- Sweden

- /

- Diversified Financial

- /

- NGM:ARBO A

Arbona And Two Other European Penny Stocks To Consider

Reviewed by Simply Wall St

As European markets grapple with the fallout from higher-than-expected U.S. tariffs, major indices have experienced significant declines, reflecting broader concerns about global trade tensions and economic uncertainty. In this context, investors may find value in exploring smaller or less-established companies often referred to as penny stocks. While the term might seem outdated, these stocks can offer a mix of affordability and potential growth when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.974 | SEK1.89B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.45 | SEK228.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.45 | SEK258.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.76 | SEK228.75M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.42 | PLN115.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.45 | €51.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.94 | €31.48M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €2.82 | €55.41M | ✅ 1 ⚠️ 4 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.055 | €283.72M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Arbona (NGM:ARBO A)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arbona AB (publ) is an investment company focusing on small and medium-sized listed and unlisted companies in Sweden, with a market cap of SEK1.66 billion.

Operations: The company's revenue is generated entirely from its operations in Sweden, amounting to SEK636.21 million.

Market Cap: SEK1.66B

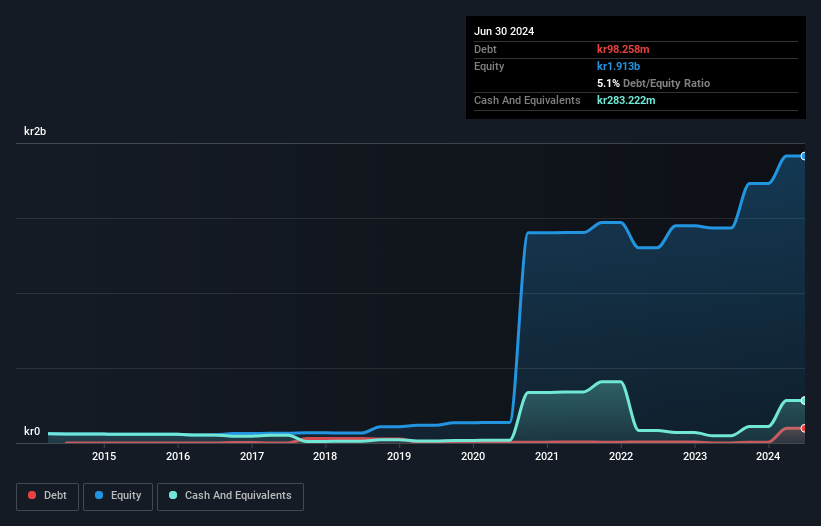

Arbona AB, an investment company in Sweden, has demonstrated a significant increase in revenue to SEK636.21 million from SEK49.57 million last year, although net income declined to SEK175.11 million from SEK291.98 million due to large one-off gains previously impacting results. The company operates debt-free with short-term assets exceeding both short and long-term liabilities, suggesting strong liquidity management. Despite negative earnings growth over the past year and a low return on equity of 9%, Arbona trades at a substantial discount below its estimated fair value of 44.2%. Earnings per share decreased from SEK0.56 to SEK0.34 year-on-year.

- Get an in-depth perspective on Arbona's performance by reading our balance sheet health report here.

- Gain insights into Arbona's historical outcomes by reviewing our past performance report.

Ocean Sun (OB:OSUN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ocean Sun AS develops floating power systems with solar panels and has a market cap of NOK89.46 million.

Operations: The company generates revenue primarily from its Heavy Construction segment, amounting to NOK7.21 million.

Market Cap: NOK89.46M

Ocean Sun AS, with a market cap of NOK89.46 million, operates in the heavy construction segment and is currently pre-revenue with sales of NOK7.61 million for 2024. The company remains unprofitable, reporting a net loss of NOK16.95 million but has improved its revenue from the previous year. Ocean Sun is debt-free and maintains sufficient cash runway for over a year despite high share price volatility and negative return on equity at -59.94%. Recent leadership changes include appointing Kristin Husby Mork as Chief Commercial Officer to bolster commercial strategy amid expansion efforts in renewable energy markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Ocean Sun.

- Examine Ocean Sun's past performance report to understand how it has performed in prior years.

Scout Gaming Group (OM:SCOUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scout Gaming Group AB (publ) is a company that offers B2B daily fantasy, sportsbook, fantasy betting, and other sports betting products mainly in Sweden, Norway, Ukraine, and Malta with a market cap of SEK51.35 million.

Operations: Scout Gaming Group does not report specific revenue segments.

Market Cap: SEK51.35M

Scout Gaming Group AB, with a market cap of SEK51.35 million, operates in the sports betting sector and has shown revenue growth to SEK44.41 million in 2024 from SEK31.03 million the previous year. Despite being unprofitable, it has reduced its net loss significantly to SEK6.36 million from SEK41.11 million a year ago and maintains a solid cash runway exceeding three years based on current free cash flow levels. The company is debt-free and benefits from an experienced management team and board, though its share price remains highly volatile with negative return on equity at -24.37%.

- Unlock comprehensive insights into our analysis of Scout Gaming Group stock in this financial health report.

- Evaluate Scout Gaming Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Click here to access our complete index of 432 European Penny Stocks.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:ARBO A

Arbona

Invests in small and medium sized listed and unlisted companies in Sweden.

Good value with adequate balance sheet.

Market Insights

Community Narratives