- Sweden

- /

- Hospitality

- /

- NGM:BODY

Bodyflight Sweden AB (publ)'s (NGM:BODY) Shares Bounce 31% But Its Business Still Trails The Market

Bodyflight Sweden AB (publ) (NGM:BODY) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

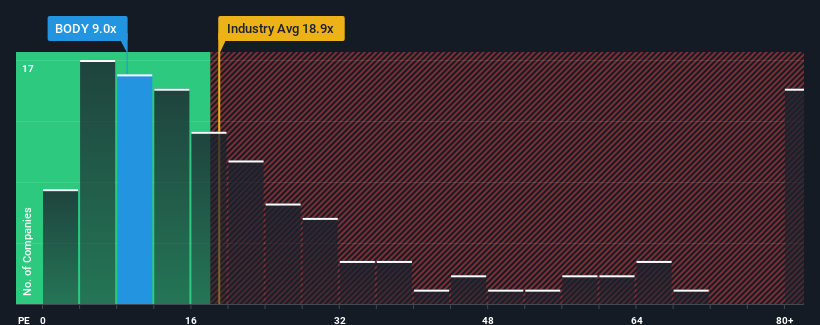

Even after such a large jump in price, Bodyflight Sweden's price-to-earnings (or "P/E") ratio of 9x might still make it look like a strong buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 23x and even P/E's above 40x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Bodyflight Sweden as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Bodyflight Sweden

Is There Any Growth For Bodyflight Sweden?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Bodyflight Sweden's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 92%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Bodyflight Sweden is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Bodyflight Sweden's P/E?

Even after such a strong price move, Bodyflight Sweden's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Bodyflight Sweden revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Bodyflight Sweden (of which 1 is potentially serious!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Bodyflight Sweden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bodyflight Sweden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:BODY

Bodyflight Sweden

Operates vertical wind tunnel that simulates a parachute jump free fall without having to jump out of an airplane in Sweden.

Low and slightly overvalued.

Market Insights

Community Narratives