- Sweden

- /

- Consumer Services

- /

- OM:ALBERT

Optimistic Investors Push eEducation Albert AB (publ) (STO:ALBERT) Shares Up 43% But Growth Is Lacking

eEducation Albert AB (publ) (STO:ALBERT) shareholders have had their patience rewarded with a 43% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 8.0% isn't as impressive.

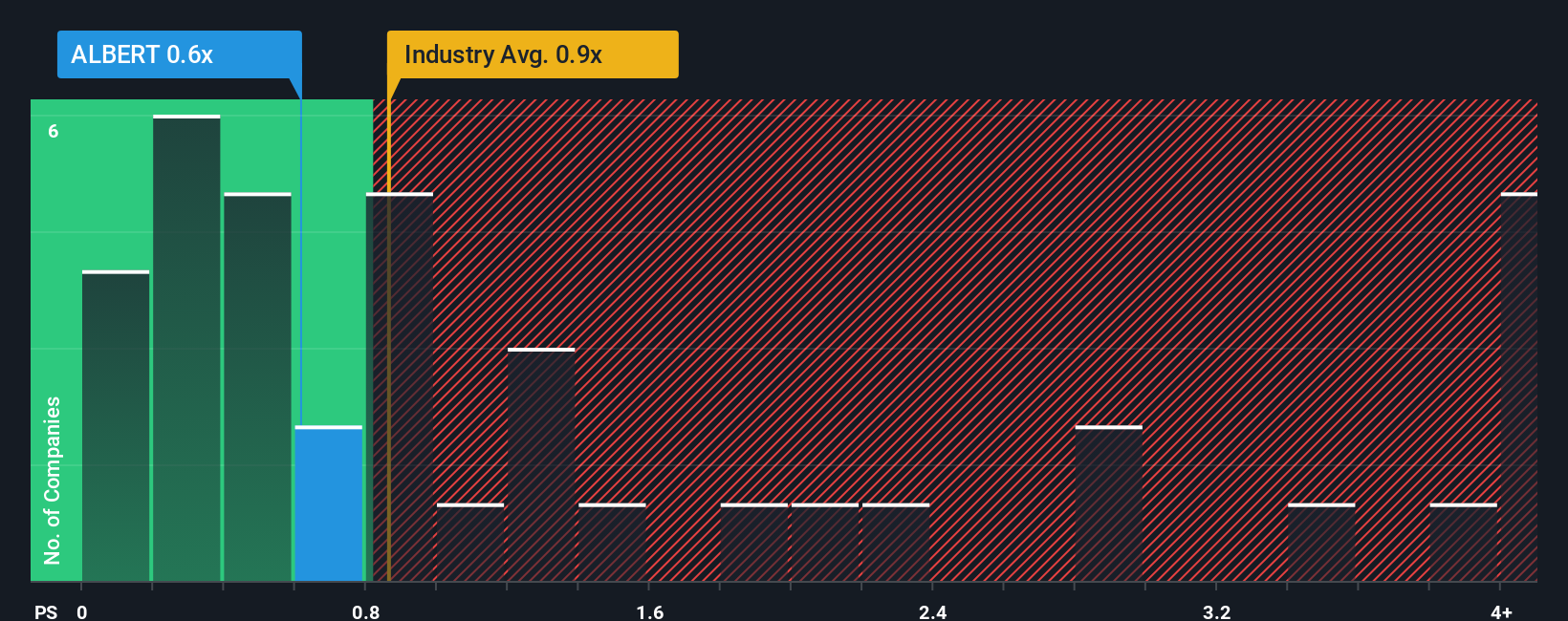

In spite of the firm bounce in price, there still wouldn't be many who think eEducation Albert's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when it essentially matches the median P/S in Sweden's Consumer Services industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for eEducation Albert

What Does eEducation Albert's Recent Performance Look Like?

While the industry has experienced revenue growth lately, eEducation Albert's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on eEducation Albert.Is There Some Revenue Growth Forecasted For eEducation Albert?

In order to justify its P/S ratio, eEducation Albert would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.9%. Even so, admirably revenue has lifted 71% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 0.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 5.7%, which is noticeably more attractive.

With this information, we find it interesting that eEducation Albert is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From eEducation Albert's P/S?

eEducation Albert appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that eEducation Albert's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 3 warning signs for eEducation Albert (1 can't be ignored!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ALBERT

eEducation Albert

Develops and markets digital educational services on a subscription basis to private individuals and schools in Sweden and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives