPLTN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Investment AB Spiltan is a Swedish investment company that focuses on long-term investments in both listed and unlisted companies, with a market capitalization of approximately SEK 7.5 billion.

Operations: Spiltan generates its revenue primarily from unclassified services, with recent figures indicating a negative revenue trend. The company consistently reports a gross profit margin of 100%, suggesting that cost of goods sold is not applicable or minimal. Operating expenses, particularly general and administrative expenses, are notable cost components impacting net income. Recent data shows fluctuations in net income margin, reaching as high as 106.76% in some periods due to non-operating factors.

PE: -19.2x

Investment AB Spiltan, a small company with an external borrowing-based funding structure, recently reported notable financial shifts. For Q3 2024, revenue reached SEK 743.88 million from a negative SEK 831.07 million the previous year, while net income was SEK 738.94 million compared to a net loss of SEK 850.52 million last year. Despite these improvements, earnings have declined by an average of 30% annually over five years, indicating challenges in achieving consistent growth or value realization in the future.

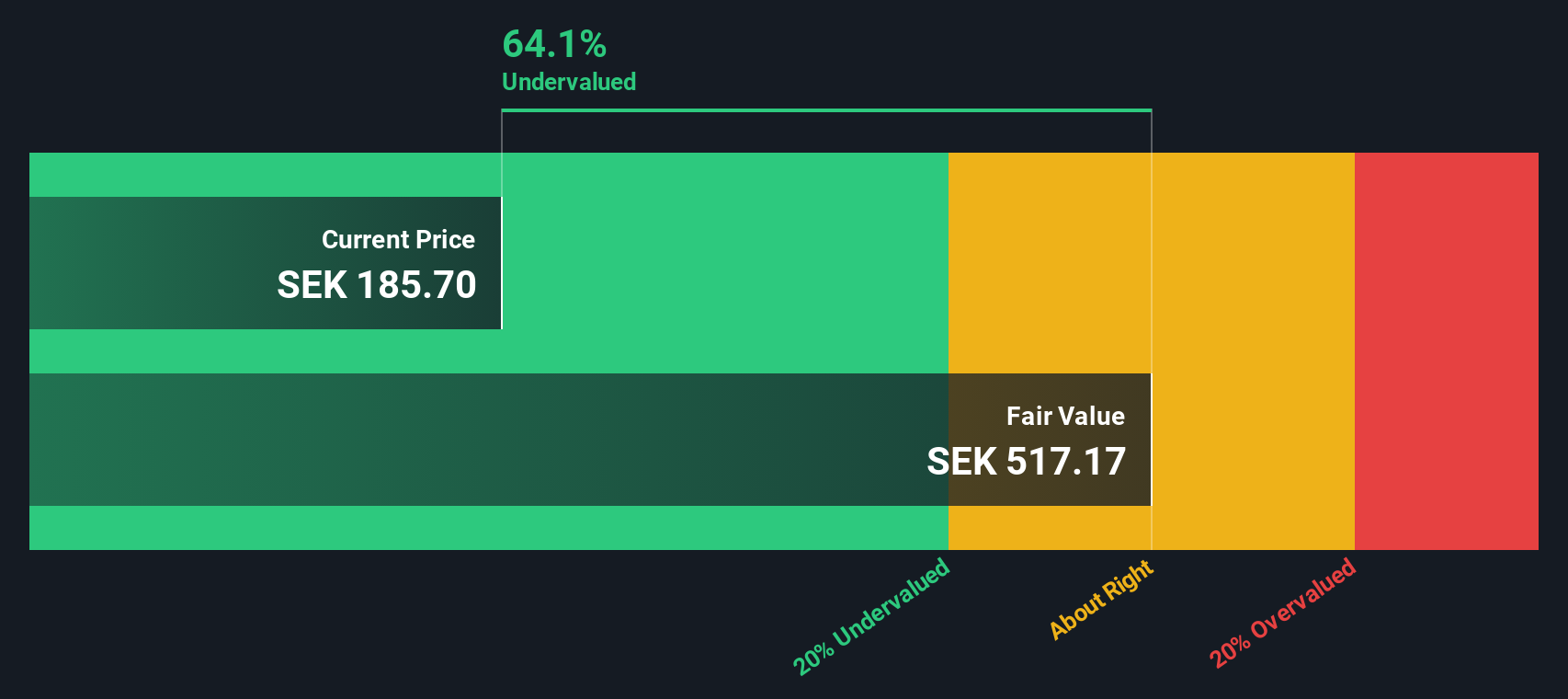

BioArctic (OM:BIOA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: BioArctic is a Swedish biopharmaceutical company focused on developing innovative treatments for neurodegenerative diseases, with a market cap of approximately SEK 16.39 billion.

Operations: BioArctic generates revenue primarily through its operations, with notable fluctuations in net income margin over recent periods. The company experienced a significant gross profit margin of 92.82% as of September 2023, highlighting efficient cost management relative to revenue during that period. However, the latest available data from September 2024 shows a decline in gross profit margin to 54.87%, indicating increased costs or changes in revenue structure impacting profitability.

PE: -67.9x

BioArctic, a small player in the biotech sector, has seen its stock fluctuate significantly over the past three months. Despite this volatility, there's notable insider confidence with recent share purchases. The company reported a net loss for Q3 2024 but is poised for growth with earnings forecasted to increase by 119% annually. Recent positive developments include a CHMP recommendation for lecanemab's approval in Europe and advancements in their BrainTransporter technology, potentially expanding future partnership opportunities.

- Unlock comprehensive insights into our analysis of BioArctic stock in this valuation report.

Understand BioArctic's track record by examining our Past report.

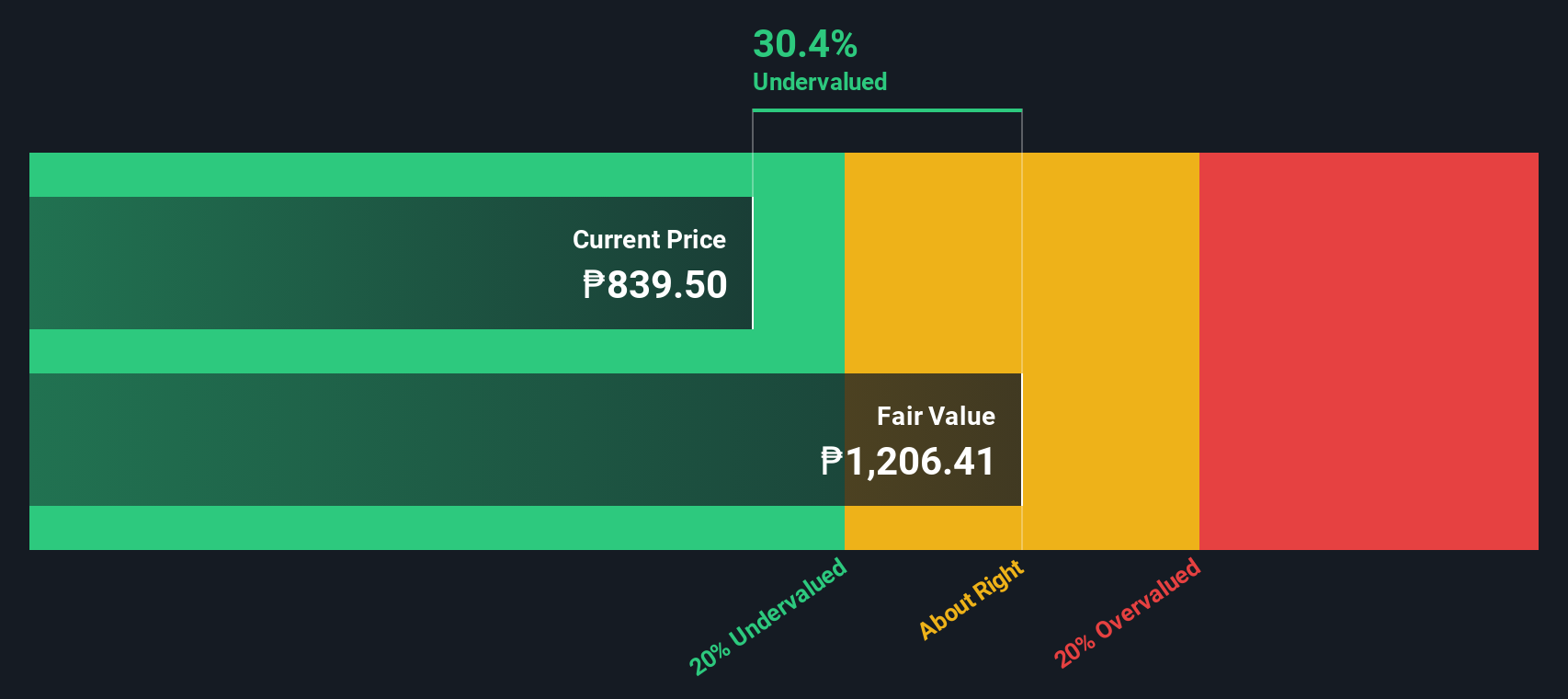

Far Eastern University (PSE:FEU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Far Eastern University operates as an educational institution with multiple revenue segments including its main campus, other schools, and trimestral schools, and has a market capitalization of ₱10.5 billion.

Operations: The primary revenue streams for the company are derived from FEU Main, Other Schools, and Trimestral Schools. The gross profit margin has experienced fluctuations over time, reaching 61.24% as of August 31, 2023. Operating expenses include significant allocations for general and administrative expenses as well as depreciation and amortization costs.

PE: 8.9x

Far Eastern University, a smaller stock, reflects potential value with notable insider confidence shown through recent share purchases. Despite a volatile share price in the past three months and reliance on external borrowing for funding, its revenue increased to PHP 608.39 million for Q1 2024 from PHP 568.64 million last year. However, net losses widened to PHP 99.76 million compared to PHP 73.09 million previously. The company declared a cash dividend of PHP 16 per share in September 2024, indicating shareholder returns remain a priority amidst financial challenges and strategic adjustments like changing auditors to SGV & Co., which may signal efforts toward improved financial oversight and future stability.

Summing It All Up

- Navigate through the entire inventory of 170 Undervalued Small Caps With Insider Buying here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:SPLTN

Investment AB Spiltan

A venture capital and private equity firm specializing in providing multi stage financing with a focus on startups and growth companies.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives