- Sweden

- /

- Food and Staples Retail

- /

- OM:AXFO

Investing in Axfood (STO:AXFO) five years ago would have delivered you a 83% gain

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Axfood AB (publ) (STO:AXFO) share price is up 55% in the last 5 years, clearly besting the market return of around 25% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 14%, including dividends.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

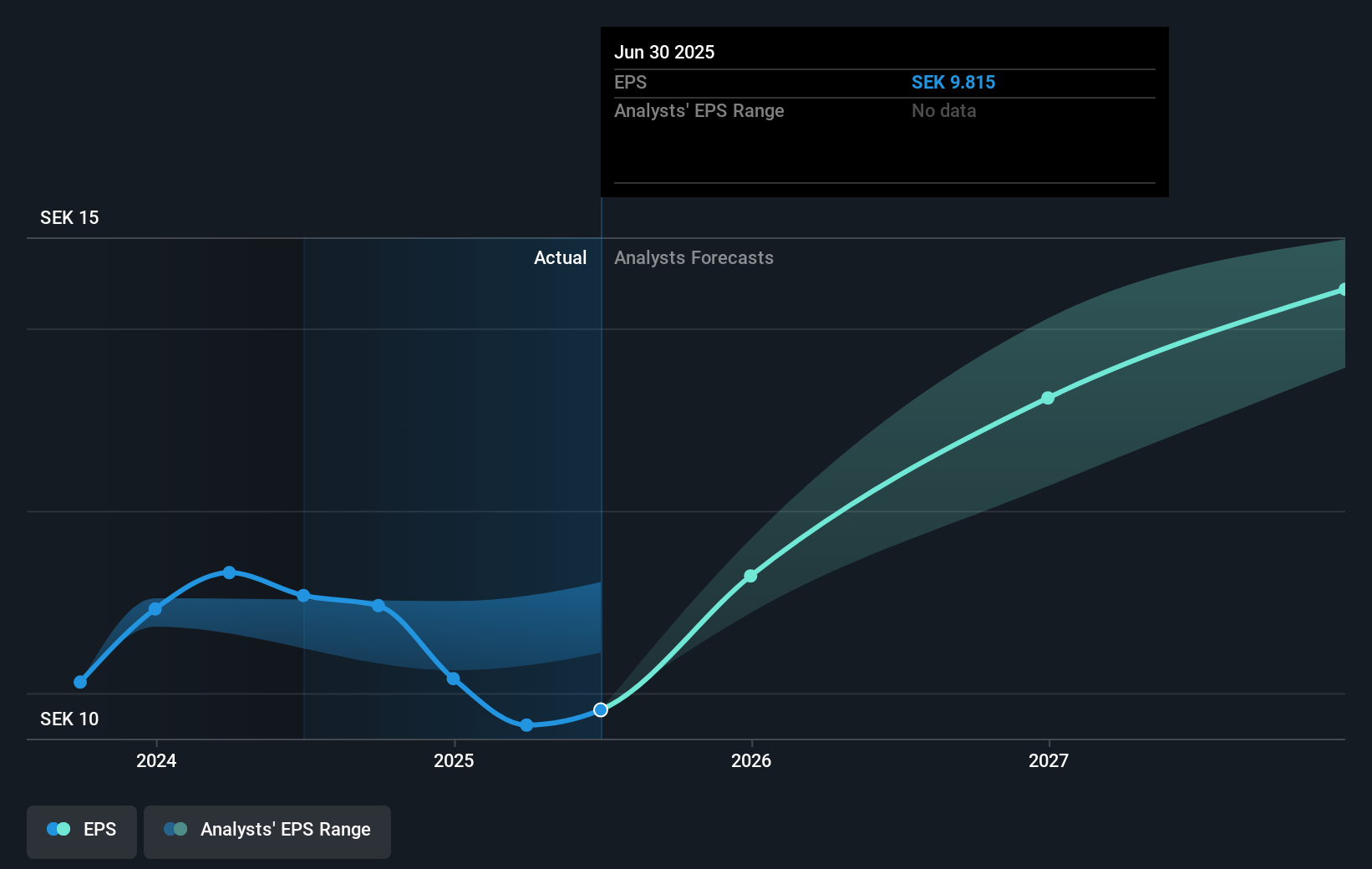

During five years of share price growth, Axfood achieved compound earnings per share (EPS) growth of 3.3% per year. This EPS growth is lower than the 9% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Axfood's key metrics by checking this interactive graph of Axfood's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Axfood's TSR for the last 5 years was 83%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Axfood shareholders have received a total shareholder return of 14% over one year. Of course, that includes the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research Axfood in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AXFO

Axfood

Engages in the food retail and wholesale businesses primarily in Sweden.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives