- Sweden

- /

- Hospitality

- /

- OM:BETS B

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets experience a positive uptick with the pan-European STOXX Europe 600 Index rising 2.77% amid easing trade tensions, investors are keenly observing opportunities to strengthen their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for growth, making them attractive options for those looking to enhance their investment strategies in the current market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.88% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.61% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.22% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.02% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.93% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.11% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.34% | ★★★★★★ |

Click here to see the full list of 234 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Construcciones y Auxiliar de Ferrocarriles (BME:CAF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Construcciones y Auxiliar de Ferrocarriles, S.A. is a company specializing in the design, manufacture, and maintenance of railway vehicles and equipment, with a market cap of approximately €1.47 billion.

Operations: Construcciones y Auxiliar de Ferrocarriles, S.A. generates revenue primarily from its Railway segment, including wheel sets and components, amounting to €3.29 billion and from its Buses segment contributing €926.87 million.

Dividend Yield: 3.1%

Construcciones y Auxiliar de Ferrocarriles (CAF) offers a mixed picture for dividend investors. While the company trades at 43.3% below its estimated fair value, providing potential capital appreciation, its dividend yield of 3.12% is lower than the Spanish market's top tier. Despite a well-covered payout ratio of 44.4%, CAF's dividends have been volatile over the past decade, lacking reliability and stability even as earnings and sales show growth with EUR 4.22 billion in sales for 2024.

- Navigate through the intricacies of Construcciones y Auxiliar de Ferrocarriles with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Construcciones y Auxiliar de Ferrocarriles' share price might be too pessimistic.

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe, with a market cap of €575.76 million.

Operations: Clínica Baviera, S.A. generates its revenue primarily from its ophthalmology clinics, with a total of €265.72 million.

Dividend Yield: 4.4%

Clínica Baviera's dividend profile shows both strengths and weaknesses for investors. While dividends are covered by earnings (66.6% payout ratio) and cash flows (69.3% cash payout ratio), their history is marked by volatility, with unstable payments over the past decade. Despite trading 26.3% below fair value, its 4.36% yield falls short of Spain's top-tier payers. Recent financial results highlight growth, with sales rising to €265.72 million and net income reaching €40.21 million in 2024.

- Click here to discover the nuances of Clínica Baviera with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Clínica Baviera's current price could be quite moderate.

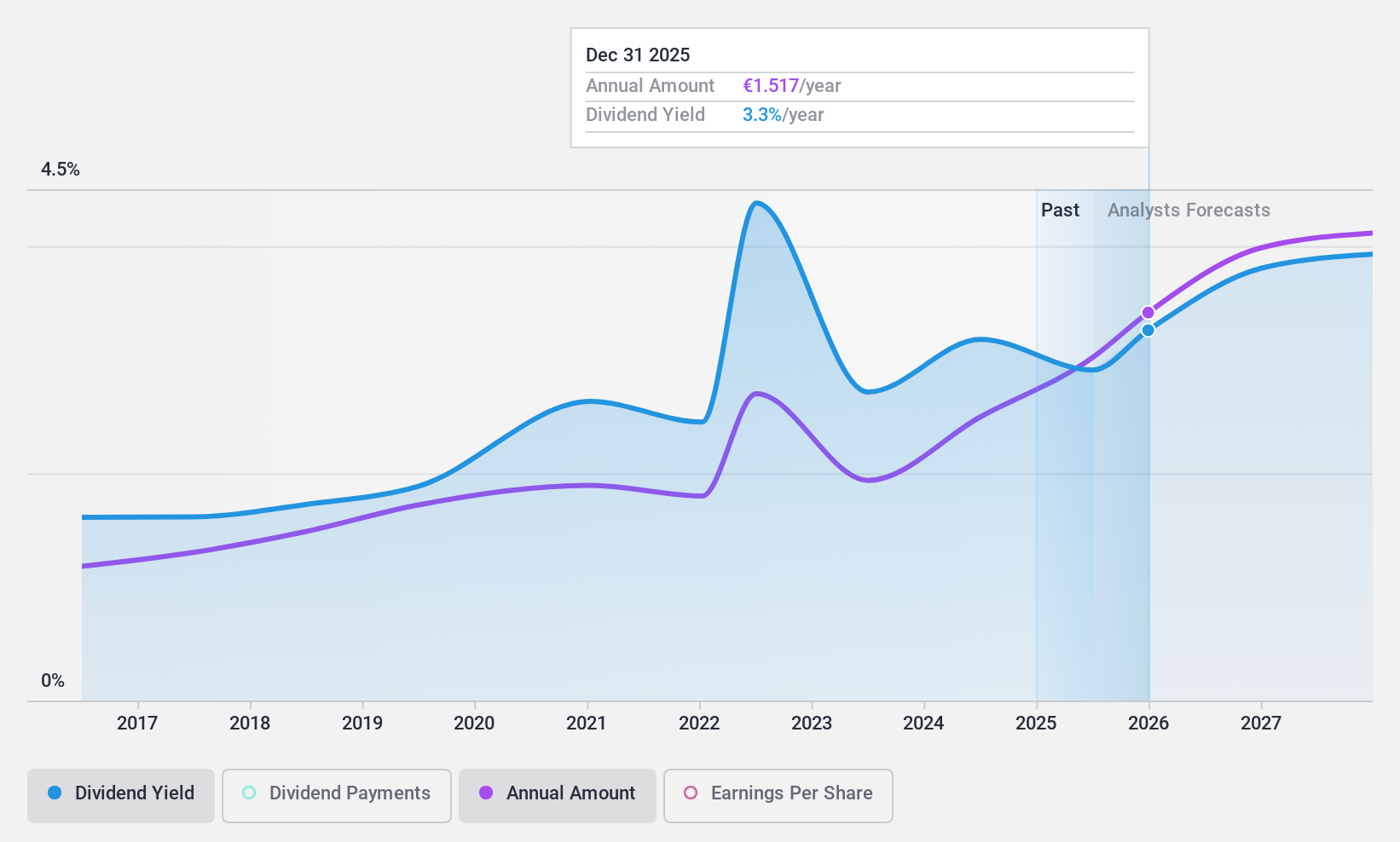

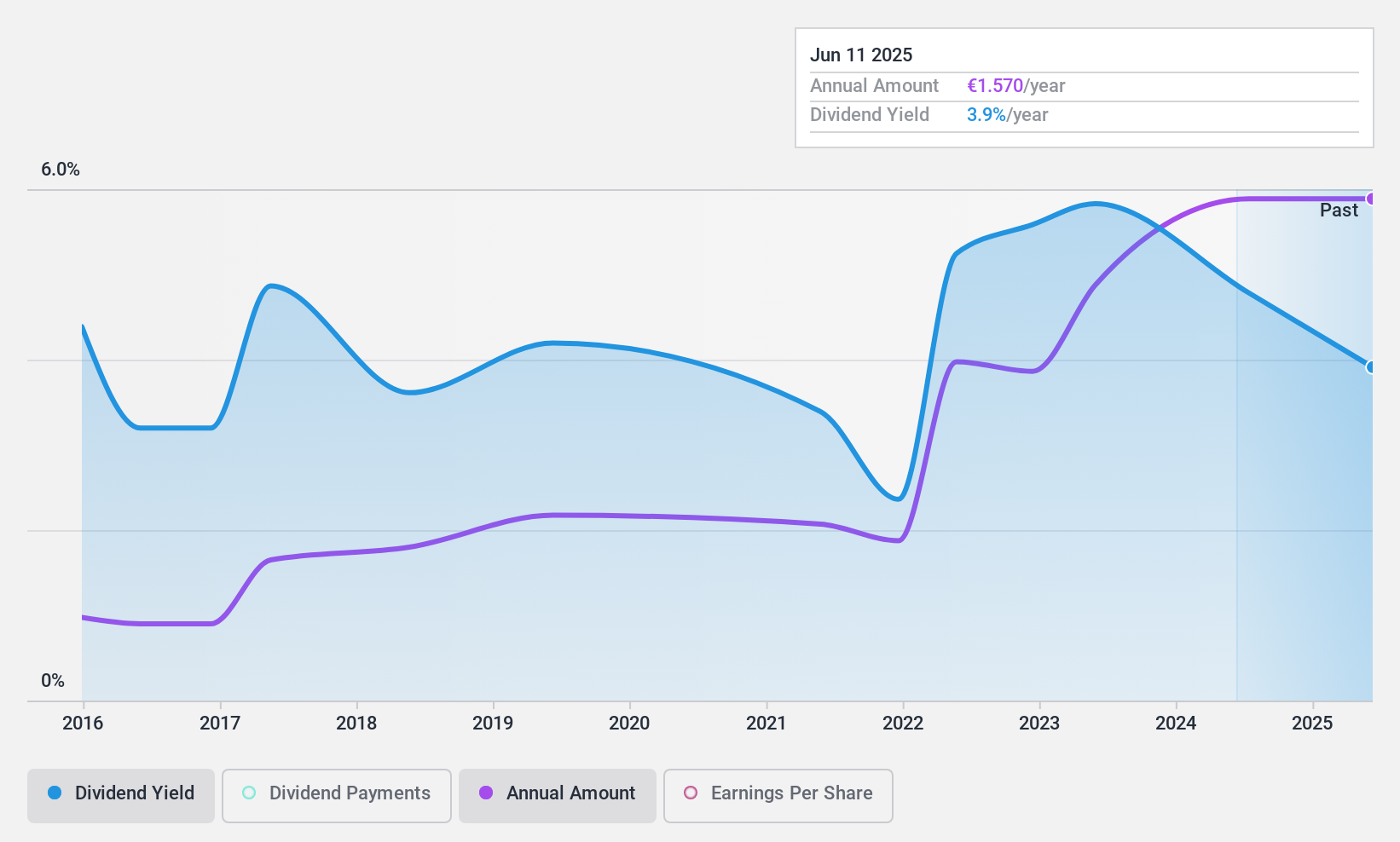

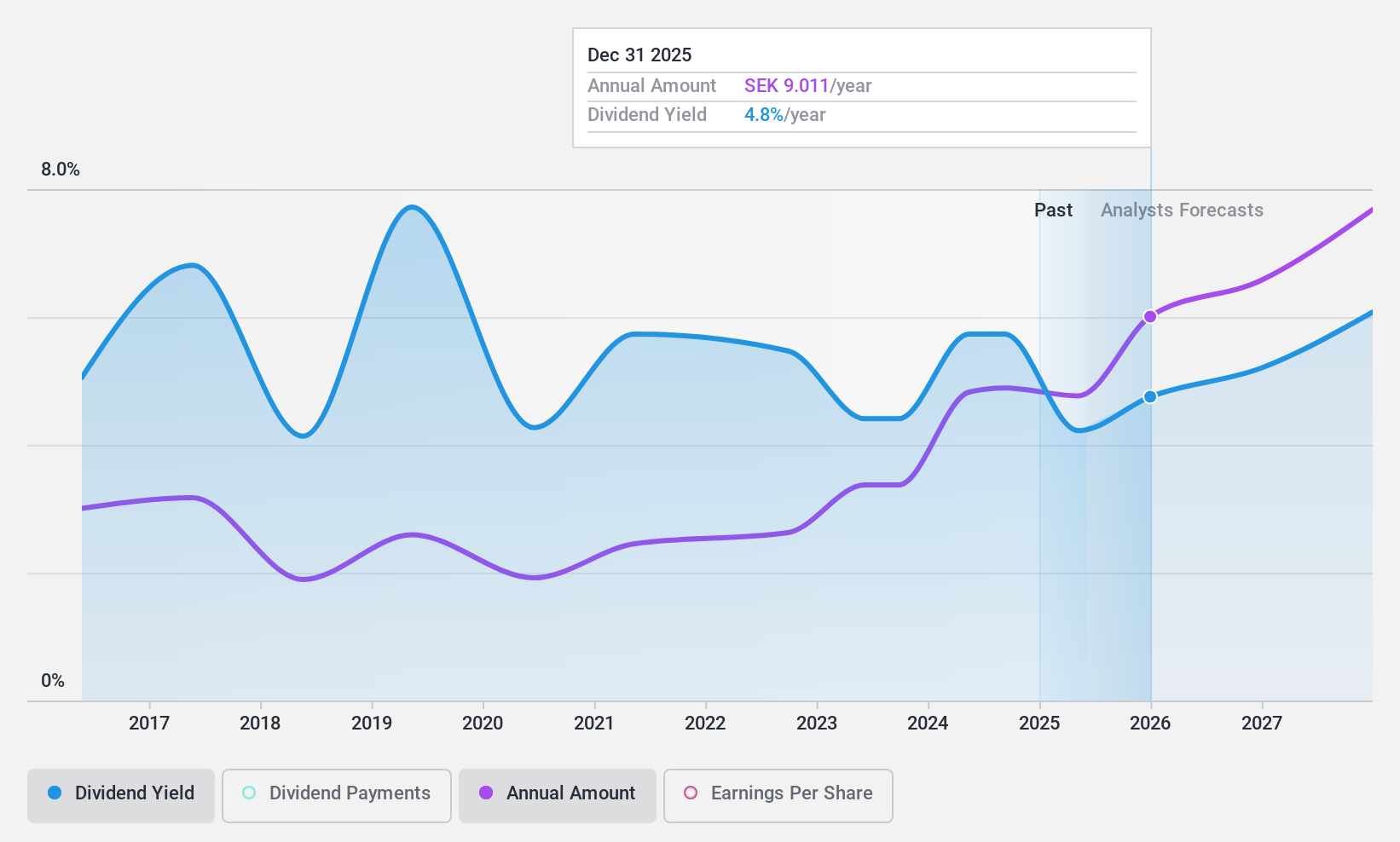

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates and manages an online gaming business across various regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK23.40 billion.

Operations: Betsson AB's revenue primarily comes from its operations in online gaming across diverse international markets.

Dividend Yield: 4.2%

Betsson's dividend profile offers a mixed view. While the company has proposed an ordinary dividend of €0.657 per share and a special dividend of €0.10, its history shows volatility with unreliable payments over the past decade. However, dividends are well covered by earnings (49.8% payout ratio) and cash flows (34.8% cash payout ratio). Recent Q1 2025 results showed growth, with sales at €293.7 million and net income at €48.2 million, supporting potential future payouts amidst ongoing M&A strategies.

- Click here and access our complete dividend analysis report to understand the dynamics of Betsson.

- Our valuation report unveils the possibility Betsson's shares may be trading at a discount.

Turning Ideas Into Actions

- Gain an insight into the universe of 234 Top European Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives