- Sweden

- /

- Hospitality

- /

- NGM:BODY

Why Investors Shouldn't Be Surprised By Bodyflight Sweden AB (publ)'s (NGM:BODY) Low P/E

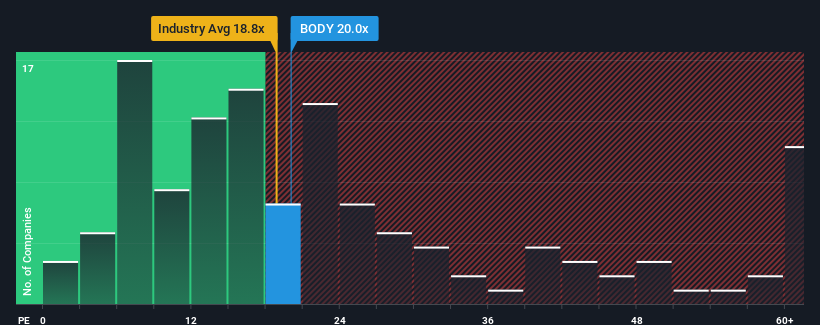

Bodyflight Sweden AB (publ)'s (NGM:BODY) price-to-earnings (or "P/E") ratio of 20x might make it look like a buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 24x and even P/E's above 44x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For instance, Bodyflight Sweden's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Bodyflight Sweden

How Is Bodyflight Sweden's Growth Trending?

In order to justify its P/E ratio, Bodyflight Sweden would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 69%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Bodyflight Sweden is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Bodyflight Sweden revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bodyflight Sweden (1 doesn't sit too well with us!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Bodyflight Sweden. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bodyflight Sweden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:BODY

Bodyflight Sweden

Operates vertical wind tunnel that simulates a parachute jump free fall without having to jump out of an airplane in Sweden.

Low and slightly overvalued.

Market Insights

Community Narratives