European Penny Stocks: Desert Control And 2 Other Noteworthy Picks

Reviewed by Simply Wall St

The European market has recently experienced a downturn, with the pan-European STOXX Europe 600 Index ending 1.23% lower due to concerns about U.S. trade tariffs and economic growth uncertainties. Despite these challenges, investors continue to seek opportunities in smaller or newer companies that may offer growth potential. Penny stocks, although an outdated term, remain relevant as they often represent companies with strong financials and the potential for significant returns. This article will highlight three such penny stocks in Europe that combine balance sheet strength with promising prospects for future growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.85 | SEK288.69M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.992 | €33.22M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.04 | SEK245.79M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.69 | €52.84M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.19 | SEK215.19M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.275 | €314.85M | ★★★★★★ |

| Cellularline (BIT:CELL) | €2.59 | €54.54M | ★★★★☆☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.10 | SEK2.01B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.38 | €23.9M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.67 | PLN124.39M | ★★★★☆☆ |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Desert Control (OB:DSRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Desert Control AS offers climate-smart agri-tech solutions to address desertification, soil degradation, and water scarcity in sandy soil regions in the United Arab Emirates and the United States, with a market cap of NOK266.59 million.

Operations: The company's revenue is derived entirely from its agrochemicals segment, totaling NOK2.17 million.

Market Cap: NOK266.59M

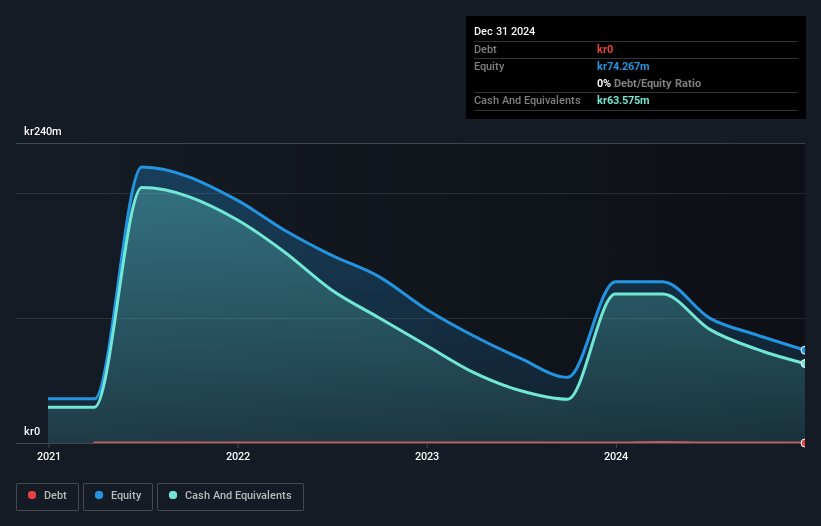

Desert Control AS, with a market cap of NOK266.59 million, is pre-revenue with earnings under US$1 million. Despite being debt-free and having short-term assets exceeding liabilities, the company faces high volatility and a negative return on equity due to unprofitability. Recent developments include a significant collaboration with Oasis Date in California for its Liquid Natural Clay (LNC) solution and participation in the UN World Food Programme's Innovation Accelerator SPRINT Programme in Iraq. Both initiatives highlight potential growth avenues for Desert Control's agri-tech solutions amidst ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Desert Control.

- Review our growth performance report to gain insights into Desert Control's future.

eEducation Albert (OM:ALBERT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: eEducation Albert AB (publ) offers digital education services on a subscription basis to individuals and schools in Sweden and internationally, with a market cap of SEK72.62 million.

Operations: The company generates revenue through two main segments: B2B, which accounts for SEK93.01 million, and B2C, contributing SEK84.06 million.

Market Cap: SEK72.62M

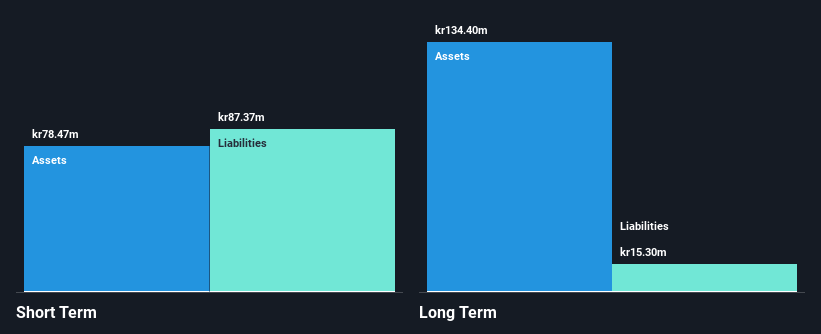

eEducation Albert AB (publ), with a market cap of SEK72.62 million, is expanding its digital education services by launching Albert Junior in the Czech Republic, following its recent entry into Romania. Despite being unprofitable and having a negative return on equity (-71.14%), the company maintains a stable cash runway exceeding one year and has more cash than debt. Short-term assets cover both short- and long-term liabilities, but volatility remains high compared to Swedish stocks. The management team and board are relatively new, while revenue growth is projected at 7.84% annually amidst efforts to optimize customer acquisition costs and maximize lifetime value per customer.

- Click to explore a detailed breakdown of our findings in eEducation Albert's financial health report.

- Gain insights into eEducation Albert's future direction by reviewing our growth report.

VRG (WSE:VRG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VRG S.A. is a company that designs, manufactures, and distributes jewelry and clothing for both women and men across Poland, Hungary, the Eurozone, and the United States with a market cap of PLN886.24 million.

Operations: The company's revenue is derived from two main segments: the Jeweler Segment, contributing PLN743.79 million, and the Clothing Segment, generating PLN588.98 million.

Market Cap: PLN886.24M

VRG S.A., with a market cap of PLN886.24 million, operates in jewelry and clothing across Europe and the US. The company demonstrates financial stability, with short-term assets exceeding both long-term and short-term liabilities, while its debt is well-covered by operating cash flow. Despite a low return on equity at 8.9% and negative earnings growth over the past year, VRG's management team is experienced with an average tenure of 3.6 years, contributing to strategic stability. The price-to-earnings ratio of 9.8x suggests potential value compared to the broader Polish market average of 12.5x.

- Jump into the full analysis health report here for a deeper understanding of VRG.

- Understand VRG's earnings outlook by examining our growth report.

Make It Happen

- Unlock more gems! Our European Penny Stocks screener has unearthed 428 more companies for you to explore.Click here to unveil our expertly curated list of 431 European Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VRG, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRG

VRG

Designs, manufactures, and distributes jewelry and clothing for women and men in Poland, Hungary, the Eurozone, and the United States.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives